Part 7 of the American Rescue Plan Act of 2021 created new rules for health insurance premium subsidies for only tax years 2021 and 2022. These new rules mean that many more Americans will be able to receive government subsidies.

Part 7 of the American Rescue Plan Act of 2021 created new rules for health insurance premium subsidies for only tax years 2021 and 2022. These new rules mean that many more Americans will be able to receive government subsidies.

Prior to this regulation, the U.S. Code doled out government subsidies only to “applicable taxpayers,” which was “a taxpayer whose household income for the taxable year equals or exceeds 100 percent but does not exceed 400 percent of an amount equal to the poverty line for a family of the size involved” (emphasis added).

However, the American Rescue Plan Act adds the temporary provision:

(E) TEMPORARY RULE FOR 2021 AND 2022.—In the case of a taxable year beginning in 2021 or 2022, subparagraph (A) shall be applied without regard to “but does not exceed 400 percent”.

This means that it is possible for families of any income size to receive government subsidies in 2022. How much subsidy you receive is based your modified adjusted gross income (MAGI), the second lowest cost marketplace silver plan in your county, and the federal poverty line.

Health Insurance

There are multiple types of health insurance and two main ways to buy them. One way is that you can purchase health insurance “off the exchange” directly from providers such as Anthem or Optima. The other way is that you can purchase health insurance through the so-called Marketplace. These marketplace plans are “on the exchange.”

Only plans which are “on the exchange” qualify for federal subsidies.

Oddly, identical plans are normally offered by providers both on and off the exchange. For example in my county, Anthem offers “Anthem HealthKeepers Catastrophic 8550” and “Anthem HealthKeepers Catastrophic X 8550.” These two plans have the same terms and coverage, but the plan with an “X” in the title is the version which is offered on the exchange.

The main place to purchase on-exchange health insurance is HealthCare.gov. For a few states, you need to go to your state exchange instead, which is found here.

There are also several private companies offering the ability to shop and purchase all plans, both on- an off-exchange, such as HealthSherpa.

If you purchase on-exchange insurance, then you may be eligible for federal subsidies. If you purchase off-exchange health insurance, then even if the plan you purchased is identical to an on-exchange plan you are ineligible for insurance subsidies.

You can only get new health insurance during so-called open enrollment or if you have a special enrollment period caused by a life changing event. This year, open enrollment is November 1, 2021 through January 15, 2022.

Advanced Subsidies?

When you enroll you can decide to either estimate your expected subsidy and receive an advance of your premium tax credit or you can decline advanced credits and receive any credits you are eligible for when you file your taxes. Either way, you will need to file Form 8962 with your taxes to figure your tax credit.

Some people can benefit from receiving the advance subsidy because if your AGI is small enough and you estimate your premium tax credit then you may get to keep the difference without repaying. However, if you make over 400% of the poverty line, then whether or not you advance the subsidy does not effect how much you get to keep.

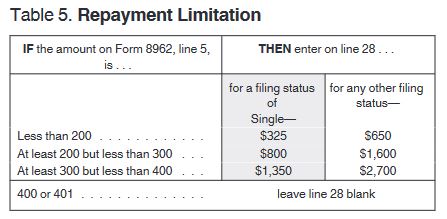

Repayment is determined by the “Repayment Limitation” explained in Table 5 of the instructions.

The amount on line 5 is your percentage of the poverty line. If you are less than 400% of the poverty line, then the amount you are required to repay is limited by the amount in the table. If you are over 400% of the poverty line, then you must repay any dollar amount you estimate wrong.

MAGI

For the purposes of the premium tax credit, your modified adjusted gross income (MAGI) is: your adjusted gross income (AGI) from Form 1040 line 11 plus any tax-exempt interest (Form 1040 line 2a), nontaxable Social Security (Form 1040 line 6a Total minus line 6b Taxable), and any amounts excluded by the foreign earned income exclusion (Form 2555 lines 45 and 50).

Because you modify your AGI only by adding back in otherwise exempted or nontaxable balances, you can use your AGI by itself for basic planning. If your AGI means that you do not receive subsidies, your modified AGI will only make you receive less.

Second Lowest Cost Silver Plan

To calculate the amount of subsidies you receive, the formula uses the price of a particular marketplace plan available to you as a benchmark. That plan is “the applicable second lowest cost silver plan with respect to the taxpayer.”

To identify the monthly price of the second lowest cost silver plan for your family, you can use HealthCare.gov’s “Health Coverage Tax Tool.”

After clicking “Get Started” under “Figure out your premium tax credit,” you pick the tax year, your birthday, and your location. In the end, the tool will tell you the monthly value of the applicable second lowest cost silver plan. As I write this, they have not yet updated their website to have 2022 coverage numbers. However, this link should theoretically be updated to include the 2022 tax year once open enrollment starts.

Federal Poverty Line

The federal poverty level can be found many places online. The easiest place to find it is on HealthCare.gov in their glossary here or on the Department of Health and Human Services website here. Again, as I write this, the 2022 numbers have not yet been released.

There are multiple poverty lines based on how many people are dependents on your tax return. A husband and wife, for example, would be the 2-person federal poverty line.

The percentage your income is of the federal poverty line is then your MAGI (described above) divided by your dependent-specific federal poverty line.

Subsidized Percentage

The amount of federal subsidy you are allotted is determined so that the second lowest cost silver plan costs no more than a specific percentage of your MAGI. That percentage is determined based on the percentage of the federal poverty line your MAGI is.

For 2021 and 2022 only, the premium percentage table is:

| Percent Poverty Line | Initial Premium Percentage | Final Premium Percentage | Additional Premium Percentage in Range | Poverty Percentages in Range |

| 0% | 0.0% | 0.0% | 0.0% | 150% |

| 150% | 0.0% | 2.0% | 2.0% | 50% |

| 200% | 2.0% | 4.0% | 2.0% | 50% |

| 250% | 4.0% | 6.0% | 2.0% | 50% |

| 300% | 6.0% | 8.5% | 2.5% | 100% |

| 400% | 8.5% | 8.5% | 0.0% | — |

The code says:

(i) In general

Except as provided in clause (ii), the applicable percentage for any taxable year shall be the percentage such that the applicable percentage for any taxpayer whose household income is within an income tier specified in the following table shall increase, on a sliding scale in a linear manner, from the initial premium percentage to the final premium percentage specified in such table for such income tier:

Most wealthy individuals will be over 400% of the poverty line and thus their premium percentage is 8.5%. This means the federal government will provide subsidies equal to the amount that the second lowest cost silver plan for their age and area costs more than 8.5% of their MAGI.

For those lower than 400% of the poverty line, then the applicable percentage is determined by prorating your percent poverty line through this table. For example, if you have an MAGI that is 312% of the poverty line, then your initial premium percentage is 6%. You are 12% into the 100% of poverty percentages in that range. So 12% of the 2.5% additional premium percentage gets added to the initial percentage or (12% / 100%) * 2.5% + 6% = 0.3% + 6% . So your final premium percentage would be 6.30%.

An Example

Take for example a family of three. In 2021, the federal poverty line for 3 people was $21,960, and 400% of the poverty line would be $87,840. For those earning more than $87,840, the premium percentage would be 8.5%.

To determine the amount of subsidies that would be provided, you would need to first multiply your MAGI by your premium percentage and then compare that to the second lowest cost silver plan. For example, a MAGI of $100,000 with a 8.5% applicable percentage, would be $8,500. The government expects that the second lowest cost silver plan for that family would cost $8,500.

Let’s imagine the second lowest cost silver plan costs $13,000 for that family. Then the subsidies the government will offer you is $13,000 – $8,500 = $4,500.

This means regardless of which on-exchange plan you pick, the government will offer you $4,500 of subsidies for an on-exchange plan.

So imagine your plan costs $10,822 for the year. With $4,500 of subsidies, that plan would only cost $6,322 for the year.

In my example, I have done this using annual numbers. However you can do the same thing using the monthly premium for the second lowest cost silver plan to calculate your monthly subsidy.

Conclusions

If you are currently shopping for health insurance for 2022, consider getting an on-exchange health insurance plan. You may be surprised at how much subsidies you can receive.

Photo by Eneko Uruñuela on Unsplash