We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

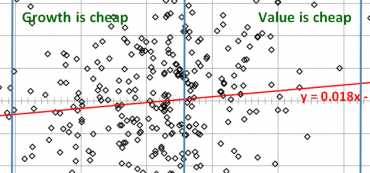

When Growth is Relatively Cheap It Will Outperform Value

When growth is relatively cheap it should outperform value.

Last Chance for 0% Capital Gains Rate

Most infomercials that begin with such urgency are trying to get you to buy something, but in this case I want you to consider selling.

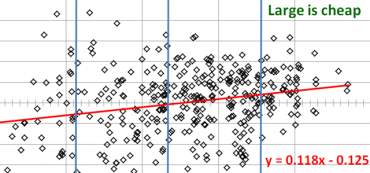

When Large Cap is Relatively Cheap It Will Outperform Small Cap

Currently large is relatively cheap and small cap is relatively expensive. For that reason, the R1000 or S&P 500 should outperform the R2000 small cap.

Using Dynamic Asset Allocation to Boost Returns

Think of static asset allocation as where to set your sails and dynamic asset allocation as a way to keep your balance as your boat glides and sometimes bounces through the waves.

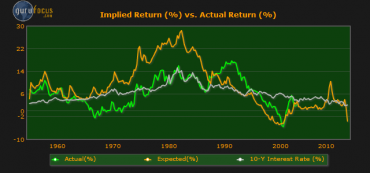

Shiller P/E Implied Market Return

A low P/E 10 bodes well for the next 20 years of investing, whereas a higher P/E 10 suggests a lower expected return.

Social Security Loopholes: “File and Suspend”

Many higher earning husbands base their filing date decision based on their own life expectancy, which is a mistake. They should rather be asking the question, “What benefit do I want to leave my wife?”

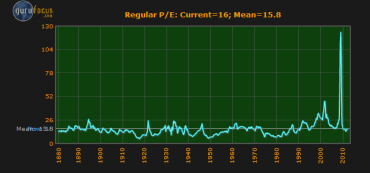

How Is the Shiller P/E Calculated?

The Shiller P/E ratio is computed by taking the current price and dividing by the average inflation-adjusted earnings from the previous 10 years.

Why Is the Regular P/E Ratio Deceiving?

The highest peak for the regular P/E was 123 in the first quarter of 2009. It was much higher than the historical mean of 15, yet it was the best time in recent history to buy stocks.

The Shiller Ten-Year P/E Ratio

What we would really like to measure are the changes in price (P) that cause a company with a good long-term track record to look relatively cheap. Economist Robert Shiller created just such a measurement.

Video: The Benefits of Having a Financial Advisor

If you want to get in shape and need push in the right direction, you hire a personal trainer. If you want advice and a push in the right direction to be in good financial shape, hire a financial advisor.

$ ?s: Roth or Pre-Tax 401(k)?

Here is the only question you should attempt to answer: Are you paying a higher tax rate now or later?

Win the Lifelong Battle Against Procrastination and Laziness

“If you want an extraordinary career, stop procrastinating.”

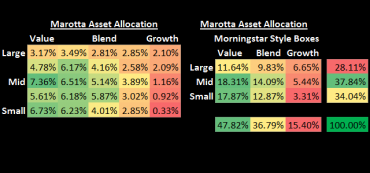

Style Boxes and the Efficient Frontier

The Marotta allocation method is a proportionally weighted allocation based on the square of each Sharpe ratio. Squaring the Sharpe ratio drastically reduces asset categories in proportion to their distance from the efficient frontier.

Why NAPFA Members are Different from Goldman Sachs

“Today, if you make enough money for [Goldman Sachs] (and are not currently an ax murderer) you will be promoted into a position of influence.”

$ ?s: Dividend Portfolios Carry Hidden Risks (Part 2)

Q: Do you recommend dividend-paying stocks? If not, what investment strategy do you recommend for retirees like me who are seeking income from our portfolios?