In “New Year’s Resolutions for the Country” I wrote:

Revenue is maximized by an economic freedom that encourages as much free enterprise as possible coupled with a flat tax. The current legislative compromise punishes married couples who are both productive. Spouses who each earn $250,000 with an additional $100,000 in capital gains will pay about $27,000 more than an unmarried couple who simply live together.

Here is my understanding of how much more a married couple has to pay simply because they are legally married:

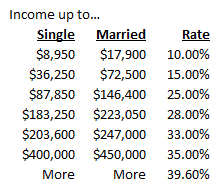

Michael and Ashley are just living together. They each earn $250,000 and have $100,000 in capital gains. They haven’t released all of the details of the tax code compromise, but I am assuming these tax rates:

Therefore their income tax is $67,558 (($8,950 * 10%) + ($27,300 * 15%) + ($51,600 * 25%) + ($95,400 * 28%) + ($20,350 * 33%) + ($46,400 * 35%)). For both of them the tax would be $135,115.

They would owe $1,900 for the Obamacare surtax ($50,000 * 3.8%). The 3.8% Obamacare tax applies to the lesser of capital gains or earned income over $200,000 if you are single or $250,000 if you are married. Since Michael and Ashely are just living together they each get $200,000 of earned income before the tax kicks in. Even though they have $100,000 of capital gains, they would only be taxed on $50,000 because they only earn $50,000 over the $200,000 threshold. For both of them the tax would be $3,800.

They would owe $15,000 in normal capital gains tax. As I understand the new tax code the capital gains tax on their $100,000 of capital gains will remain at 15% for those single earning under $400,000 or married earning under $450,000. For both of them the tax would be $30,000.

And finally, I believe that Michael and Ashley would not be subject to deduction phase outs. Detailed information on the tax compromise is difficult to find, but I believe that those earning under $250,000 would not experience these deduction phase out.

And now for the marriage penalties…

James and Linda are legally married. They each have the same earnings as Michael and Ashley, but their incomes are combined when it comes to federal taxation. They have earned income of $500,000 and capital gains of $200,000.

Therefore their income tax is $148,671 (($17,900 * 10%) + ($54,600 * 15%) + ($73,900 * 25%) + ($76,650 * 28%) + ($23,950 * 33%) + ($203,000 * 35%) + ($50,000 * 39.6%)). The would pay $13,556 more because of the tax brackets because they are married.

They would owe $7,600 for the Obamacare surtax. Since the earned income threshold for a couple is only $250,000, they are taxed on the lesser of the full $200,000 in capital gains or the $250,000 earned income which is over the $250,000 limit. They would pay $3,800 more because they are married.

They would owe $40,000 in normal capital gains tax. As I understand the new tax code the capital gains tax on their $200,000 of capital gains will be at 20% for those single earning over $400,000 or married earning over $450,000. They would pay $10,000 more because they are married.

Finally, James and Linda would be subject to the deduction phase outs. These phase outs are equivalent to an additional tax on income of about 1.2%. As a result they would pay $6,000 more because they are married.

CONCLUSION: James and Linda would have to pay $33,356 more than Michael and Ashley earning the exact same amounts simply because they are married and not living together.

So in the original article I underestimated the marriage penalty. It will be worse than I thought. You cannot argue this increased tax is their “fair share” simply because they are married.

Please refrain from comments such as “Nobody I know makes this much money.” I work with small business owners most of whom fall into similar tax situations. Many would significantly benefit financially from not being married. Comments about how few people are oppressed with unfair taxes are as bigoted and biased as if they had been made about a racial group. And comments about how you personal don’t know any just show your own ignorance.

I continue to be amazed by the financial slurs thrown at the most productive members of our society. There is a growing financial bigotry against people with productive lifestyles. They show a hatred amongst the left that against any other group would be universally condemned.

As I wrote in the the article: “The fairest taxes are levied equally on each person or equally on each dollar.”

Subscribe to Marotta On Money to stay current on the latest wealth management advice and receive free premium access to several video presentations

10 Responses

Will

I’m politically neutral on this issue. What I do know is that these tax decisions are completely out of my personal control (and most likely yours as well).

Obviously this issue has greatly affected you and others you know. I would recommend not dumping more gas on the fire by continuing to be angry about it.

Perhaps you could focus, at least for the time being, on just simply letting go.

David John Marotta

Will, are you politically neutral on civil rights? Would you suggest that civil rights advocates “focus on just letting go.” Would you suggest that their struggle against bigotry and oppression is “dumping gas on the fire by continuing to be angry about it?”

Penalizing a couple $33,356 just because couple decides to get married is MORALLY WRONG. Your being “polically neutral on the issue” is morally wrong. These are my judgements. Putting those judgements into a blog about taxes and tax policy does not mean I am angry about anything. It is my moral judgement.

Penalizing a couple $33,356 just because couple decides to get married is also ECONOMICALLY DESTRUCTIVE. Again you are wrong to be complacent just because you are not being affected. It illustrates much that is wrong with the American electorate that you suggest we “just let it go.” These tax decisions are not completely out of our control. They are a direct result of popular ignorance on the subject of taxes and tax redistribution. And I would think my efforts at tax education to be an admirable attribute that should be praised instead of discouraged.

Luis

Greetings David John,

Marriage penalties are evident and have been problematic in US tax history. Lawmakers know about and have tried to “fix the problem”. Some tax codes are steeper than others and some years have sloped the other way if I read the history correctly.

Flat tax rates would be a quick solution to this problem but I’m afraid it would invite unbalances to other parts of the equation such as plutocracy, a nation at unrest, class warfare, etc. Like I said in previous comment posts, progressive taxes make the social classes more equal in other ways.

I do not look ascant to productive members of society. I believe it is just the philosophical beliefs that appear as such. You may look ascant to the idea of redistributive wealth, but conversely this time, it is in the prism in which one sees it.

David John Marotta

Again your post contains very little of content useful for discussion.

The latest marriage penalty was directly caused by lawmakers. The latest legislation seems intent on punishing marriage in multiple ways.

Then you suggest that flat taxes would result in a plutocracy and civil unrest. Odd that you include class warfare, because deviation from a flat tax encourages class warfare with a vengeance. Repeating your opinions that redistributing wealth and highly progressive taxes are good for society doesn’t really add anything to the discussion.

I will leave you with a question? Why not simply tax at 100% any income over $500,000 a year?

John Q.

Married couples are entitled to benefits that unmarried couples are not. I suppose you can attempt to put a valuation on the benefits of those but let’s not pretend there’s no additional value that couples gain thanks to the government’s treatment of married couples versus those who are not. I’m sure there are plenty of gay and lesbian partners who would take issue with the idea that they get equal treatment under the law. If you’re going to allow them to be treated like second-class citizens, why should they pay an equal amount in taxes?

David John Marotta

John Q, You don’t really make an argument to support having a marriage penalty. You are also mistaken in what you are implying. There are few benefits of being married. Here are a couple I can think of:

(1) Each individual gets a $5.5M exemption from inheritance tax when they die. But money between spouses only faces inheritance tax on the second to die. The couple doesn’t avoid any inheritance tax, but we aren’t hitting a widow or widower with a massive tax which would cause them to have to sell the family farm until *after* the second spouse dies. We still cause the heirs to sell the farm, we just wait a little longer.

(2) A spouse can inherit government pensions. But before you suggest the complaint that gay and lesbian partners ought to be able to inherit their partner’s government pension I’d like to ask a couple of thought questions:

Most other benefits are benefits of presumption. Married couples have medical information rights, but these rights can all be gained by couples living together with a tiny bit of paperwork. The primary “benefit” of marriage is that it acts as a shorthand for a lot of this type of paperwork.

Married couples are *not* entitled to much in the way of benefits. You are simply mistaken. That is not the way that laws have been written even in the past. The earliest laws were mostly what you are not allowed to do if you are married, mostly aimed at making divorce very difficult or impossible. This was done for the purpose of encouraging the raising of children by their biological parents in a committed relationship. What is currently different is that we are now actively discouraging the raising of children with the shelter provided by their two biological parents in a committed relationship.

It is MORALLY WRONG and it is SOCIOLOGICALLY DAMAGING and it is ECONOMICALLY DESTRUCTIVE.

John Q.

” There are few benefits of being married.”

There’s a whole legal system of benefits that automatically are granted to those who are married that require complex legal structures to replicate for those who are not, if they are even allowed. In many states, laws and State Constitutions have been amended to deny anyone but married heterosexual couples the rights of that are granted to married couples. These are rights that married couples take for granted. You may not value them but I’m sure you would if you were in the shoes of those who have been denied them.

Megan Russell

You’re right that a marriage license is short-hand for a lot of legal assumptions, but are you really arguing that because of that married couples should be penalized on their tax returns?

John Q.

Mr. Marotta is trying to claim that the benefits that accrue to married couples are negligible. Because he believes that, he doesn’t see why they should be taxed differently than unmarried couples or single people. I take the view that married couples enjoy many benefits that other tax payers do not. Why shouldn’t married couples pay more for the greater benefits that they enjoy due to their favored status in the law and government policy?

Chris Forsyth

John Q,

I think you are coming at it from the wrong direction. Gay and lesbian couples should be allowed to wed (it’s starting to happen thank goodness) and then they can get the married couple benefits you are talking about. The so-called marriage penalty was not devised as a way to equalize this situation — as if you could equalize civil rights through a monetary payment.

The marriage penalty is just wrong. I struggled over Christmas break to explain to my college student son why the tax code works this way. I don’t think I really had any answer better than “that’s just the way it works.”

That said, it is ironic indeed that we find ourselves in a world with so many two-income married couples that the marriage penalty operates as illustrated in this blog. Clearly these tax brackets were intended not as a penalty to anyone but as a way to give a break to the single-income couple. For many years I was a high earning single man and it really cheesed me off that my married co-workers paid lower taxes on the same income, just because they happened to be married. But I understood it as an effort by Congress to leave a little extra in the take home pay for those guys to support their wives and children.