We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

‘Go Fishing’ in the Calm Sea of Bonds

Adding bonds to an all-stock portfolio can boost returns and lower volatility, especially in choppy markets. Bonds should be a small but important part of your gone-fishing portfolio allocation.

Get More Bang For College Bucks

Before you spot a single Ivy League or big-name private school, public campuses grab 17 of PayScale’s first 18 spots. Leading is Georgia Tech’s 13.9% return on investment. Next is the University of Virginia’s 13.3%.

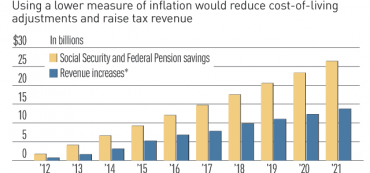

Debt Talks Target Cost Of Living – Social Security Falls Further Behind

To solve the deficit reduction riddle, Obama reportedly is embracing an idea that purports to raise tax revenue without a tax hike and claims to cut Social Security outlays without cutting benefits. Better check your wallet.

Some $100 Billion Locked Up In ‘Sliver’ of Hedge Funds

Despite assurances to the contrary, a segment of hedge funds still has up to $100 billion locked up and won’t allow redemptions.

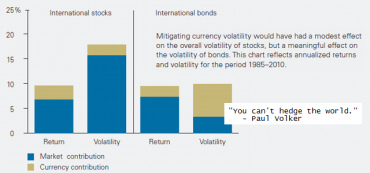

Global Fixed Income (International Bonds): Hedged or Unhedged?

International bonds now make up more than 35% of the world’s investable assets, and yet many domestic investors have little or no exposure to these securities.

Radio: California vs. Amazon Battle

On Tuesday, July 12, 2011 from noon-1pm, David John Marotta was interviewed on radio 1070 WINA’s Rob Schilling Show. The topic was the battle between Amazon.com and the state of California over taxation.

‘Go Fishing’ With Hard Asset Stocks

Hard assets have been one of the most significant asset classes over the last decade. From all indications, it will continue to be a critically important investment category to protect your portfolio from the effects of inflation and the continuing devaluation of the U.S. dollar.

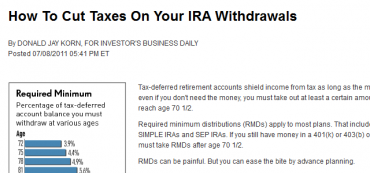

How To Cut Taxes On Your IRA Withdrawals

This article from Donald Jay Korn for Investor’s Business Daily describes the benefits of advance tax planning to reduce the tax bite that is inevitable as you grow older and required minimum distributions (RMDs) become a larger portion of your retirement account.

Obama’s Gasoline Change Doesn’t Change Basic Economics

Last month the Obama administration announced it would release 30 million barrels of oil, the largest ever, from the U.S. Strategic Petroleum Reserve. Only those without an understanding of basic economics would applaud such a move.

Radio: Why Real Estate Should Be In Your Portfolio

David Marotta discusses why real estate should be part of a portfolio asset allocation.

An Overseas Gone-Fishing Portfolio

Even in our gone-fishing portfolios we suggest investing more overseas than in the United States. For most investors, foreign stocks will be their largest and most important allocation. Including the right mix of foreign stocks will help you relax and go fishing no matter which foreign seas are in turmoil.

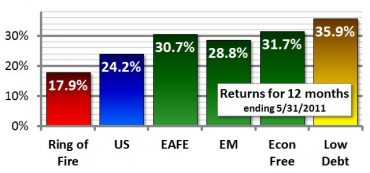

Radio: Continue to Avoid the Ring-of-Fire Countries

On Jun 21, 2011, David John Marotta appeared on Radio 1070 WINA’s Schilling Show to discuss which countries to avoid investing in, or to underweight, due to high debt and deficit and low economic freedom.

Radio: Continue Avoiding “Ring-of-Fire” Countries

David Marotta discusses avoiding countries with high debt and deficit.

‘Gone Fishing’ American Style

Creating a gone-fishing portfolio begins with a top-level asset allocation. We use six asset categories. The three for stability are short money (maturing in less than two years), U.S. bonds and foreign bonds. The three asset categories we use for appreciation are U.S. stocks, foreign stocks and hard asset stocks.

Continue to Avoid the ‘Ring of Fire’ Countries

Americans seem to be divided on the importance of raising the U.S. debt ceiling. Regardless of your personal politics, avoid investing in countries that cavalierly allow their debt and deficit to balloon.