In addition to regularly rebalancing client portfolios, we analyze future price-to-earnings ratios (called “forward P/E ratios”) monthly to overweight sectors where earnings appear cheap and underweight those where earnings appear expensive based on historical valuations. This strategy of tilting towards cheaper funds and away from expensive ones is called Dynamic Tilt.

In addition to regularly rebalancing client portfolios, we analyze future price-to-earnings ratios (called “forward P/E ratios”) monthly to overweight sectors where earnings appear cheap and underweight those where earnings appear expensive based on historical valuations. This strategy of tilting towards cheaper funds and away from expensive ones is called Dynamic Tilt.

This month, the forward P/E ratios showed considerable variation with many sectors returning to a fairer valuation.

U.S. Stocks

As U.S. large cap has started its next Bear Market, U.S. forward P/Es finally look fairly valued or even undervalued. Consumer Staples, Healthcare, Technology, and Large Cap hover close to their averages while Mid Cap Value and Small Cap Value sit almost half a standard deviation below their historical average.

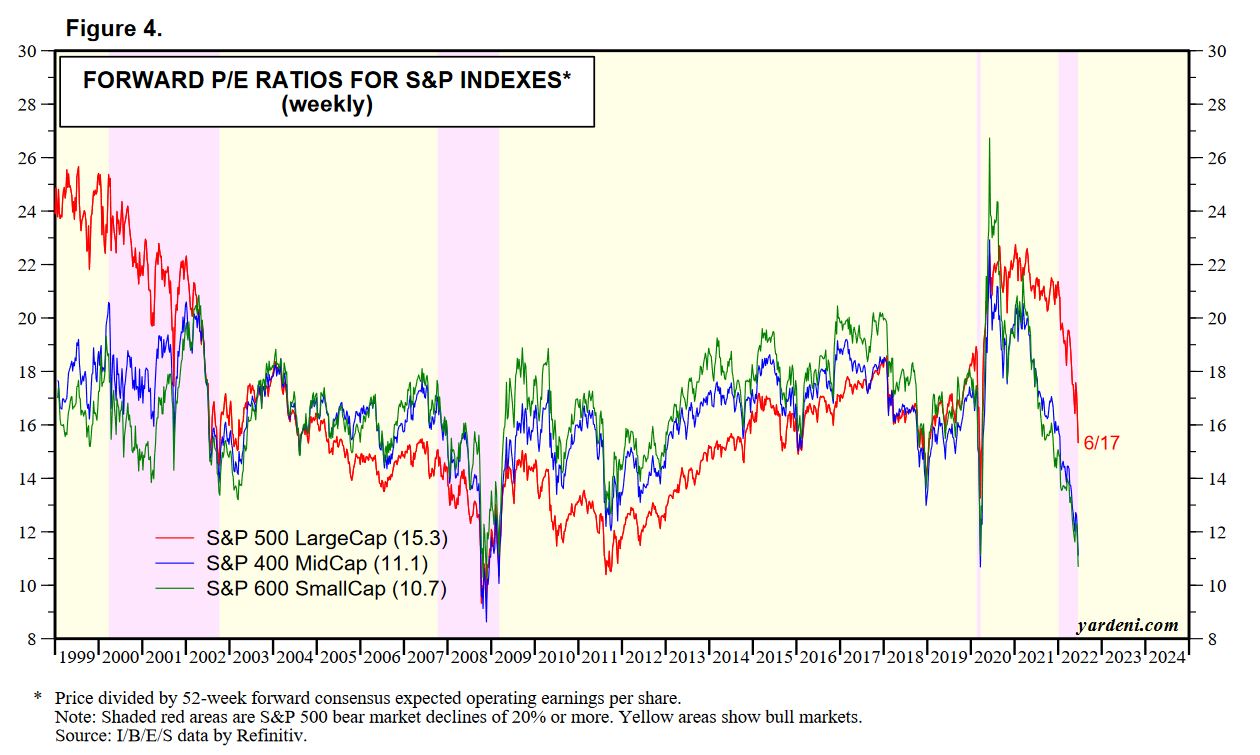

The Yardeni Research provides “Stock Market Briefing: Selected P/E Ratios ” which shows market cap forward-P/Es over time. In Figure 4 (PDF Page 5), you can see the forward P/Es of Large Cap (S&P 500), Mid Cap (S&P 400), and Small Cap (S&P 600).

You can see how both Small Cap and Mid Cap (green and blue) have seen a steeper decline in forward P/E ratio than Large Cap (red).

Small Cap tends to see larger losses leading into market downturns as investors panic and sell it off when investor sentiment starts to turn. However, they also tend to recover steeply when sentiments change as investors flock back to purchases in the sector.

Vanguard Small Cap Value Index Fund (VBR) had its last peak closing on November 8, 2021 at $185.72. Now, the ETF is down -17.66% as of June 13, 2022’s $152.33 close.

The low forward P/E means that their price is currently low compared to their expected earnings. This suggests that more people have sold than the expected company earnings justified. This opens the possibility of being a contrarian and buying additional value for less cost.

In response to these valuations, we’ve tilted towards Mid Cap Value and even more strongly towards Small Cap Value.

Foreign Stocks

In the foreign markets, most of our free countries appear fairly valued, with forward P/E ratios right around their historical P/E ratios.

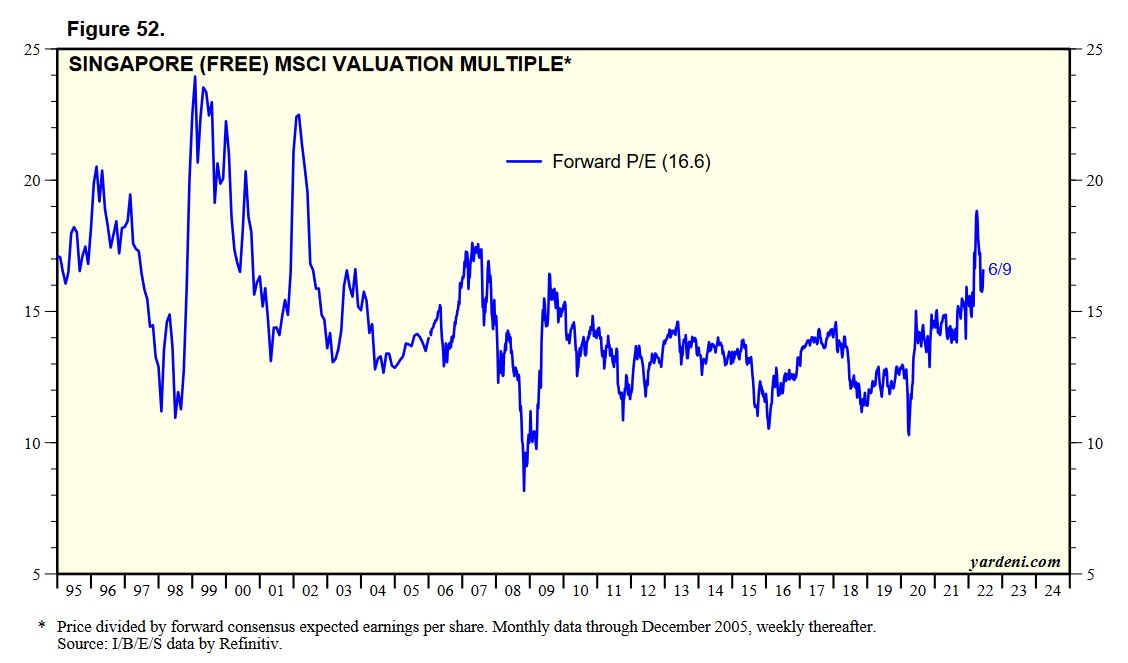

The noteworthy outlier is Singapore, which still sits overvalued. The Yardeni Research provides “Global Index Briefing: MSCI Forward P/Es ” which shows country-specific forward P/Es over time. In Figure 52 (PDF Page 28), you can see Singapore’s forward P/E ratio rising sharply through June 9, 2022.

Less earnings for the same price makes Singapore a more expensive buy right now. In response to this increase in the price of expected earnings, our dynamic tilt has naturally tilted away from Singapore, under-weighting the country. Our dynamic tilt will do this until either Singapore’s twelve-month earnings improve or its price dips to a more appropriate valuation. Currently, its forward P/E is still over one standard deviation above its historical average.

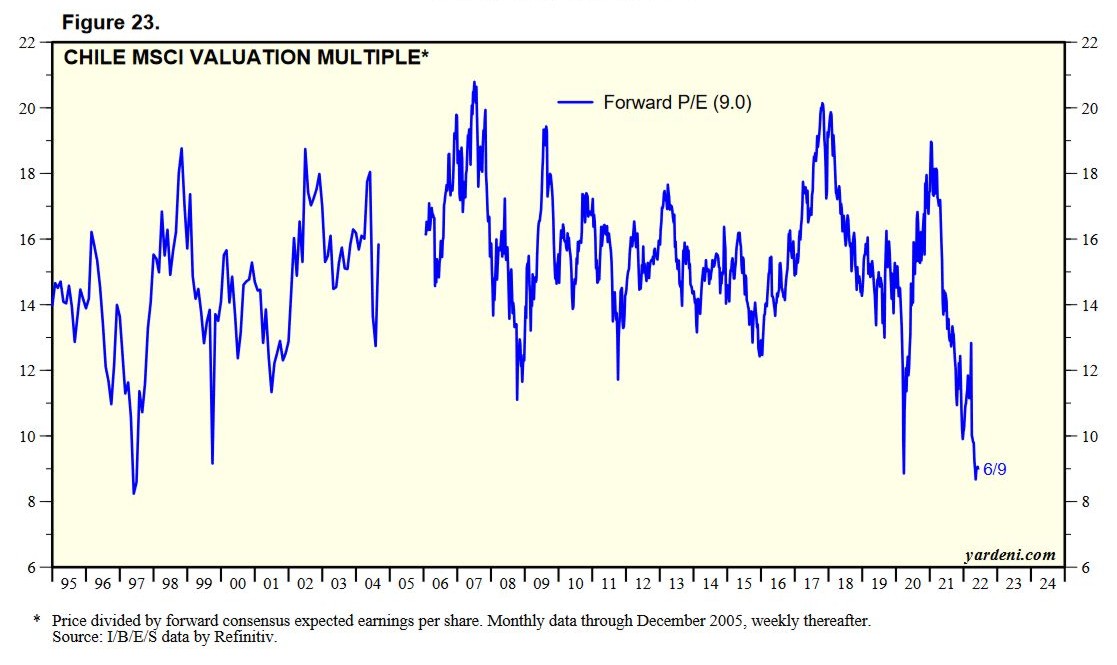

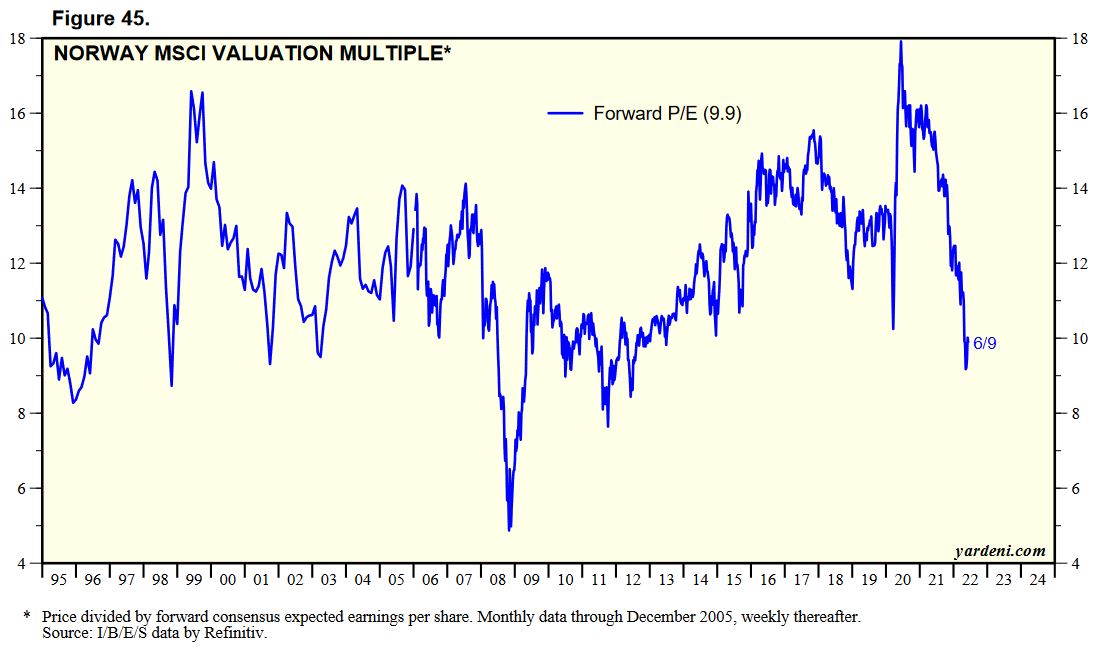

On the other end of the spectrum, the forward P/E of Chile and Norway both sit one standard deviation below their historical averages. In these Figure 23 (PDF Page 14) and Figure 45 (PDF Page 25), you can see Chile and Norway’s forward P/E ratios declining sharply through June 9, 2022.

More earnings for the same price makes Chile and Norway a less expensive buy right now. In response to this decrease in the price of expected earnings, our dynamic tilt has naturally tilted towards Norway and Chile, overweighting the countries.

Summary

Valuations based on forward P/E ratios are suggestive not predictive. We believe that this dynamic tilt adds another layer of contrarian rebalancing to help boost returns which is why we adjust the tilt of target sector allocations monthly.

A dynamic tilt based on forward P/E ratios tends to do the opposite of chasing returns. If a stock has gone up, rebalancing would suggest trimming it back to its target asset allocation. If it has gone up and increased the forward P/E ratio, a dynamic tilt would suggest setting the target asset allocation slightly lower and selling even more of it. And if a stock has gone down, rebalancing would suggest buying more to bring it back to its target asset allocation. If it has gone down and decreased the forward P/E ratio, a dynamic tilt would suggest setting the target asset allocation slightly higher and buying even more of it.

Studies have suggested that when stocks have a low forward P/E ratio, they have a higher expected mean return. And conversely when they have a high forward P/E ratio, they have a lower expected mean return. We use the forward P/E ratio to tilt all of our target stock allocations in our managed portfolios.

Photo by Huy Phan on Unsplash