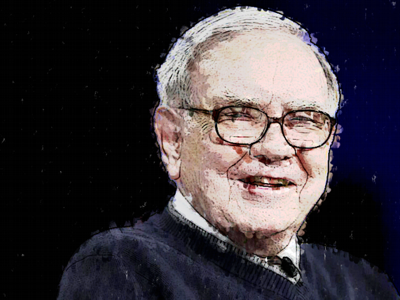

On the same day that the S&P 500 plunged 6.7% in reaction to the Standard & Poor’s downgrade of US sovereign debt, Bloomberg is reporting on two different headlines stating that Warren Buffet’s company, Berkshire Hathaway, is on a buying spree.

On the same day that the S&P 500 plunged 6.7% in reaction to the Standard & Poor’s downgrade of US sovereign debt, Bloomberg is reporting on two different headlines stating that Warren Buffet’s company, Berkshire Hathaway, is on a buying spree.

The first story reveals that Berkshire Hathaway made over $3.6 billion in new stock investments during the last several months. The second story outlines a new $3.25 billion bid that Berkshire Hathaway has made for Transatlantic Holdings Inc., a competing international reinsurance organization.

What would possess the world’s most famous investor to be purchasing business investments while many are dumping and running for the exits?

Do not mistake Buffett’s bets with the belief that Buffet sees a market rebound coming quickly. Warren Buffett has no crystal ball.

Investing when Mr. Market is a bi-polar emotional wreck requires the ability to look beyond the short term volatility and focus on lasting outcomes. Warren Buffet often uses his annual investor updates to encourage investors to turn their focus from Berkshire Hathaway’s price and begin to view themselves as co-owners in a portfolio of businesses.

As businesses earn money, their owners are rewarded. As of this writing, an investor in the S&P 500 receives an earnings yield (based on the last twelve months of earnings) of over 7% and that the projected earnings yield for the next twelve months is close to 9%. These earnings are generated every time Exxon sells a gallon of gas, Apple sells an iPad and IBM sells their information technology solutions worldwide. The lower the price on the S&P 500 goes, the higher this earning yield will go.

And while prices bounce from highs to lows, value investors recognize that attempting to time their entry point with the market bottom is a guessing game at best. Instead, they focus on real business earnings which have proved to be much more stable throughout history.

Investing in a low cost diversified portfolio puts an engine of business earnings in your accounts. You should also consider using some of your free cash in money market accounts or trim some of your US Bond investments to buy more stocks. History suggests that this rebalancing approach during the hard times has flourished through the Great Depression and both World Wars.

Buffett is betting that this approach will survive the test of time again and so should you.

One Response

Richard Steven Gregg

As the old expression goes: “He has money to burn…!”, so he can afford to get burned if things don’t pan out. It’s all just a gamble. We were lucky to sell at the right time, others might not be so lucky, Time will tell…..