I was watching SSgA Emerging Markets N (SSEMX) at the end of the year and was extremely disappointed in the fund’s precipitous drop. Then when I saw the returns for the year the fund was doing just fine.

I may have misinterpreted what was going on in this fund in mid-December when the value of the share dropped from around $16.60 to $10.50 but I don’t understand how to explain what happened to the share price. What was going on in the fund?

– Confused Investor

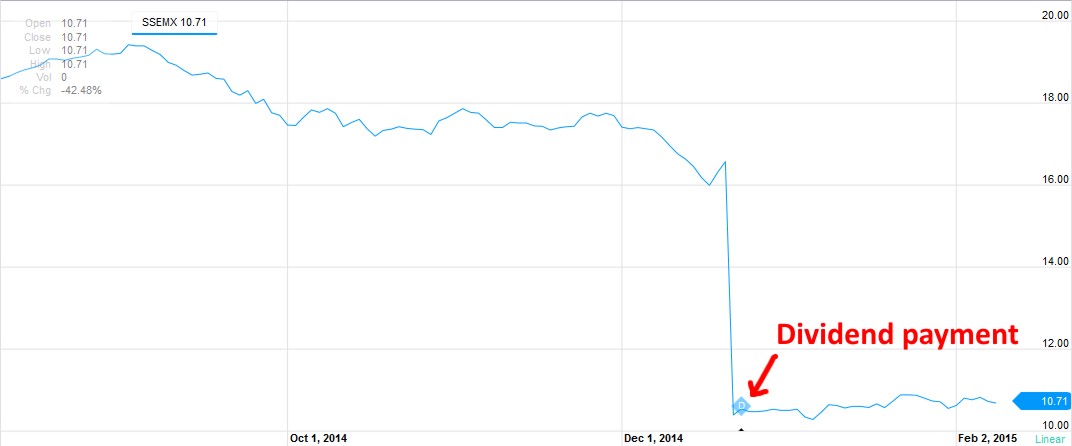

Both Google Finance and Yahoo Finance can be confusing and misleading at times. Here is Google Finance’s chart for SSEMX:

Clearly this can’t be the precipitous drop that it appears to be because Google Finance lists the 1 year return for this fund as +7.10%.

Here is that same time period from Yahoo Finance:

That little white “D” in a light blue triangle represents a dividend payment being paid out. That is an indication that the value of the fund did not drop because of market movements. It dropped because the share price before the payment reflected that shareholders were going to receive the payment. And the share price after the payment reflected that shareholders had already received the payment.

It is like having a gift card worth $16.65 on December 21st. But on December 22, 2014 after you’ve received and eaten a hamburger costing $6.23, the gift card is only worth $10.42. The payment of the dividend changes the value of the stock in the same way.

On Yahoo Finance, you can view historical prices for SSEMX:

Normally Yahoo tries to adjust for dividends by computing an adjusted close which takes those dividends into account and therefore smooths the returns to what they should be. But in this case it doesn’t look like Yahoo has computing the adjusted close correctly.

Yahoo reports the dividend being paid between 12/19 and 12/22. But the drop in price because the dividend’s payment occurs a day earlier between 12/18 and 12/19. This makes it a little more confusing than it needs to be.

Yahoo computes the adjusted close simply by taking out dividends and working backwards.

On 12/22 the fund was worth 10.57.

On 12/18 the fund was worth 16.60 but 6.232 was going to be distributed as a dividend so the adjusted close should have been 10.368 (16.60 – 6.232). Instead Yahoo shows the adjusted close as 6.67. This is simply wrong on their part.

Both the authors and the clients we manage often invest in the investments mentioned in these articles.

Photo used here under Flickr Creative Commons.