One of the most common financial mistakes is to forget about inflation.

My grandmother, Florence Mortlock, was born in 1904. At the time, you could buy a dozen eggs for a quarter and a week’s worth of groceries for a few dollars.

Had you told her that she would need hundreds of thousands of dollars in order to fund her retirement, she would not have believed you. She would have thought that if she managed to save $5,000 it would be a princely sum of money.

And yet, by the time she died in 2004 at age ninety nine and a half, she had (and needed) hundreds of thousands of dollars. But by then a hundred thousand dollars had no more purchasing power than $5,000 did when she was born.

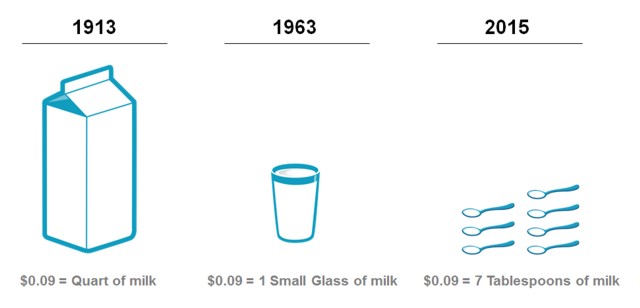

It is not surprising that she did not consider inflation. Inflation was a total of 3% for the first 120 years of our country, between 1792 and 1913. But for the next 100 years, between 1913 and 2013, inflation totaled 2,380%! Having experienced that amount of inflation, we should not be so easily fooled.

Taking inflation into account changes nearly everything about financial planning. Safety of principle should no longer be your primary concern. You should not try to pay off your mortgage early because long term investments earn more than low-interest mortgage payments cost.

Investing in stocks means taking risks, but investors need stock investments in order to keep up with inflation. Your money will likely buy less tomorrow. You need investments which appreciate more than inflation.

On average, stock investments appreciate about 6.5% above inflation and bond investments appreciate about 3.0% over inflation.

What is important to remember is that cash, which seems very safe, depreciates by inflation. Inflation can average 4.5% annually. By trying to keep your money safe in cash, 4.5% inflation will cause it to lose half its purchasing power in 16 years. This makes cash one of the riskiest investments.

Bonds are also risky. Over long periods of time, an investment mix with more stocks and less bonds will have a higher return and a lower long-term volatility. This is why we recommend stocks for the long run.

There is an optimum allocation to bonds. You need enough bonds to cover withdrawals from your portfolio for the next several years. Having the right allocation to bonds is priceless as it will help you not run out of money. But having too much invested in bonds can be tragic. Investing mostly in bonds can mean a lower lifestyle in retirement. And even at age 65, you should probably have an asset allocation of 75% stocks and only about 25% in bonds.

Although inflation can be low at times, there is every indication that incentives are in place for higher inflation. The government gains by taxing inflation. And they have been under-reporting inflation since 1996. In order to balance the risks of inflation, we recommend having an allocation to resource stocks, but not to gold. The optimum asset allocation to gold is always zero because gold is very volatile and its expected return is 0% above inflation. By comparison, stocks are less volatile and have a higher mean return than gold. This is why we use resource stocks to hedge inflation rather than the resources themselves.

We invest just enough in bonds so that we can sleep well tonight knowing that the next several years of spending are invested in stable investments. But we recommend investing the remainder the remainder in stocks so that we can continue to eat well in ten years.

Image used by permission from Dimensional Fund Advisors.