Diversification is a staple of financial advice. Don’t put all your eggs in one basket because if you drop the basket you won’t have any eggs. In the same way, don’t put all your assets in one company stock because if that company doesn’t perform well you might have jeopardized your financial needs.

Diversification is a staple of financial advice. Don’t put all your eggs in one basket because if you drop the basket you won’t have any eggs. In the same way, don’t put all your assets in one company stock because if that company doesn’t perform well you might have jeopardized your financial needs.

Diversification is responsible. It is the difference between being willing to break every bone in your body as an Olympic skier and safely skiing with friends.

In month to month snapshots, diversification dampens both the highs and the lows. You always have an investment to complain about and an investment that is your darling.

The goal of financial planning isn’t to invest in only what goes up. The goal is to support your financial needs, which is why your portfolio needs diversification.

In any given month, a diversified portfolio will never perform better than all of its components. Asset allocation will never “win.” Not even one month. This is an obvious result of diversification. The diversified portfolio is a weighted average of its underlying components. It will always lose to something. On average, it comes in third or fourth (of the six asset classes) each month.

Dimensional Funds in their recent article “Why Should You Diversify?” writes:

When international stock returns lag, investors may feel tempted to double down on their home market. Historical data suggests the long-term benefits of diversifying globally. …

While international and emerging markets stocks have delivered disappointing returns relative to the US over the last few years, it is important to remember that:

1) Non-US stocks help provide valuable diversification benefits.

2) Recent performance is not a reliable indicator of future returns.

In other words, when foreign stocks performs poorly, investors prefer not to be diversified, even though diversification has shown large long-term benefit.

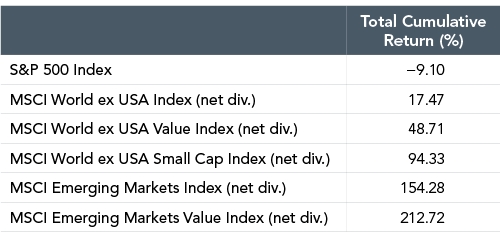

The article includes the following table showing the decade between January 2000 and December 2009:

This table shows the S&P 500 with a negative return for the decade while the rest of the word presents positive returns.

From this, some might try to conclude that you should not invest in the United States. However, such people would be wrong. Instead, you should conclude that one decade is not a long enough time period by which you can judge investment categories.

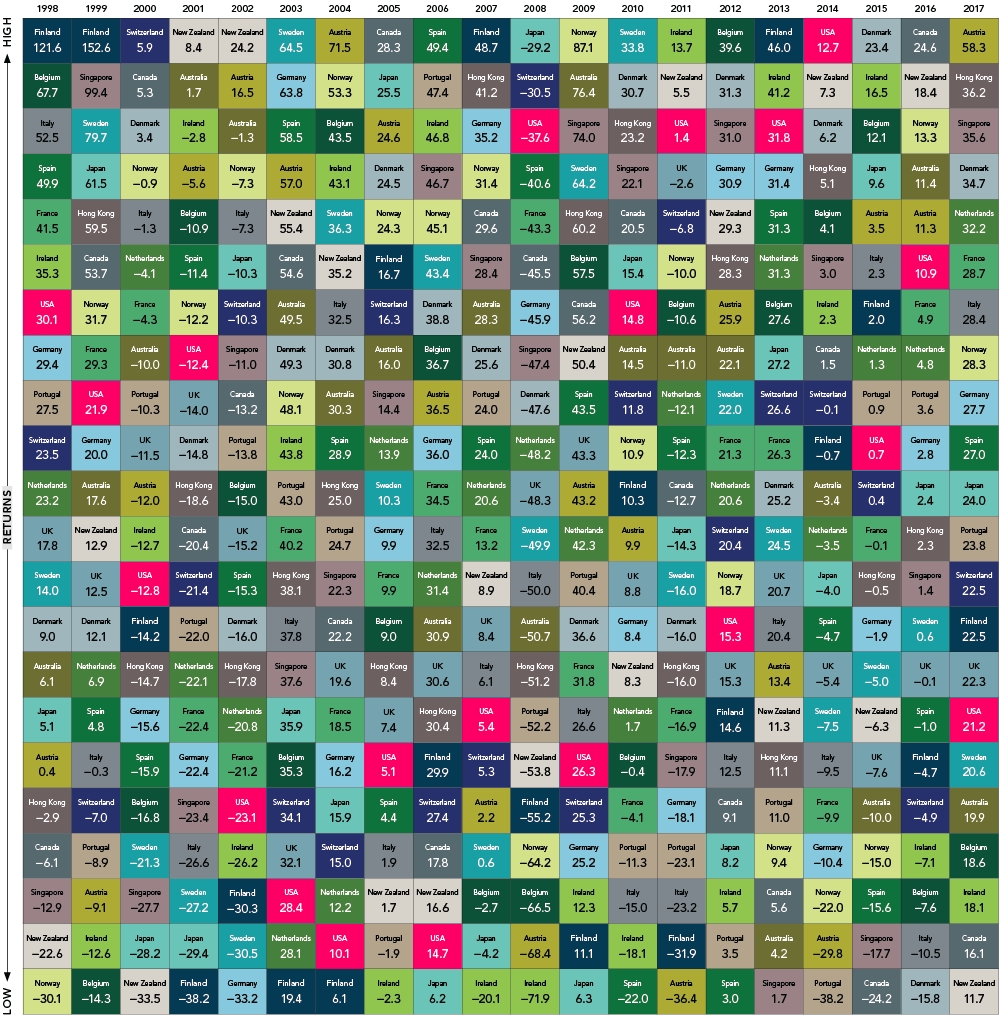

They also had a nice chart showing 22 developed market country returns over the past 20 years. We have altered this chart to highlight the returns of the United States in hot pink to help show how although it has done well recently, it has not always historically.

The years 2002 through 2007 show the time period when the U.S. markets most severely lagged the foreign markets. Many investors wrongly assume that 2008 was a year in which U.S. markets underperformed. It was actually the opposite with the global markets losing more than the U.S. markets. Since 2008, the U.S. markets have performed well.

We continue to believe that diversification among many different countries provides a more consistent return than investing entirely in the United States. The same benefits arise from other portfolio diversification.

Photo by Anthony Delanoix on Unsplash