Q: This market slump is causing me great anxiety. I am losing my retirement savings, and I do not know that I have enough time to wait out a recovery that may never come. What advice do you have for someone who is considering a strategy shift toward fixed income?

Sincerely,

Fleeing to Fixed Income

MONEY QUESTIONS by Matthew Illian, CFP®

Dear Fleeing,

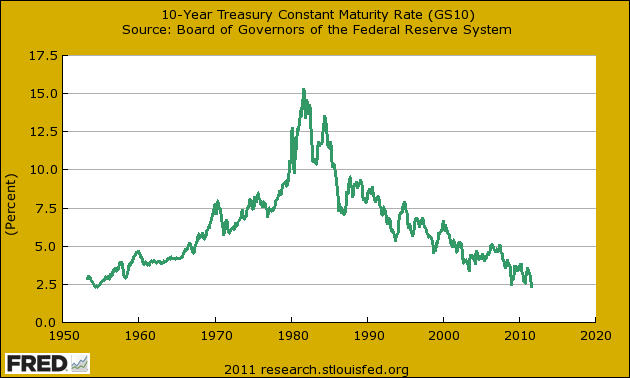

Any investments that are being used to sustain your living needs must keep pace with inflation and provide real appreciation. Overemphasizing the fixed-income markets only makes sense if they offer a more attractive opportunity set of outcomes. Money markets or cash investments are currently not paying a return and historically have not kept up with inflation. As I write, the 10-year Treasury bonds are trading with a yield below 2%. You have to go back to 1950 to find such low rates.

When rates are this low, the duration of a 10-year bond is near 9 years. This means that a 1% increase in the interest rate of a 10-year bond will reduce the price by nearly 9%. For example, if you pay $10,000 for a 10-year bond at 2% and rates rise to 3%, the sales price of your bond will be cut to $9,100. Bond investors from the 1950s through the 1970s realized very poor returns because they were living during a rising rate environment, which is certain to return when the fixed-income markets stabilize.

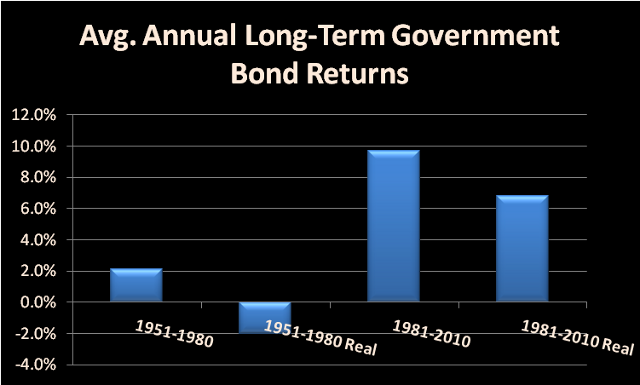

Long-term investors who started investing in government bonds in 1950 averaged just over 2% over the next 30 years. When you factor in inflation, bonds did not even keep up. They lost just over 2% annually when these price increases are factored in.

In contrast, bond portfolios work out very well during a declining rate environment. Those investors who started investing in bonds when rates were peaking back in 1981 have seen average annual returns near 10% during the last 30 years and a positive 6.8% after accounting for inflation.

It is not hard to interpret from the accompanying mountain shaped chart above that the fixed-income investments are more likely to see returns that mirror the 1950s to 1980s period than they are the more recent fixed-income returns.

Source: Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago

Compare these subdued fixed-income yield expectations with the S&P 500, which has a dividend yield over 2.3% and an earnings yield of 8%. And when inflation starts picking up, stocks do a better job of maintaining value than bonds. At this point, you have to ask yourself which you would rather own. The opportunities in the foreign markets are even more attractive. The companies that make up the EAFE index have a dividend yield of 3.3% and an earnings yield over 8%. The combination of instability in the eurozone and a strong dollar is creating very attractive buying opportunities for equity investors.

For short term security, keep the next five to seven years of safe spending in fixed-income and the remainder in appreciating equities. Investing your equities in a globally diversified portfolio will give you a better chance of meeting your retirement goals.

If you have a money question that is nagging at you, please submit it using our contact page. http://www.marottaonmoney.com/contact. We attempt to respond to every question. If yours is chosen for MONEY QUESTIONS, we will give you a pseudonym and let you know the date the Q&A will be published.