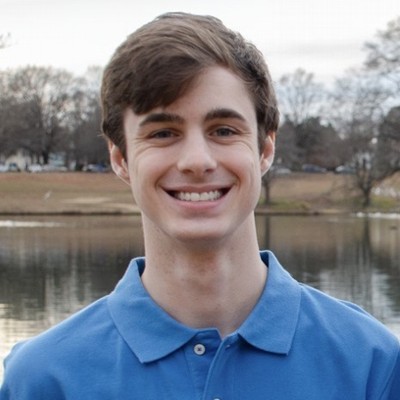

We are very pleased to announce that Jacob Massanopoli is our newest CERTIFIED FINANCIAL PLANNER™ (CFP®) professional at Marotta Wealth Management!

The CFP® certification is the recognized standard of excellence for competent and ethical personal financial planning. To use the certification, you have to meet the initial certification requirements (known as the four “Es”). They are Education, Examination, Experience, and Ethics.

The first requirement of Education, Jacob satisfied through Virginia Tech’s Financial Planning program. Jacob first found the Virginia Tech program by chance. In college, he was originally interested in a Finance major. However, he knew he didn’t want to do corporate finance at a large corporation.

A week after talking over other possible finance careers with a professor, the Financial Planning department presented their program to his class. The candor and personality of the two presenting professors, Dr. Lytton and Professor Klock, helped Jacob know that the career path was a perfect fit.

He met Marotta Wealth Management for the first time when David Marotta was giving a presentation on Roth conversions to Virginia Tech’s FPA chapter. Jacob was interested in the topic and even later went on to build a basic Roth conversion tool at his first financial planning internship.

By his senior year, Marotta Wealth Management was actively looking for individuals with strong proficiency in Microsoft Excel to join our tax specialty team, and it was a perfect match. Jacob graduated from Virginia Tech in 2021 with a Bachelor of Science in Business and started working for our firm a month later in June.

Jacob Massanopoli

By November, he satisfied the Examination requirement, passing the six-hour CFP® exam on the first try.

After two years of mentoring under David John Marotta, CFP®, Jacob satisfied the Experience requirement in July 2023. He submitted his final application and background check to the CFP Board and was accepted, passing the Ethics requirement and making him a CERTIFIED FINANCIAL PLANNER™ professional. For more information about this designation, see the CFP Board website.

At Marotta, Jacob is part of our tax specialty team. He helps create our customized Roth conversion recommendations for Comprehensive clients and is also a relationship advisor to a select number of clients.

A Brief Interview with Jacob

What is your favorite Marotta Wealth Management service?

As a member of the tax team, I have to say the tax planning service of course! Roth conversions caught my interest while I was at Virginia Tech and in my internship before working at Marotta, so it’s been great learning more about how they are used as a tool in tax planning and financial planning as a whole.

What is your favorite part of being with Marotta Wealth Management?

Working from home is definitely my favorite part about working here. The freedom to live anywhere I’d like has enabled me to live with and near friends that I wouldn’t have been able to see nearly as often if I was working in an office. Since I live in D.C., I also was able to sell my car and it is a great feeling to not have to worry about parking, gas, insurance, and all the other things that go into owning a car.

What is your favorite Marotta Wealth Management article or series? Why?

I very much enjoy the Freedom Investing and Gone-Fishing Portfolio series. As someone who doesn’t specialize in stock picking and portfolio design, I appreciate the simplicity of the Gone-Fishing Portfolio and the fact that we post it on our blog for all our readers to use. As for Freedom Investing, it’s neat to see the historical performance tracking and how the strategy seems to have an edge over the index.

What advice do you give to those who are just getting started with investing?

Open a Roth IRA and buy low expense ratio index funds.

Jacob’s Latest Articles

#BestOf2022 How to Calculate Taxable Social Security

If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits.

Why I-Bonds May Not Be As Great As They Seem

If you’re thinking about buying an I Bond, make sure it fits properly into your financial plan, and you aren’t just chasing the high interest rate.

How to Calculate Taxable Social Security (Form 1040, Line 6b)

If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits.