Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions. After age 65, your HSA can function like a Traditional IRA for non-qualified health expenses.

Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions. After age 65, your HSA can function like a Traditional IRA for non-qualified health expenses.

We recommend contributing the maximum every year as long as you are eligible.

Once you’ve open an HSA and have started making contributions, it is important that you set beneficiary designations on the account. Here’s how to do that for a Fidelity HSA.

Instructions

After logging into Fidelity, click “Profile” in the top left-hand menu:

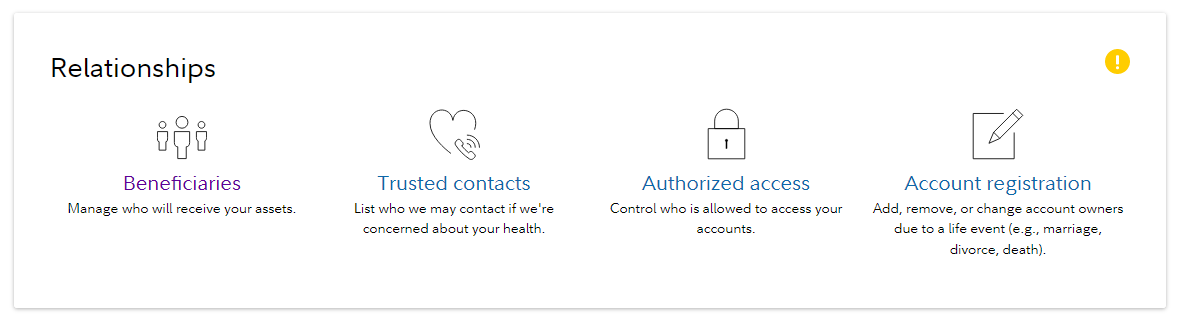

You will first see your profile information, such as name, address, phone number, etc. Scroll past this information and you will see a section titled “Relationships”. Under this heading, click on the link for “Beneficiaries”.

From there, you will be able to update your beneficiary information by selecting “edit” on the right side of your account name and number.

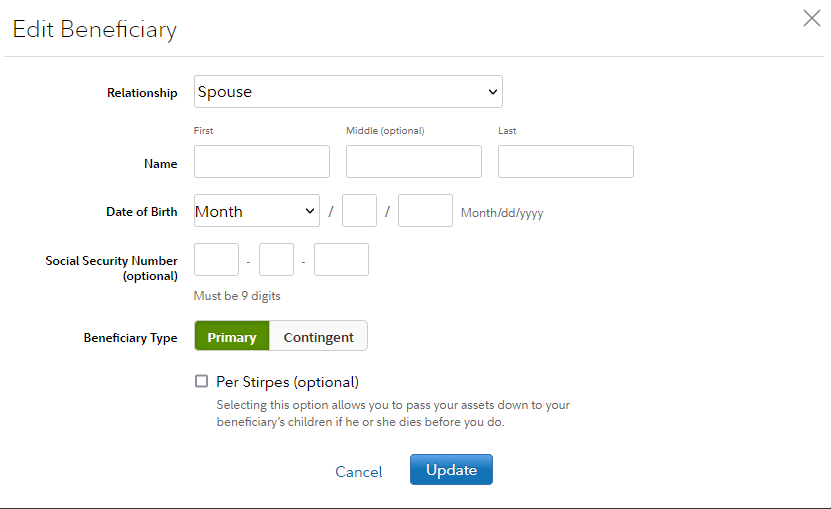

For each beneficiary you will need to provide their relationship to you, name, birthday, and select beneficiary type (primary or contingent). A primary beneficiary is the first group who will inherit your HSA if you pass away. A contingent beneficiary is who would inherited your HSA if your primary beneficiary(ies) has predeceased you.

You may also check if you’d like that beneficiary to be per stirpes, which allows you to pass your assets down to that beneficiary’s children if he or she dies before you.

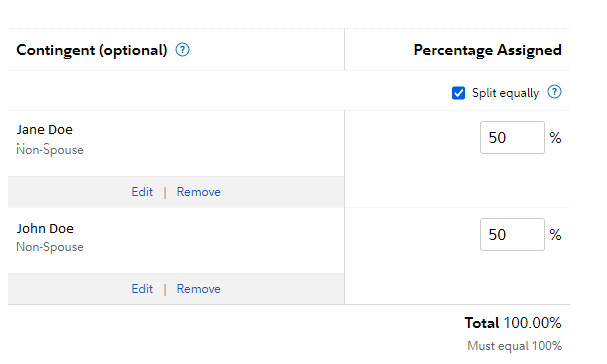

You can have multiple beneficiaries within each category. If you add multiple beneficiaries of the same type, you will be able to assign a percentage to each beneficiary on the page that loads.

If you would like your beneficiaries in each category to inherit in equal percentages, you can check the “split equally” box in the upper right corner and the web page will automatically fill in the percentages.

All percentages for each beneficiary type must add up to 100%.

General Thoughts

Upon your death, your HSA can pay for qualified medical expenses incurred on your behalf up to a year after your death, but these do not include funeral expenses.

Your spouse can inherit the HSA tax-free as an HSA. For this reason, most families benefit from listing their spouse as the sole 100% primary beneficiary.

When an HSA is left to a non-spouse, the account stops being an HSA. The assets are distributed, and the value of the account becomes taxable to the beneficiary. If the beneficiary is your estate, the value is included on your final income tax return. If the beneficiary is an individual, they must include the value on their income tax return.

Unlike a traditional IRA, which can be taken out gradually over a number of years, the entire value of an HSA is taxable for a non-spouse beneficiary in the year it is inherited. This is the main disadvantage of an HSA over a traditional IRA.

Many account owners will want to designate their child(ren) as their contingent beneficiary(ies). However, if your own income tax rate is lower than your children’s, you can designate your own estate as the contingent beneficiary. This effectively leaves your HSA to whoever you have identified in your Last Will and Testament, but also burden’s your final tax return with the bill rather than your heirs.

If you want to designate your own estate, this can be done by leaving the contingent field blank or by filling out the fields with your own information and putting “The Estate Of…” at the start of the name field.

If you have charitable intentions in your estate plan, another option is that you can set the contingent beneficiary of your HSA as a charity. Because charities are exempt from income tax, this prevents your HSA from being taxed entirely. A testamentary donor advised fund is useful when wanting to identify charitable beneficiaries.

While you can leave your HSA to a trust, we recommend discussing this plan with your estate attorney or tax preparer before implementing it. Depending on the type of trust, you may be creating a tax problem which is otherwise easily avoided.

If you need help with the Fidelity website, you can contact them directly at 800-544-6666.

Photo by Toa Heftiba on Unsplash. Image has been cropped.