John Blood has a nice article in Investment Advisor magazine entitled “Factor Investing: A Post-Modern Portfolio Theory

.”

John Blood has a nice article in Investment Advisor magazine entitled “Factor Investing: A Post-Modern Portfolio Theory

.”

In a previous article I talked about “Factor Investing: Small and Value Factors.” In this article I would like to highlight another factor, that of “profitability” which is sometimes called “quality” instead.

This latest factor of investing is relatively new, having been “discovered” relatively recently in papers by Robert Novy-Marx (2012) and Fama/French (2015).

Unlike size and value, quality has no universally accepted definition.

The rough idea is that the stock price of companies that are profitable are more likely to appreciate than companies which are not profitable. Profitability could be measured with as simple a measurement as revenue minus expenses. Or it could be a more complex analysis of “return on investment, earnings stability, dividend growth stability, strength of balance sheet, financial leverage, accounting policies, strength of management, accruals, and cash flows.”

Some have suggested that “quality” is mostly a marketing term because indexes and funds based on a quality factor are relatively new. Other have criticized the quality factor suggesting that it is already included in a composite of other factors such as “an investment factor and a return-on-equity factor .” All of these criticisms may be true and yet there still may be something to be gained by over weighting stocks high in quality.

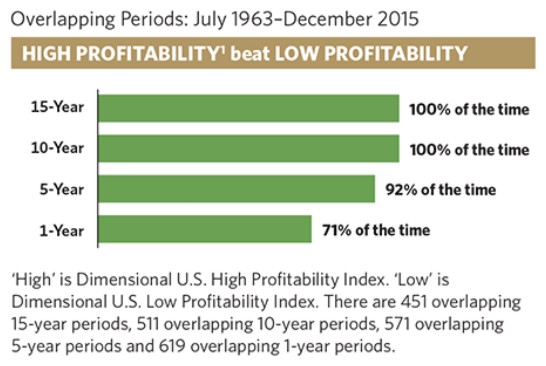

Finding a factor for long term investing requires decades and decades of returns in order to find a statistically higher mean return for some stocks over others. The quality factor depends on having information about publicly traded companies which has been available just barely long enough to discover a statistically significant trend. Here is the analysis of the historical performance of the quality factor premium over rolling periods during the past 52 years:

Because Quality is a relatively new factor, products based on a quality index are also relatively new. We use three exchange traded index funds based on factors which include quality. We use them at least partly because they have lower expense ratios and no transaction fee when traded at Charles Schwab. The use of factors is also an added benefit. As Blood explained in his article:

Because the [factor] approach is more strategy-based than product-based, advisors can select the least expensive, most efficient product that delivers consistent exposure to the chosen attribute.

When we select a specific security to represent a given sector we look for a fund which is well diversified withing its sector with a low expense ratio and a small trading cost. For our country specific investing we had been using country specific iShare exchange traded funds (ETF) with an average expense ratio of 0.48% and a transaction cost of $8.95. We found that State Street Global Advisors offers SPDR country specific ETFs with an average expense ratio of 0.30% and no transaction costs when traded on the Schwab platform.

Additionally, these SPDR funds use an index based on three factors: value, quality, and low volatility. (Low volatility is “the tendency for a security’s value to remain stable, changing in value at a steady pace over time .)

Because these funds are relatively new, performance data is only available for these country specific SPDR funds since 6/30/2014. Although this short time period (27 months) is not statistically long enough to determine if State Street’s Strategic Factors out perform over long time period, we already have separate evidence that these factors ought to, on average, boost returns, not only for the three factors being used to select stocks (value, quality, and low volatility) but also for the 0.18% annual lower expense ratio.

And what we in fact find over this time period (6/30/2014 through 9/30/2016) is that the SPDR ETFs did indeed significantly out perform the iShares ETFs while experiencing lower volatility.

The SPDR® MSCI Canada StrategicFactorsSM ETF (QCAN) out performed the iShares MSCI Canada ETF (EWC) by 3.06% annually while experiencing a 0.81% lower annual volatility.

The SPDR® MSCI Australia StrategicFactorsSM ETF (QAUS) out performed the iShares MSCI Australia ETF (EWA) by 1.77% annually while experiencing a 1.35% lower annual volatility.

And the SPDR® MSCI Germany StrategicFactorsSM ETF (QDEU) out performed the iShares MSCI Germany ETF (EWG) by 1.92% annually while experiencing a 4.69% lower annual volatility.

Again, while these results are not necessarily indicative of long term trends, the factor research and the lower expense ratios suggest that these funds are probably preferable to the iShares alternatives.

Photo is used under Flickr Creative Commons license.