Another year is in the books and it’s another challenging year for the hedge fund industry as the appeal of these highly compensated money managers continues to lose luster. Hedge fund woes are best highlighted by the seven-year-old $1 million wager Warren Buffett made with Protégé Partners, a New York money manager. With three years remaining on a ten year $1 million bet, Buffett and index fund investors everywhere are sitting pretty.

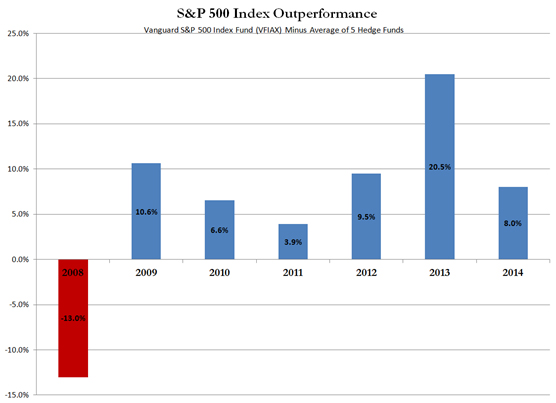

Over the last seven years of this race between the Vanguard S&P 500 Index (admiral shares) and a basket of selected hedge funds, the Vanguard S&P 500 Index has outperformed in six of them. During that time, the index fund is up 63.5% and the hedge funds trail far behind with an approximate growth of 19.6%. The hedge fund returns are only approximate because these funds are not valued daily in a public market, which is an added concern for investors who value liquidity.

When the markets crashed in 2008, the Vanguard S&P 500 Index Fund was down 37% and the hedge funds were 24% during that same period. However, since that crash, the index fund has offered significant outperformance.

-Hedge fund data reported by Carol Loomis of Fortune Magazine

However, this bet also highlights the differences between a hedged and unhedged investment strategy. A hedged investment strategy is typically going to have lower volatility. They do this by investing in positions that should preserve value when the rest of the market suffers. However, 2008 proved that these so called hedges aren’t as effective as many would hope. Watching your portfolio value drop by nearly a quarter offers no relief to your typical risk-adverse investor.

On the flip side, hedged positions create a drag on a portfolio in a bull market. Sometimes this is because the hedge portfolio is buying insurance options which expire worthless and other times it is because the fund is shorting stocks which are increasing in value. Over the full market cycle, the average hedge fund underperforms the total returns of a diversified typical stock and bond portfolio.

Successful investors accept that investing requires one make peace with the volatility of the markets. Those who are unable to tolerate these fluctuations will find no solace in the average hedge fund. Any strategy that claims to reduce market risk is either also reducing returns or it is covering up potential risks. If you are seeking to become an investing protégé, you’ll be better off looking for a mentor outside of the hedge fund community.

Photo used here under Flickr Creative Commons.