Regulation can do as much harm as good. Such is the case with the current push to give FINRA the oversight of registered independent advisors. I read with interest in the August, 2012 Investment Advisor magazine a soapbox piece by Steven Weydert, President of Weydert Wealth Management entitled, “Product Verses Process” which read:

“In late April, House Financial Services Chairman Spencer Bachus reintroduced his draft bill calling for a self-regulatory organization for advisors. As Washington Bureau Chief Melanie Waddell wrote in May, FINRA is a lead candidate in assuming the SRO role. As of press time, the fate of the bill was still undecided, but the bill could come up for a vote in July.

“The prospect of falling under FINRA’s oversight has incited loud opposition throughout the advisory industry. Below is one example, submitted by a user on AdvisorOne.com.

The absurdity of suggesting that investment advisors and broker-dealers often provide “indistinguishable services” demonstrates a stunning depth of misunderstanding regarding the two industries.

Brokers manage products; investment advisors manage process. With brokers, process is incidental; with investment advisors, products are incidental. With brokers, it’s pay-and-then-go (on to the next transaction and hidden commission); with investment advisors, it’s pay-as-you-go (100% transparent and invoice only). Equating the two models demonstrates a kind of mind-numbing ignorance that almost makes one wonder why a decent person would try to serve the retail investment space. In the eyes of the law, investment advisors are not much different than brokers. Lumping us together as if we share the same industry is beyond revolting.

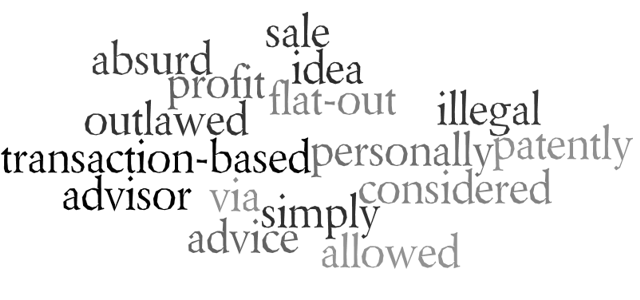

Do you know who else finds this revolting? How about Britain? How about The Netherlands? How about India? How about Australia? In these countries, financial advisors are banned from brokering products on commission. It’s flat-out illegal. The idea that an advisor should be allowed to personally profit from his own advice via a transaction-based sale is considered so patently absurd that it’s simply outlawed. Yes, that’s right; the entire broker-dealer business model is banned from the investment advice industry in countries with the common sense to see how vital this is to protect the public and the advice industry from the sales world.

The current model in the United States confuses clients who don’t understand terms like fee-only and fiduciary.

Regardless of whether or not financial advisor are regulated by the FINRA brokerage organization or if brokers and commission-based agents hiding as fee-based (not fee-only) advisors are allowed to continue to profit from their own advice, you should be smart and choose a fee-only advisor. Go to napfa.org to find a NAPFA member in your area.

Subscribe to Marotta On Money and receive free access to the presentation: Ten Questions to Ask a Financial Advisor.

2 Responses

Doug

Supporting this would seem to be self-serving for your own business purposes, ultimately going against your free market libertarian viewpoints espoused in previous posts. I can understand the general premise of serving the client’s interests first, but getting the law involved leads to a slippery slope.

-Doug

David John Marotta

Greetings Doug,

Just to be clear, I do not support making it illegal. I think we need financial salespeople. But the consumer should be smart enough not to seek a salesperson for objective financial advice. Having said that, I suspect that some time in the next 30 years it will be made illegal in the United States as well. Currently, however, only about 7% of the financial services world operates on a fee-only basis and the laws are written with the other 93% in mind for good or ill.

The proposal is to have FINRA (the brokerage self-regulatory group) regulate registered financial advisors, including fee-only advisors. This level of government intervention would be disastrous. Given my choice, I’d rather just have the brokerage industry not allow to practice as a financial advisor than given regulatory power over financial advisors like us.

What I find remarkable is that commission-based agents and brokers act like advocating fee-only financial planning is absurd and there is nothing unusual about entrusting your financial welfare to advisors with clear conflicts of interest.

Few consumers understand the difference between fee-only and fee-based. Nor do they understand the conflicts of interest or how to tell how their financial advisor is being paid. A libertarian free market is based on the idea that the consumer is informed and the disclosures are clear and not misleading.