In “Wealth Of Nations Is Their Freedom” we wrote:

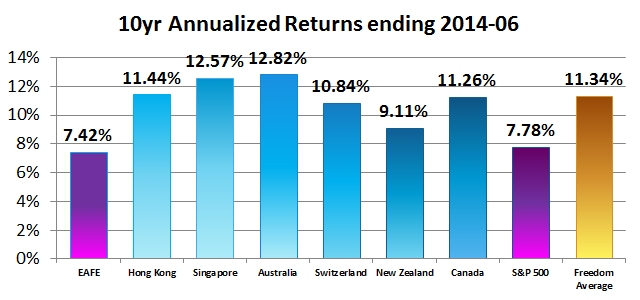

Investments outside the United States are commonly compared with the MSCI EAFE Index of developed countries. EAFE stands for Europe, Australia and the Far East. The EAFE Index has had an annualized return for the past decade of 7.42%. On average, the economically free countries have an annualized return of 11.34%, 3.92% more than the EAFE Index.

Over the past decade, Hong Kong has averaged 11.44%, Singapore 12.57%, Australia 12.82%, Switzerland 10.84%, New Zealand 9.11% and Canada 11.26%. This year, they are the only six countries to receive the designation “free” from the Heritage Foundation, having earned a score of 80% or higher.

The United States ranked 12th this year with the designation of “mostly free” and had an annualized return of 7.78% over the past decade.

For a practical example, imagine you invested $1 million in each country group: the EAFE’s developed foreign countries, the S&P 500 of the United States and each of the six free countries and waited 10 years.

The EAFE Index would have grown to $2.05 million. The S&P 500 would have grown to $2.12 million. And the six free countries would have beaten them both and grown to $2.93 million. These returns include last year’s stellar appreciation in the United States.

Here is that same information in graphical format:

This is the difference between a cumulative return of the EAFE index of about 105% verses a cumulative return of about 193% for Freedom Investing.

These are a significant difference in returns.