We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Estate Planning is More Than Just a Will: 3 Essential Documents You Should Have

A good estate plan is every bit as useful during your lifetime as it is at your death. No matter your age or how much (or how little) money you have, there are three essential estate planning documents you should have.

Estate Planning

The most important product of estate planning is achieving family harmony.

Why Can’t Our Social Security System Be More Chilean?

Both economists and reasonable citizens understand that reforming our Social Security system is inevitable.

How to Calculate An Advisor’s Value: Annuity Planning

Without a doubt, the best single annuity option for any client – that is, the option that creates the higher monthly cash payment – is to delay Social Security.

World Performance – September 2013

Historically September has one of the worst averages, but this year it provided very good returns.

Wealth Inequality in America, Part 3

Even the negative or inconsequential effects of welfare often fail to convinced some people that a new system of assistance is necessary.

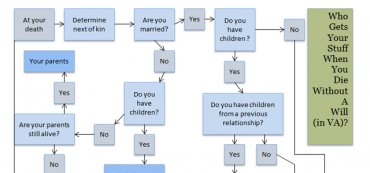

Who Gets Your Stuff When You Die Without a Will?

It can be tricky to figure out who your “next of kin” is, so here’s a handy flowchart to help you figure out who gets everything you leave behind if you don’t have a will.

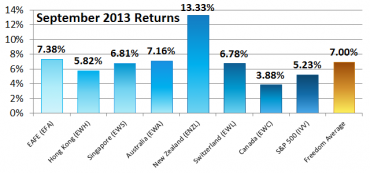

Countries with Economic Freedom – July, August, & September 2013 Returns

We recommend investing in countries which are high in economic freedom and low in debt and deficit.

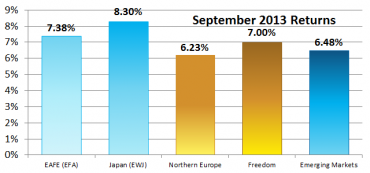

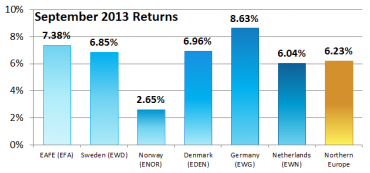

Northern Europe Performance – September 2013

Northern European countries averaged 6.23% in September 2013.

Who Are the Bogleheads?

At the reunion, Bogle shared that he’s just a common guy with some really good ideas.

How to Calculate An Advisor’s Value: Dynamic Withdrawals

Having a plan not to run out of money is priceless.

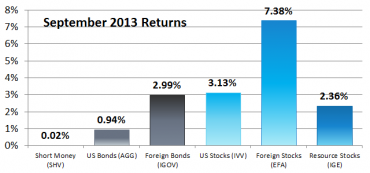

Six Asset Classes – September 2013 Returns

In September 2013 the returns of foreign stocks beat US stocks by 4.25%.

Wealth Inequality in America, Part 2

Blaming the 85% with 100% of the wealth for the poverty of the remaining 15% is unreasonable. The two are unrelated.

2013 IRA & Roth Contribution Limits

There’s still time to make sure you’ve maxed out your retirement contributions — your future self will thank you.

When To Say No: 7 Investments to Avoid

“A well-designed financial plan can get derailed by the wrong investment. Here are seven things investors can probably do without.”