The markets are inherently volatile and fickle. Sometimes the asset category which has been moving one direction throughout the year finally finds resistance and moves back sharply in the opposite direction.

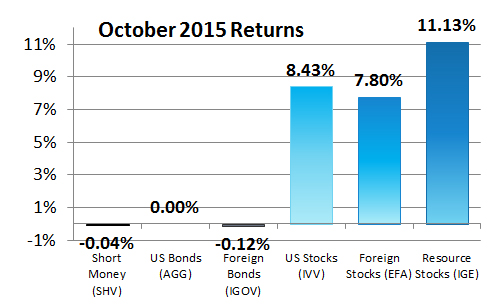

Here is how the markets performed in October 2015:

October was a good month in all three stock categories and it was a reversal of the year-to-date trends.

US Stocks and Foreign stocks moved back into positive territory and Resource stocks gained back a large part of their losses.

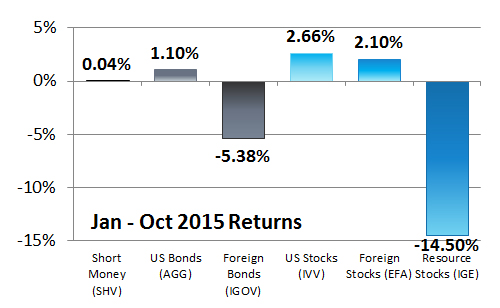

How the markets performed Year-to-Date (through the end of October):

There is always the temptation to think that a category such as Resource stocks is “going down” (present tense) when all you can really say is that they have gone down (past tense) year-to-date.

Then all of a sudden (such as this past month of October) they reverse course and go up by 11.13%.

The returns for Resource stocks listed here are the returns for iShares North American Natural Resources ETF (IGE).

IGE is comprised of 87.9% stocks in the United States and 11.3% stocks in Canada. IGE is also 84.9% Energy and 8.7% Basic Materials.

Energy stocks in the United States have done no better than foreign energy stocks. Vanguard Energy Fund Admiral Shares (VGELX). which includes more foreign stocks is still down -12.4%. Vanguard Energy ETF (VDE) which is comprised almost entirely of stocks in the United States is down -13.4% year to date.

As always when there is a reversal of this type, investors who were actively rebalancing their portfolio were selling what had gone up and had bought what had gone down. They experienced the rebalancing bonus of volatile investments. In fact one of the lessons of the markets is that volatility helps increase the rebalancing bonus.