If I’m worried about what the markets are going to do, isn’t is a good idea to purchase puts? Won’t this hedge the markets and protect me in case the markets go down?

Jordan

Greetings Jordan,

When you buy a put option you purchase the right to sell a specific security at a given strike price through a specific expiration date. This provides a hedge against the market dropping below that price. If the market drops below that price before the expiration date you can sell your security and limit your losses.

So let’s say you wanted to protect your position of Vanguard 500 ETF (VOO) for 90% of its current value through the end of the year.

Vanguard 500 ETF (VOO) closed Friday at exactly $53.00 per share. There are put options for sale at a strike price of $48.00 per share. The ask price is $4.00. This is the price that someone is willing to sell it to you. These options would expire on January 20th, 2012. This offers downside protection for four months or about one third of the year.

We look up put prices on the Schwab trading platform, but you can get similar information at the Chicago Board Options Exchange (CBOE) at http://www.cboe.com

Type in VOO into the Quote box. You want to select “List all options, LEAPS, Credit Option & Weeklys if avail.” in order to get options that last longer than a month.

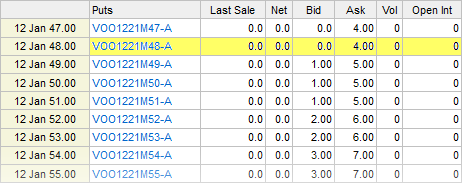

You should get a long list of options which, in part, looks like this:

The put for VOO with a strike price of $48.00/share expiring on Jan 12, 2012 has an ask price of $4.00 per share.

So if you owned $1M of VOO (about 18,867 shares) it would cost you about $75,472 to purchase enough puts to cover your exposure.

In other words you have limited your potential loss to down 9.43% by guaranteeing an additional loss of 7.54%. That means that unless VOO drops more than 17% in the next four months you would have been better off not having bought the insurance at all.

My favorite Paul Volker quote is: “You can’t hedge the world.” And the reason you can’t is because it costs too much. Spending 7.54% for four months of insurance means that you would have to spend 22.64% to cover the whole year.

And since your downside protection is only 9.43% during each four month period, the markets could drop 9% each four month period and you would not be protected. That’s a cost of 22.64% a year and you would not be covered for a steady drop of 9% every four months or 27% for the whole year. Then I would be out 49.64% and there’s still no protection. I know the math isn’t quite that bad (after a 9% drop your insurance would cost less) but you get the idea.

This is one of the reasons our 10 investment rules for safeguarding your money include the rule to only buy investments that trend upward.

Make sure that your investment strategy isn’t trying to hedge the world so much you are guaranteeing a poor return.