Resource stocks, sometimes called “hard asset stocks,” include companies that own and produce an underlying resource such as oil, natural gas, precious metals, base metals, coal, lumber, or even real estate in the case of real estate investment trusts (REITs). Each of these are resource stocks for the same reason: Their expenses were paid up front with the purchase of the extraction, timber, or mineral rights or with the purchase of real estate properties and that ownership lasts for a long period of time, so inflation cannot meaningfully impact their expenses. Meanwhile their profits in the form of sale prices or rents can increase with inflation. This means that resource stocks can provide a portfolio with protection against high inflation.

Resource stocks, sometimes called “hard asset stocks,” include companies that own and produce an underlying resource such as oil, natural gas, precious metals, base metals, coal, lumber, or even real estate in the case of real estate investment trusts (REITs). Each of these are resource stocks for the same reason: Their expenses were paid up front with the purchase of the extraction, timber, or mineral rights or with the purchase of real estate properties and that ownership lasts for a long period of time, so inflation cannot meaningfully impact their expenses. Meanwhile their profits in the form of sale prices or rents can increase with inflation. This means that resource stocks can provide a portfolio with protection against high inflation.

Investing in resource stocks is not the same thing as investing directly in commodities. Buying gold bullion or a gold futures contract is an investment directly in raw commodities and their volatility. The optimum asset allocation to physical gold and silver is 0% since the average return is just inflation whereas the expected standard deviation (risk) is very high. A gold mining company’s profits behave differently, making it a resource stock investment.

Currently, our Resource Stock sectors are U.S. Real Estate, Foreign Real Estate, and Energy. Even though both U.S. Real Estate and Energy funds have a high mean return and serve as inflation-protecting Resource Stocks in a portfolio, the two sectors have little in common with one another with a 3-year correlation possibly as low as 0.12. In this way, the resource stocks asset class represents one of the most diverse collection indexes.

Although they are often behaving strangely compared to the rest of the portfolio, the beauty of resource stocks is the fact that they are not highly correlated to U.S. large-cap stocks as a whole. Additionally, the correlation between resource stocks and bonds is even lower and may even be negative. A negative correlation means that bonds and resource stocks, as separate asset classes, are often moving in opposite directions. Balancing a bond portfolio with resource stocks can help hedge the risk inflation poses to a bond portfolio.

For all these reasons, there are significant periods in the longer term economic cycle when including resource stocks helps boost returns.

This past quarter of January to April 2020 has been a disappointing one for Energy, likely as a result of the COVID-19 virus stay-at-home orders which keep energy demand low. Cars are parked, planes are grounded, and boats are docked. Energy prices and oil futures are the cheapest they have been in a while as only a few essential travelers are using oil.

As MarketWatch reported, the May oil futures contract is set to expire negative, meaning companies would be paying people to take oil off their hands. In “The oil market is running out of storage space and production cuts loom ,” MarketWatch reports it this way:

Current oil production is about 90 million barrels per day, but demand is only 75 million barrels per day. …most analysts are expecting the U.S. to reach full oil storage by late April or early May, with global storage reaching full capacity by early June,” said David Grumhaus, co-chief investment officer at Duff & Phelps Investment Management.

With storage running tight, negative rates for a single month is something unique to the futures market. Energy funds, although not futures, are obviously affected by the prices of their production.

In 2011, we wrote in “‘Go Fishing’ With Hard Asset Stocks,” “Hard assets have been one of the most significant asset classes over the last decade. From all indications, it will continue to be a critically important investment category to protect your portfolio from the effects of inflation and the continuing devaluation of the U.S. dollar.”

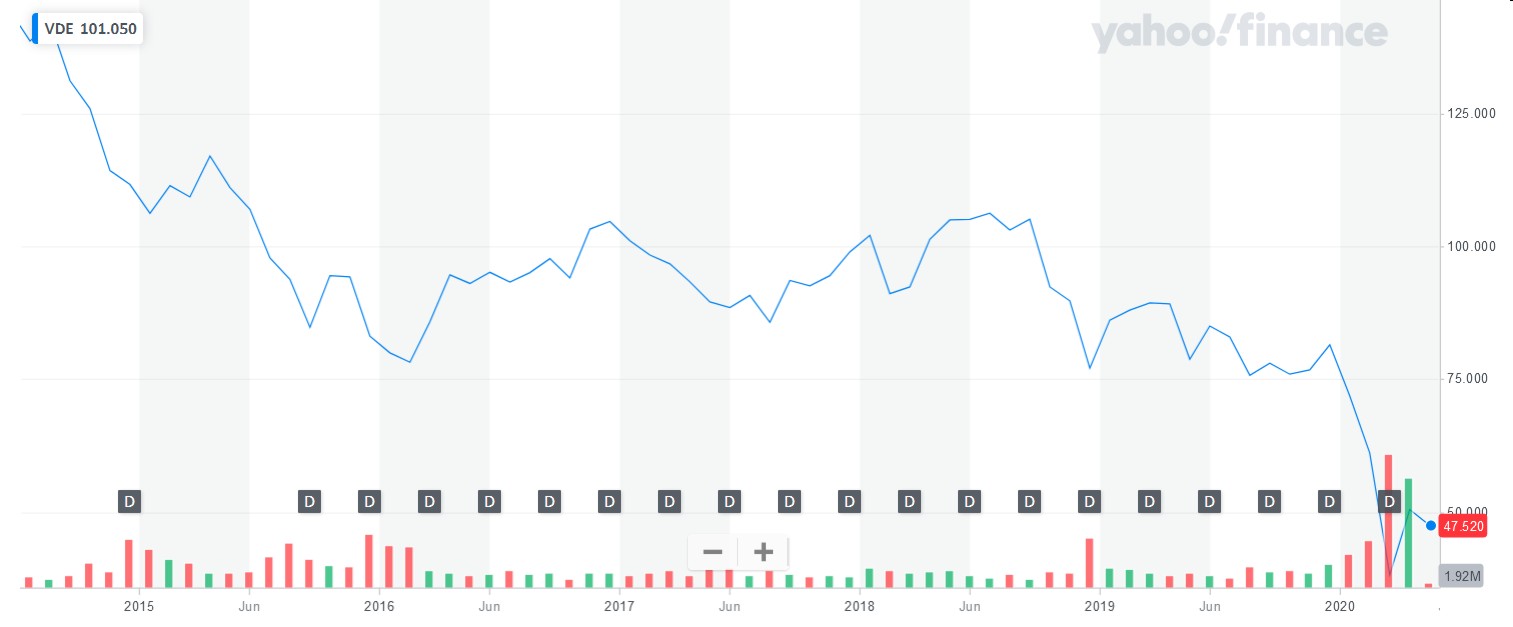

In the three years from 2011 to 2014, there was a cumulative inflation of 5.2% with each year growing 2.1%, 1.5%, and 1.6% from the year before. On January 1, 2011, Vanguard Energy Index Fund ETF Shares (VDE) closed with an adjusted price of $78.14. Then, on June 23, 2014, Vanguard Energy Index Fund ETF Shares (VDE) peaked with an adjusted closing price of $121.30. This was a stellar return, up 55.23% from the start of 2011.

In the next three years from 2014 to 2017, the cumulative inflation was down to only 3.5% with each year growing 0.1%, 1.3%, and 2.1% from the year before. From that relative high, VDE’s price fell. Now, as of May 1, 2020, VDE closed at an adjusted price of $47.52, down -60.82% from its prior peak.

In 2015, we wrote in “Mailbag: Are Energy Funds A Good Buy?,” “Although it may take a while for energy prices to recover, I think they are still a good investment.”

In 2016 and despite still being down from its prior peak, Energy had some of the best returns of the year with Vanguard Energy ETF (VDE) up 28.93%.

While bonds can perform well in periods of low inflation or deflation, Energy can perform well in periods of high inflation or hyper-inflation. Likely for this reason, Energy’s correlation to long-term government bonds is potentially negative -0.2687 or -0.2874 while it’s correlation with generic domestic bonds as a whole is potentially only positive 0.3279.

In this way, often times when the Stability of your portfolio experiences downward volatility, its your Energy or other Resource Stocks that can help smooth your portfolio returns out again and keep your portfolio stable. However, when bonds do very well, especially during times of low inflation or even deflation, Energy can be disappointing.

Although many investors worry that climate change efforts could bankrupt the Energy sector, investing in an Energy fund, rather than individual companies, protects your assets from some of those fears. As renewable energies like wind, water, solar, or other new energy sources become bigger and better, the companies that are producing these resources will seamlessly become bigger in the Energy sector and thus part of your Energy index fund. In this way, so long as you believe that people in the future will still demand some kind of Energy, your Energy index fund will evolve with the changing industry.

Energy, in one way or another, has always had a relatively consistent demand in our modern era. This is called an inelastic demand curve. The idea is that regardless of the price, consumers have a desired quantity that they want and will purchase. Even though this coronavirus pandemic has temporarily taken some of that demand away, I believe most of us anticipate that travel and transportation will return to some sort of normal after these stay-at-home orders are lifted.

Historically, Energy fund prices have had a strong reversion to their mean. This means that low returns in Energy are historically generally followed by high future returns, and vice versa. By setting a target allocation to Energy and diligently trimming and filling it to keep it on target, this means that it is relatively easy to, through the diligence of rebalancing, buy low and sell high. Furthermore, because of its low correlation to other sectors, there is likely a strong rebalancing bonus on top of that.

Energy companies are a strong component of a balanced portfolio because of their low correlation to bonds and other stocks while still having a high expected return. It is extremely volatile, and its large losses can easily trigger our Loss Aversion, while its gains are forgotten. However, the volatility of Energy does not need to be timed to achieve your financial goals.

It is a sector that quietly balances your bonds and fuels your rebalancing bonus. Diversification means always having something to complain about. Recently, it has been energy.

Photo by Ashish Thakur on Unsplash