Many people lack the time and expertise to develop an intelligent retirement asset allocation plan. Analyzing a long list of fund options is exhausting for some. For others, it feels like trying to read a dinner menu written in a foreign language. To help translate, we have crafted investment recommendations at each age that can be used by University of Virginia employees.

Many people lack the time and expertise to develop an intelligent retirement asset allocation plan. Analyzing a long list of fund options is exhausting for some. For others, it feels like trying to read a dinner menu written in a foreign language. To help translate, we have crafted investment recommendations at each age that can be used by University of Virginia employees.

The University of Virginia offers optional savings programs that allow employees to defer income into a 403(b) or 457 plans through three different providers; Fidelity, TIAA CREF and ING. All of the plans offer age-based and risk-based single-fund investment options. These fund-of-funds typically tack on an extra fee for the service of packaging. The Fidelity Freedom K 2040 Fund is one example that targets those retiring around 2040 and costs 0.68%. The added cost isn’t much when you’re first getting started, but it can add up as your plan balance grows.

To improve on these standard all-in-one packages, we have selected a diversified group of funds appropriate for each age that were created with three guiding principles in mind. The first is keeping costs low. The second seeks global diversification, and the third allocates a portion of the portfolio to investments that are more resilient to the negative impact of inflation.

Costs Matter

The age 40 portfolio we designed using the Fidelity TDSP fund options only costs 0.24%. This comes from the weighted average of the expense ratios from the 15 funds we used to create this portfolio model. Here are the recommended fund allocations and expense ratios for a 40 year old:

University of Virginia’s Fidelity 403(b)

Tax Deferred Savings Plan (TDSP)

85% stocks (appreciation) and 15% bonds (stability)

3% Vanguard Inflation-Protected Securities – Admiral Shares (0.10%)

6% Vanguard Short-Term Inv.-Grade Admiral Shares (0.10%)

6% Fidelity New Markets Income (0.84%)

15% Vanguard Total Stock Market Index – Institutional Shares (0.04%)

2% Vanguard Value Index – Signal Shares (0.10%)

8% Vanguard Mid-Cap Value (0.28%)

2% Vanguard Small-Cap Value (0.24%)

2% Vanguard Health Care – Admiral Shares (0.30%)

2% Fidelity Select Technology (0.79%)

20% Vanguard Total International Stock Index – Signal Shares (0.16%)

3% Fidelity Canada (0.77%)

13% Northern Emerging Markets Equity Index Fund (0.30%)

8% Vanguard Energy – Admiral Shares (0.26%)

4% Vanguard Precious Metals (0.26%)

6% Vanguard REIT Index – Signal Shares (0.10%)

100% TOTAL (average weighted expense ration: 0.24%)

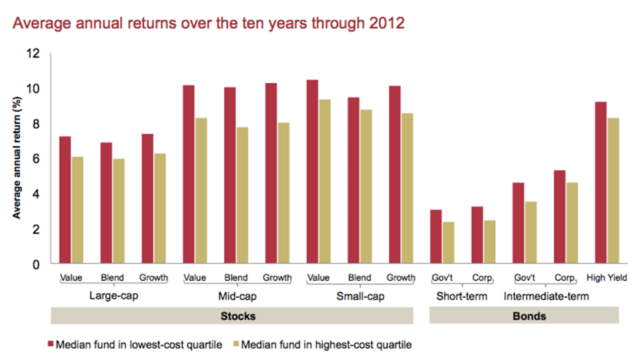

The most consistent factor of investment success is achieved with careful attention to costs. The more you pay in fees, the more likely you are to underperform. The effect of fees can be summed up in the accompanying chart created by Vanguard, showing that lower cost funds (in red) best higher cost funds (in tan) no matter what asset class they covered.

– Produced by Vanguard Funds Group

Global Diversification

Investors have a notorious history of chasing hot performing funds. Even though all of us aspire to buy low and sell high, this sage advice is regularly turned on its head by the vicissitudes of human emotion in the midst of market volatility.

The current hot spot is now focused on U.S. stocks and in particular on small-cap growth stocks that are up 33.24% through the end of September. We prefer to underweight this asset class because it has a long history of underperforming risk-adjusted returns. During the same period, the MSCI Emerging Market index is only up a measly 0.98% despite being the top performer from 2012. A securely anchored investment plan will not be dashed about by the tide of public opinion or the fickle emotional state of Mr. Market.

A robust investment plan incorporates investments in both large and small companies around the world. The U.S. markets make up just under half of the total value of the global market. Yet most U.S. investors illustrate a strong home bias when choosing investments. History suggests tells us that this tendency is usually a mistake. Studies suggest that allocations between 30% and 60% in foreign stocks optimize the risk-adjusted returns.

Constant Eye on Inflation

Inflation is the great enemy of long-term savers because it completely rewrites the math equation that finds equilibrium between current consumption and deferred gratification. As prices rise, savings is penalized as future dollars become worthless.

During inflationary times, cash and bonds are not a safe store of value because their promised interest payments buy less with each passing day. U.S. investors can help protect themselves by allocating investments to foreign bonds, foreign stocks, and resource stocks.

If the U.S. dollar is losing value, foreign bonds can help buffer this effect but only if they are unhedged. Foreign stocks also offer a buffer against a declining U.S. dollar. Investors can also rest a bit easier when they know their portfolio is diversified around the world and held in every major currency.

We also invest strategically in resource stocks that typically respond well to inflationary pressures because the act as an alternative currency. Resource stocks funds often focus energy, commercial real estate investments and base materials or precious metals and mining.

One one hand, you could suggest that these adjustments are only marginally better than a standard prepackaged all-in-one fund. On the other hand, you can realize an extra $250,000 in savings for every additional 1% you earn over a 40 year career. We’re not talking about pocket change.

To access the portfolio recommendations that we have created for University of Virginia employees, click here: UVA Tax-Deferred Retirement Plan Asset Allocation Tools

Additionally, we are holding a seminar to review these UVA retirement plan asset allocation recommendations on December 11, 2013 at 6:30pm in the Century Room at the Gordon Ave. Library in Charlottesville.