There can be great value in the sage advice of a fee-only fiduciary advisor. Even if they brought no value for their investment management, they could still bring great value for their help in comprehensive wealth management.

While a competent financial counselor can bring value, an expensive investment product cannot.

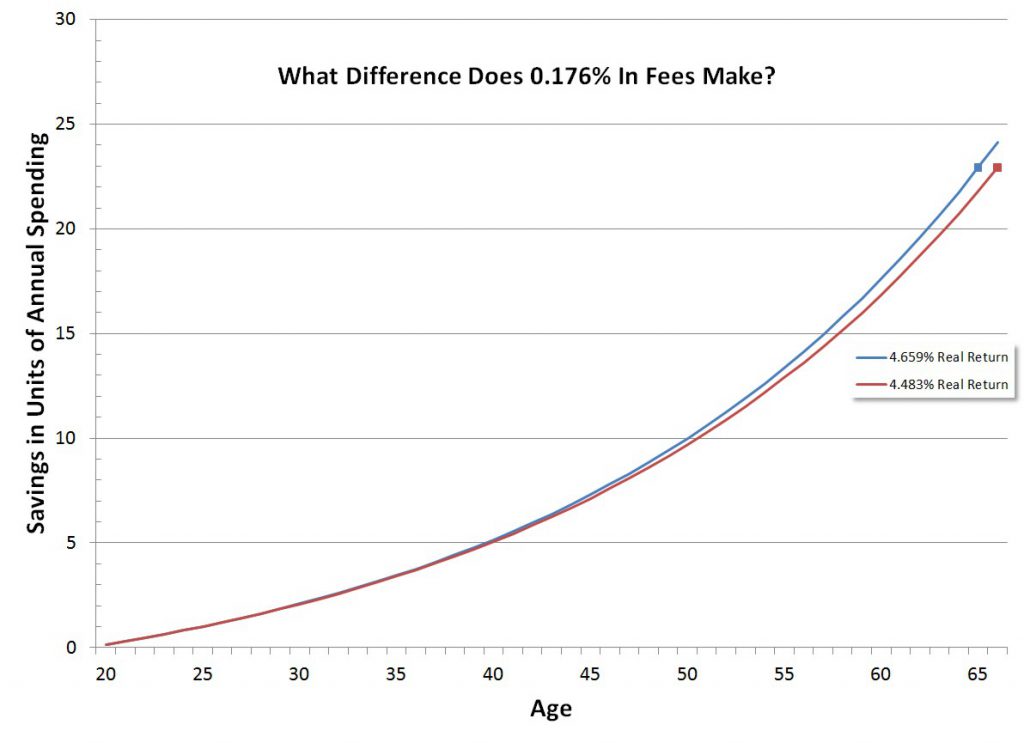

Given two S&P 500 funds, the fund that charges less in fees and expenses allows investors to keep more of the underlying returns. A small difference in returns has a large affect over long periods of time.

Imagine two investors who each take our advice and save 15% of their annual spending toward their retirement. They start at age 20.

By age 25, their savings has grown to the value of an entire year’s worth of spending. The first investor’s account grows by a 4.659% real return after inflation and by age 65 they have 22.9358 units of annual spending.

We have calculated safe spending rates at every age and we estimate that you can safely spend 4.36% of your savings at age 65. Spending 4.36% of 22.9358 units means that they can spend exactly 1.000 units of annual spending and thus exactly maintain their lifestyle in retirement.

The second investor invests in slightly more expensive funds. The extra fees are 0nly 0.176% higher. In the investment world, each percentage is broken down into hundredths of a percent and given the name “basis points.” Our second investor’s funds charge an extra 17.6 basis point.

Our second investor doesn’t really care. He reasons that it is a very small amount and probably doesn’t matter much. And although he doesn’t benefit from what those extra marketing charges are paying for, he imagines that he isn’t really being hurt that much either. He mistakenly compares those fees for what he would have to pay for real advice and thinks he has gotten a deal. In reality, he has paid extra and gotten nothing to show for it. He has failed to purchase advice the lack of which has cost him dearly.

As a result of the added 0.176% higher fees, his investments only grow by a 4.483% real return. It seems like a minuscule difference. One year when inflation is 4.1% the first investor’s return was 8.759% and the second investor’s return was 8.583%. The two numbers hardly seem different and the second investor doesn’t give his higher fee funds a second thought.

As a result of the added 0.176% higher fees, his investments only grow by a 4.483% real return. It seems like a minuscule difference. One year when inflation is 4.1% the first investor’s return was 8.759% and the second investor’s return was 8.583%. The two numbers hardly seem different and the second investor doesn’t give his higher fee funds a second thought.

Over time, the difference between the two accounts increases.

The first investor reached the ability to safely retire at age 65. The second investor doesn’t reach that same 22.9358 units of annual spending until age 66.

Even small unnecessary fees make a large difference over long periods of time.

An extra 0.176% in fees over your working career means working an entire extra year!

We work very hard to reduce the costs of investment products by curating the list of funds we buy. We know that if we have $250 million under our management then saving 0.176% in fees is worth $440,000 to our clients!

And 0.176% is a small difference. The normal amount of 12b-1 fees for non-loaded funds is 0.25%. The average asset weighted expense ratio for equity mutual funds in 0.68%. And the average expense ratio of actively managed equity funds is 0.84%.

Fees matter and investors often make the mistake of paying too much simply for their investment vehicles.

Photo used here under Flickr Creative Commons.