Last week we wrote about the efficient market hypothesis and how John Bogle created the first index funds. We also saw how Bogle preferred the The Vanguard Total Stock Market Fund as the best index to use.

We continue our discussion about index investing with an article by Temma Ehrenfeld in Financial Planning magazine entitled, “Indexing Works“. She takes on the idea that active managers can shift out of stocks in time to stem losses in bear markets and shows that this simply is not true. In answer to the question, “Can manager predict market drops in time?” she writes:

Even fans of index funds often believe they do worse than funds with active managers during bear markets. The idea is that a savvy manager can shift money out of a crashing asset class in time to improve overall performance. As it turns out, “most events that result in major changes in market direction are unanticipated,” says Christopher B. Philips, CFA, a senior analyst in Vanguard’s Investment Strategy Group.

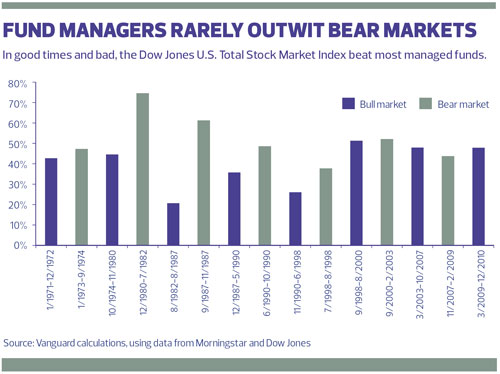

Here is the chart showing how many managed funds beat the Dow Jones U.S. Total Stock Market Index during bull markets and bear markets:

Active management does not seem to help. Ehrenfeld goes on to talk about what is a reliable gauge to future performance, low fees:

In addition, a Financial Research Corp. study found that a fund’s expense ratio was the most reliable gauge of its future performance, with low-cost funds consistently above average. This cost advantage accumulates over longer time periods, Vanguard reports. Bear markets tend to be short, which might help active managers. In fact, they haven’t earned their higher fees in white-knuckle times.

And what about during bull markets? Active managers fared even worse. In seven of the eight bulls since 1971, the Dow performed better than the average actively managed fund.

Make sure the funds you are invested in have low fees.

Photo by Megan Marotta