We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Is Federal Student Aid Among the Best or Worst Government Programs?

The unintended consequences of good intentions can do more economic harm than all the mean-spirited greed within capitalism.

Squirrel Away Money While You Can

Franco Modigliani won the Nobel Prize for a simple technique that squirrels know intuitively from birth. You have to squirrel away some nuts during times of plenty so you can survive during times of scarcity.

Radio: What Equality Should We Seek in Society?

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show discussing the idea of “equality” in society.

Why Do Women Earn Lower Incomes Than Men?

Choosing to work less than 80 hours is not wrong, especially not when all you are going to get is that last 30%.

Hedge Funds Trail Vanguard Index Funds

In another edition of “you can make the numbers say whatever you want” two financial industry studies are contradicting each other.

A Grown-Up Discussion on Income and Wealth Inequality in America

Most work toward equality of results impoverishes everyone.

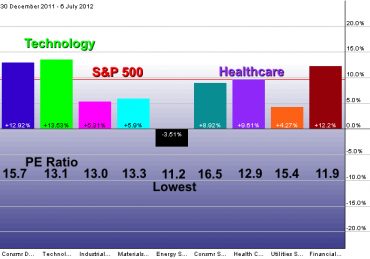

Technology Sector Doing the Best YTD, Energy the Worst

Sector rotation would suggest that we are still at the beginning of a market recovery. This is probably the bottom of energy stocks.

What Equality Should We Seek in Society?

Studies suggest that brains may be wired with either a utopian or a tragic view of the world, corresponding roughly to liberals and conservatives. We continue to talk past each other in political debates.

Even with Low Interest Rates You Should Have an Allocation to Bonds

“Investors may hold fixed income securities to reduce portfolio volatility, generate income, maintain liquidity, pursue higher returns, or meet a future funding obligation.”

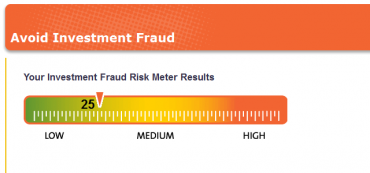

Protecting Your Parents: Keep the Sharks at Bay

Make sure that Mom and Dad have a family member and a fiduciary advisor watching out for their finances.

$ ?s: Six AMT Reduction Strategies

There are two opposing approaches to limit your AMT tax. The obvious strategy is to lower your income so you avoid this AMT bull’s-eye. The less obvious approach is to raise your income.

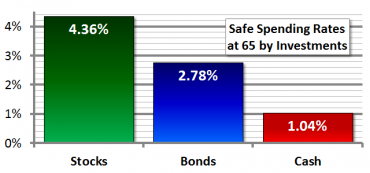

Risk – Return Decisions

Portfolio construction begins with the most basic allocation between investments that offer a greater chance of appreciation (stocks) and those that provide portfolio stability (bonds). There is no such thing as a safe investment that pays market rates of return.

What Is Comprehensive Wealth Management?

Advisors who offer comprehensive wealth management are like financial concierges. Their only goal is to meet your needs. If you ask for fresh strawberries, they try to find them for you.

Tax Planning: Choose the Appropriate Investment Vehicles

Here are some additional tax planning resources regarding choosing the appropriate investment vehicles.

Tax Efficient Investing

It can be useful to maintain a grid where all of the available asset classes are arranged in order, by tax efficiency and potential return based on time horizon, so clients can clearly see when and where tax-deferral can offer the greatest benefits.