Reading current financial news and predictions is very unsettling. Reading old financial news and predictions can help inoculate investors and advisors alike to the financial noise.

As I was doing research for another article I read “Climbing the Wall of Worry ” by Richard Bernstein from December, 2012. To put his newsletter in context, advisors started 2012 recommending that investors underweight US stocks. Then 2012 proved to be a good year for US stock with the S&P 500 appreciating 16.00%. Now at the end of 2012, advisors were particularly worried about the US markets and even recommended a stronger underweight to US stocks. In the midst of that consensus, Bernstein wrote:

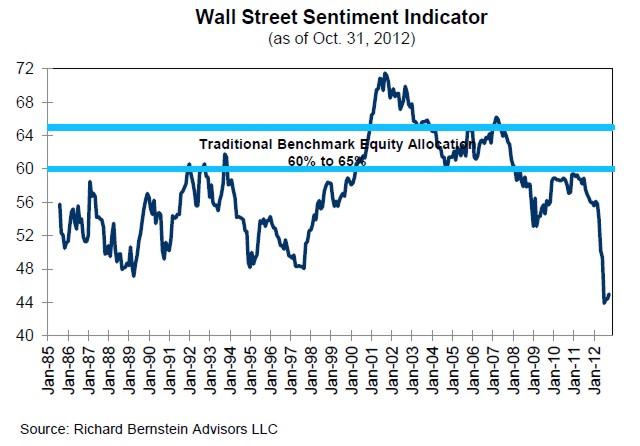

The Wall Street Sentiment Indicator

Approximately thirty years ago, we began to study the information content of Wall Street strategists’ consensus recommended asset allocations. We found, when adding a little math, that the consensus recommended asset allocation was a very reliable contrary indicator. That is, it paid to be bullish when Wall Street suggested underweighting equities, and vice versa.

Chart 1 shows one version of this indicator in which we plot the consensus recommended equity allocation for a balanced fund against the typical normal long-term equity weight of 60-65%. In this chart, a reading of 50% indicates that the average Wall Street strategist was recommending 50% of a balanced fund (i.e., stocks, bonds, and cash) be invested in equities.

As a fantastic example of bull markets climbing the wall of worry, Wall Street strategists never recommended overweighting equities at any point during the entire bull market of the 1980s and 1990s. They finally recommended overweighting equities subsequent to the Technology bubble. That overweight proved to be just in time for the so-called “lost decade in equities”, during which US stocks produced a negative return over ten years.

Today, however, Wall Street strategists are recommending the lowest equity allocation in the near-thirty year history of the data. As was the case before the lost decade, the stock market has performed well during a period of fear.

Berstein’s contrarian indicator paid off. Even though sentiment was at an all-time low and few thought we were going to have a stellar year in the US markets, that is exactly what happened. The S&P 500 appreciated 32.39% during 2013 and an additional 13.69% during 2014. In other words, it paid to continue to rebalance your portfolio and keep a healthy allocation to US stocks.

Here is our advice published on the blog from January, 2012:

- Your Portfolio Needs Rebalancing: Most investors do not have a balanced portfolio. They look for investments with little to no risk that still provide great rates of return. And by chasing this elusive chimera they miss the easy money they could make from having a good asset allocation in the first place and rebalancing it periodically.

- Book Review: The Investment Answer: Investors know you should buy low and sell high, but in reality it is very hard to sell a position that has grown significantly and invest this money in another position that has performed relatively poorly. But as Goldie and Murray point out, “Rebalancing is an automatic way to buy low and sell high, without your emotions getting in your way.” Want proof that rebalancing works? From 1990 to 2009, an annually rebalanced portfolio returned 17.6% more than a static portfolio.

- Being Reasonable: “Unrealistic upside expectations are hard to manage, which means clients face a high probability of being disappointed even if their portfolios deliver what would otherwise be deemed acceptable performance. Basically, their portfolios are doing fine, it’s their expectations that are messed up. Conversely, after a ugly bear market, it can be difficult for investors to remember that investments actually can produce gains.”

- Video: Where Do You Invest? Learn All Six Asset Classes: Most investors invest in only one and a half of the six asset classes. Learn where to invest in all six and how to tilt in each to over-emphasize appropriate categories.

- Debt, Uncertainty and Volatility in 2011: As I’ve said many times, asset allocation means you always have something to complain about. But it also means you only have a partial complaint. Overweight what does better on average even if it fails to do so one quarter. Never let a brilliant long-term strategy be ruined by an emotional reaction to one quarter or even one year’s worth of returns.

- Indexing Works: Active management does not seem to help.

Our message has consistently been: Set a brilliant long-term strategy, rebalance regularly, and then don’t ruin it by watching the news.

In 2012, people wondered why we allocated anything to US Stocks. Now they wonder if we should invest anything in Foreign Stocks or Resource Stocks. And we’re probably better off for not listening to them.

Photo used here under Flickr Creative Commons.