The American Rescue Plan Act of 2021 created new rules for health insurance subsidies for only tax years 2021 and 2022. These new rules mean that many more Americans will be able to receive government subsidies. You can read more about those changes and rules in “How the Wealthy Can Take Advantage of Health Insurance Subsidies in 2022.”

The American Rescue Plan Act of 2021 created new rules for health insurance subsidies for only tax years 2021 and 2022. These new rules mean that many more Americans will be able to receive government subsidies. You can read more about those changes and rules in “How the Wealthy Can Take Advantage of Health Insurance Subsidies in 2022.”

To receive subsidies requires that you enroll in marketplace coverage. The amount of subsidies you receive is based on your modified adjusted gross income (MAGI), the second lowest cost marketplace silver plan in your county, and the federal poverty line. It is worth noting that the amount of subsidies you receive is not based on which level plan (gold, silver, bronze, or HSA bronze) you actually purchase.

While my last article on the topic went into the mathematics of how to project your premium tax credit, the Kaiser Family Foundation (KFF) has a Health Insurance Marketplace Calculator which makes the process even easier. They have updated this calculator to both 2022 health insurance numbers and the American Rescue Plan Act Rules. It can be used to quickly calculate your potential premium tax credit savings. Here’s how:

Inputs

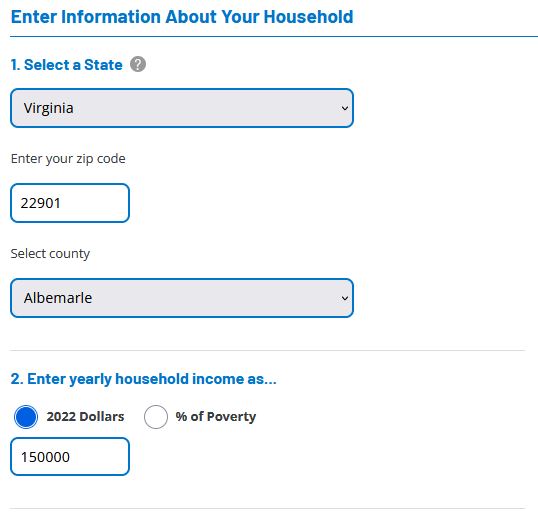

Go to https://www.kff.org/interactive/subsidy-calculator/.

Select your state, enter your zip code, and select your county.

For yearly household income, either enter your estimated MAGI or simply select “% of Poverty” and input 400% for now.

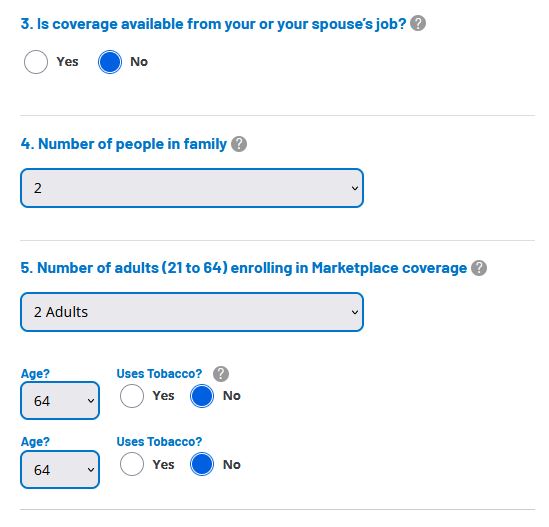

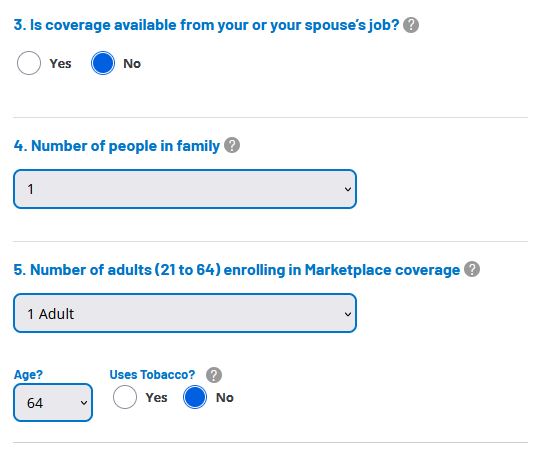

Answer the question “Is coverage available from your or your spouse’s job?” The help text reminds you:

Select “No” if your employer requires you to spend more than 9.78% of your household income on your own insurance premium, or if the health insurance your employer offers does not meet the health care law’s minimum value standards.

Under “Number of people in family,” put the number of dependents on your tax return.

Select the number of adults / children for whom you are getting insurance and then share their ages. For 2022 health insurance, the age they are looking for is the age you will be on December 31, 2021.

Click submit.

Results

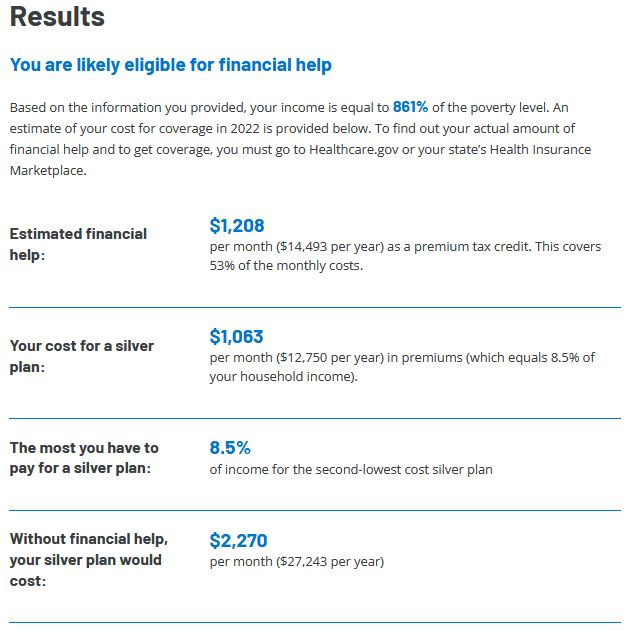

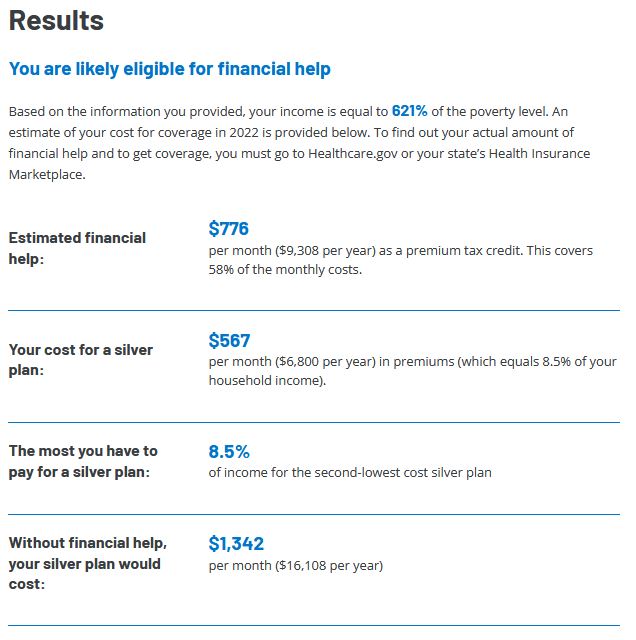

Under the “Results” section, scroll down to “Without financial help, your silver plan would cost:”

Record the number listed in the “($ per year)” section.

Then, divide that number by 8.5%. This is how much money you could earn (modified adjusted gross income) over which you would no longer receive any subsidies.

If your 2022 MAGI is below that number, then you could receive some subsidies by enrolling in a marketplace plan.

Examples

Two adults both age 64 in Albemarle County, Virginia with a household income of $150,000 could receive $14,493 for the year as a premium tax credit by enrolling in any marketplace plan. Furthermore, they could receive some amount of subsidies up to a MAGI of $320,505 (the second lowest cost silver plan of $27,243 divided by 0.085).

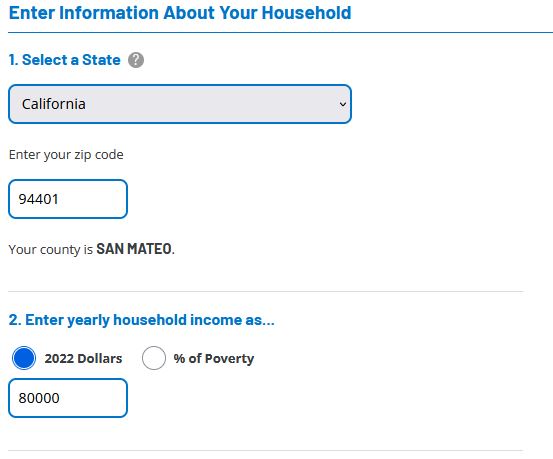

One adult age 64 in San Mateo, California with a household income of $80,000 could receive $9,308 for the year as a premium tax credit by enrolling in any marketplace plan. Furthermore, they could receive some amount of subsidies up to a MAGI of $189,505 (the second lowest cost silver plan of $16,108 divided by 0.085).

It is important to note here that if you have a grandfathered plan, chances are that keeping your grandfathered plan is going to be cheaper in the long run than trying to seek subsidies today. These subsidy rules are only available for 2022, whereas you can keep your grandfathered plan, if you don’t leave it, for years to come.

Also, if you have an employer plan, chances are that your employer is already so heavily subsidizing your insurance that it is cheaper than the marketplace plans even after subsidies.

Lastly, if your employer offers a Health Reimbursement Arrangement such as a Qualified Small Employer HRA (QSEHRA), chances are you cannot benefit from subsidies or your subsidy total will be reduced by the reimbursement allowance.

For those of us who are already shopping for health insurance for 2022 though, the premium tax credit federal subsidies may be able to offer considerable savings. This year, look into getting an on-exchange health insurance plan. You may be surprised at how much subsidies you can receive.

Photo by Tim Foster on Unsplash