Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions.

Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions.

We recommend that if you are eligible for an HSA, you prioritize funding it to the maximum allowed each year. In 2021, this maximum amount is $3,600 for individuals and $7,200 for families (up from 2020 by $50 and $100 respectively).

The additional allowed catch-up contributions for those over the age of 55 is $1,000, which has remained unchanged since 2009. Both spouses participating in a family plan are eligible for the catch-up contribution.

The next step after having opened, funded, and invested in your Health Savings Account (HSA) at HSA Bank is to set your beneficiaries.

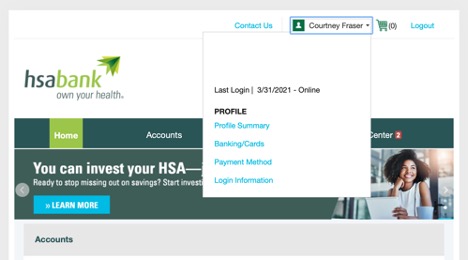

After logging in to HSA Bank, click on your name in the upper right corner to open a drop down menu. In the menu, select “Profile Summary.”

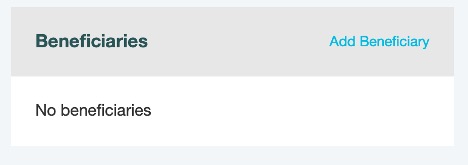

On the page that loads, scroll down to the section headed “Beneficiaries.” Click “Add Beneficiary” to add a new one and “View / Update” to edit an existing one.

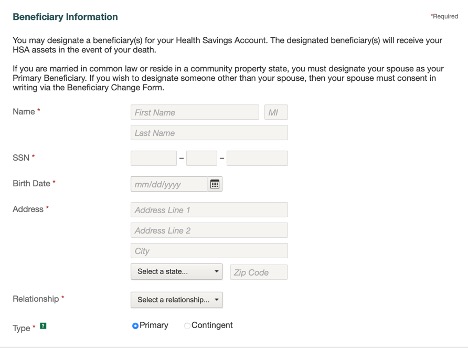

For each beneficiary, you will be required to provide the following information: Name, Social Security Number, Birth Date, Address, and their Relationship to You.

Each beneficiary designation will either be a primary beneficiary designation, the first group of people who will inherit the HSA after you die, or a contingent beneficiary, the group of people who will inherit the HSA only if no primary beneficiaries are still living.

You can have more than one of each type of beneficiary. If you do have more than one, you will be asked to identify what share, listed as a percentage, of the account you want each heir of that level to receive. If one beneficiary of that level predeceases you, their share will be reallocated to the remaining beneficiaries pro rata.

Upon your death, your HSA can pay for qualified medical expenses incurred on your behalf up to a year after your death, but these do not include funeral expenses.

Your spouse can inherit the HSA tax-free as an HSA. For this reason, most families benefit from listing their spouse as the sole 100% primary beneficiary.

When an HSA is left to a non-spouse, the account stops being an HSA. The assets are distributed, and the value of the account becomes taxable to the beneficiary. If the beneficiary is your estate, the value is included on your final income tax return. If the beneficiary is an individual, they must include the value on their income tax return.

Unlike a traditional IRA, which can be taken out gradually over a number of years, the entire value of an HSA is taxable for a non-spouse beneficiary in the year it is received. This is the main disadvantage of an HSA over a traditional IRA.

Many account owners will want to designate their child(ren) as their contingent beneficiary(ies). However, if your own income tax rate is lower than your children’s, you can designate your own estate as the contingent beneficiary. This effectively leaves your HSA to whoever you have identified in your Last Will and Testament, but also burden’s your final tax return with the bill rather than your heirs.

If you want to designate your own estate, this can be done by leaving the contingent field blank or by filling out the fields with your own information and putting “The Estate Of…” at the start of the name field.

If you have charitable intentions in your estate plan, another option is that you can set the contingent beneficiary of your HSA as a charity. Because charities are exempt from income tax, this prevents your HSA from being taxed entirely.

While you can leave your HSA to a trust, I would discuss this plan with your estate attorney or tax preparer before implementing it. Depending on the type of trust, you may be creating a tax problem which is otherwise easily avoided.

Photo by Christopher Czermak on Unsplash