In my article entitled “For The Past 34 Years, Gold Has Just Kept Up With Inflation” I wrote:

So $512 grew to $1,368.75 of gold or $1,552.93 of CPI Index equivalent purchasing power.

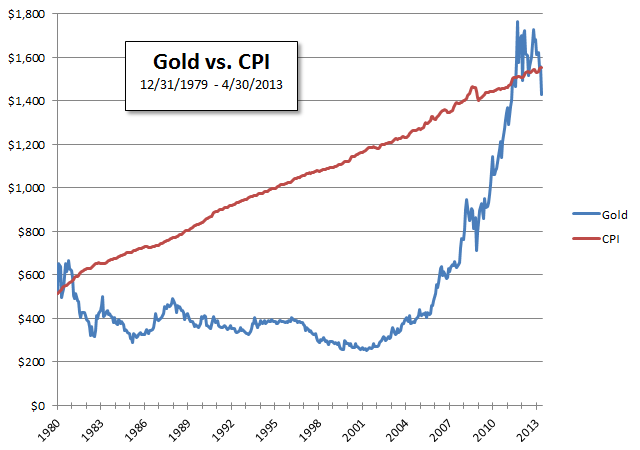

I gave this chart showing Gold vs. the CPI Index:

From the end of 1979 through 4/30/2013:

- An ounce of gold grew from $512 to $1,430.89.

- The CPI Index grew from $512 to $1,552.93 for an equivalent purchasing power.

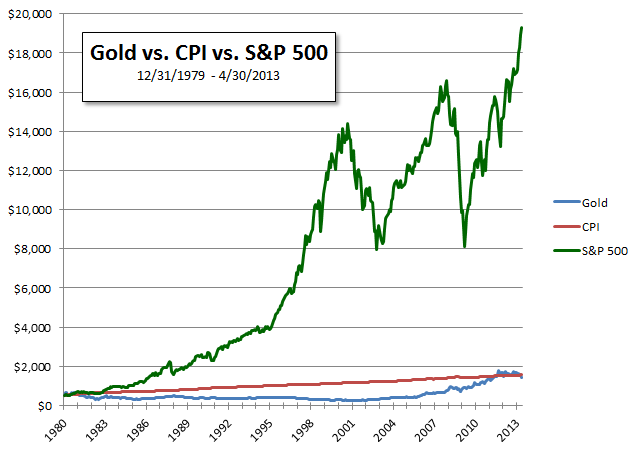

But what I didn’t show is the growth of the S&P 500 Total Return.

- And $512 in the S&P 500 grew with reinvested dividends for a total return of $19,323.19 which is 13.5 times greater than gold.

Here is a chart which adds the S&P 500 Total Return:

Which is why I wrote in “The Optimum Asset Allocation to Gold Is Always Zero“, “The optimum allocation to gold is always zero because its return is too low to be a real investment.”

Subscribe and receive the free presentation: If Not Gold, Then What?!