Back in 2006 I wrote the article “How Your Children Can Win the Stock Market Game” recommending:

Back in 2006 I wrote the article “How Your Children Can Win the Stock Market Game” recommending:

To win a short-term investment contest you have to invest like a downhill skier. Bet everything on your one trip to the bottom in hopes of being elevated to the top. But, the strategy to win such a competition is almost exactly the opposite of a good investment philosophy in real life. In a mock investment competition you shouldn’t diversify. Diversifying your investment smoothes returns guaranteeing a return toward the middle of the pack. Instead, you want to put all your capital in one risky investment and hope for the best.

In this article, I explore the mechanics of how you might build such a portfolio within the common constraints of The Virginia Stock Market Game. But first, let’s do a thought experiment and explore what type of portfolio is likely to win this competition.

What Strategy Might Win?

In Virginia, awards are given to the top three teams.

If there were 100 participants in your state and grade category, your random chance of being in the top three if everyone chooses a similar strategy would be just 3%. But the more you diversity your portfolio, the less likely your chance of winning. Imagine that you diversify your strategy to include a small piece of everyone else’s strategy. If you did that you would only have an average return, not an extraordinary one. If you diversify, about 50 other participants would likely beat your return and 50 lose to your return.

Even fourth place won’t be in the winner’s circle. You have to distinguish your return in order to score in the top three. Any other outcome, no matter how well you did, won’t be considered a winner. So with such a small chance of winning, your goal should be to have fun, learn something, and distinguish your team in whatever way you choose. Let’s do another thought experiment.

Imagine that all of the participants invested in the S&P 500 and you choose to invest in something very different. Now your odds of winning are raised to 50%. Either your choice will do better than the S&P 500 and you will win or your choice will do worse than the S&P 500 and you will not win. Most participants won’t win, and the goal of the game is to have fun. The money isn’t real. In fact, if your team loses everything and goes bankrupt it could be more exciting than an above average return. At least they will be talking about you!

Now imagine that every team chooses an investment strategy of rags or riches. One team chooses an investment strategy that will probably win or lose 10%. Another team chooses a strategy that will either win or lose 15%. And a third chooses a strategy that will either win or lose 20%. If you could only find a strategy that will probably win or lose 25% you would again have a 50% chance of winning the overall competition. Unlike investing with real money, in the stock market game the more volatile your portfolio the more likely your chances of winning.

Unlike actual investing, the stock market game favors participants who trade the cash cow that provides them with their daily milk for a handful of beans hoping that they are magical.

The Equity Rule

Putting all of our money in a single volatile stock is terrible investment advice but an ideal game strategy. But the Equity Rule of the competition limits the total amount of equity that can be invested in a single security at the time of trade. The purpose of this rule is to teach participants to diversify their portfolios. The Equity Rule states, “A Maximum Percent Equity rule of 20% means that a team cannot invest more than 20% of their current equity times 1.5 (because they can buy on margin) in a single company.”

Let’s understand this rule.

Teams start with $100,000. But teams are allowed to borrow up to 50% of their portfolio’s value. This is called “going on margin.” The amount you borrow is subject to paying a 7% annual interest. I will discuss below if this is a good idea or not, but for now, this means that you cannot invest more than 20% of the $150,000 buying power you have in any one equity. This limit is only calculated when you buy a stock. Once purchased. if the total price of the shares increases above the maximum percent equity you can still keep your shares however you will not be able to purchase any more shares of that stock.

This rule means that initially, we cannot purchase more than $30,000 of any individual stock. Another way of thinking about the rule is, assuming that we are not using margin, the minimum number of stocks we can invest in would be four. And we could invest them in any pattern. We could put $25,000 in each of the four, or we could invest $30,000 in three and $10,000 in the fourth.

Four stocks does not diversify a portfolio. But of course in this twisted game, we oddly want to build as a concentrated position as allowed by the rules.

If you invest in four stocks from different sectors of the economy, they are likely to have very different returns. These different returns will, on average, dampen portfolio volatility. Dampening portfolio volatility will result in a portfolio more likely to go up or down by 10% rather than our target 25%. Therefore, we want to have as volatile a portfolio as possible.

Since we would like to put all of our equity in a single stock, the next best thing is to invest in four different companies which are all in the same sector of the economy. Companies which move in sync with one another are more likely to all move up or all move down together, boosting the variance of our portfolio’s return and increasing the chance that we win the competition.

Technology Example

You could, for example, pick an industry such as technology. If you were able to, you might invest everything in Vanguard Information Technology ETF (VGT).

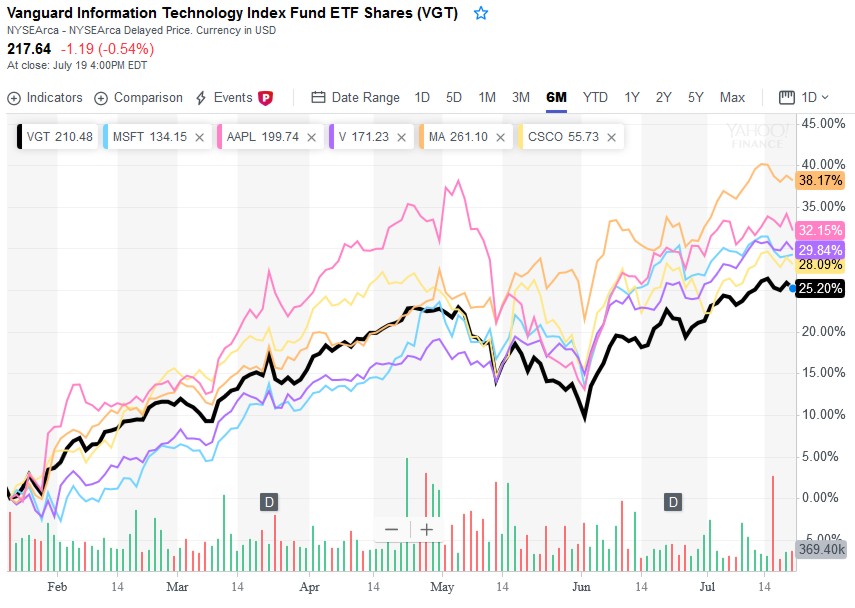

For the six months ending 7/21/2019, VGT appreciated 25.20%.

Meanwhile during that same time, the top five holdings of VGT appreciated:

- 29.28% Microsoft Corp (MSFT)

- 32.15% Apple Inc (APPL)

- 29.84% Visa Inc Class A (V)

- 38.17% Mastercard Inc A (MA)

- 28.09% Cisco Systems Inc. (CSCO)

Here is chart of what returns might have looked like if a six month competition closed on 7/19/2019. VGT is the bold black line.

VGT is currently comprised of 328 different holdings. As you blend the returns of those holdings together, they approach the average return of the fund. But average doesn’t win Stock Market Games.

So if you picked four of the top five companies within VGT you might increase the chance of having a wildly above or below average return.

In fact as you look at the companies within VGT, you may decide to concentrate even further. You could choose to invest in four credit companies like Visa and Mastercard, adding American Express (AXP), Discover (DFS) or Capital One (COF).

Perhaps you want to avoid the large cap stocks that everyone has heard about and invest in random smaller companies. Smaller companies on average appreciate more than large companies. They are also more volatile and therefore the type of investment you are looking for. You could look at the five smallest companies held in VGT.

During the past six months, the bottom five holdings of VGT appreciated:

- -40.87% Applied Optoelectronics Inc.(AAOI)

- -10.60% Alpha & Omega Semiconductor Ltd.(AOY.SG)

- 21.47% International Money Express Inc. (IMXI)

- -30.51% NeoPhotonics Corp.(NPTN)

- -33.89% Exela Technologies Inc. (XELA)

Here is chart of what returns might have looked like if a six month competition closed on 7/19/2019. once again, VGT is the bold black line.

This is a wonderfully abysmal return! Your team would have a great deal of fun losing most of its pretend money and have a topic of conversation with all your friends and family. If you are mentally prepared for this possible outcome, doing very poorly can be as much fun as doing well.

Trading Costs

The Virginia Stock Market Game Guide says that a 1% broker’s fee is charged for all transactions. Assuming that we invest our entire $100,000, we start down 1% with our portfolio worth just $99,000.

Every trade will cost us 1% of the money we trade. If we invest all our money, and then sell everything and buy something else, we will have lost 3% of our portfolio on trading costs. This potential drag on the portfolio is probably not worth extensive trading, especially given the short time horizon of the competition itself. I would suggest making initial purchases and then not trading again during the competition.

Use Of Margin

Teams are allowed to borrow funds up to 50% of your portfolio value at a cost of 7% per year, posted weekly. If your portfolio value drops such that you are on margin for more than 50% of the portfolio value you will experience a margin call requiring you to sell equities until your margin value is less than 50% of your portfolio value.

Normally margin is not a good idea. And I would suggest younger team’s not use their margin capability.

But in a short-term trading game with no consequences, you may decide to take a large chance and risk more than you could normally afford investing in the markets. If you experience a margin call and are forced to sell, you will experience another 1% trading cost. It may be prudent to allow for a significant market drop and only use a portion of your available margin for investing, perhaps four investments of $30,000 each. Just be prepared for the possibility of a spectacular portfolio implosion.

Short Sales

Normal shares are purchased for investment and later sold for a profit or loss. A short sale does this in reverse. Stock shares can be borrowed and sold without owning any shares. Then later you must purchase shares in order to close the short and return shares from having borrowed them. This is normally only done for a company whose stock price you believe will drop. If you short sell 50 shares at a price of $100 per share you will receive $5,000 but have a short position worth -$5,000 of -50 shares. If the price later drops from $100 to $50 per share, you can purchase 50 shares for just $2,500 to close the short position. You keep the extra $2,500 ($5,000 sell minus $2,500 buy).

Since on average stocks go up in value this can be a risky strategy. We would not recommend younger participants engage in short selling.

Cash

Money left uninvested earns interest at an annual rate of 0.75%. Since this is such a small interest rate it would probably be better to keep your portfolio fully invested.

Strategy Ideas

The number of strategy ideas is as infinite as the publicly traded companies that comprise the market. If you have an interesting strategy, you can make the news even if you don’t win the competition. And if you win the competition you can help ensure that you make the news. Additionally you can submit an essay about your strategy to writing contests.

Here are a few ideas to help spark your own creativity.

Beer: Dartmouth Professor of Finance Ken French collects some interesting data for the returns of 49 different Industry Portfolios. One of the best performing industries for the past century appears to be the beer industry. Invest everything in a few beer companies. This strategy could also be utilized to pick a different very specific industry.

I, Pencil: Leonard Read wrote the essay “I, Pencil” in 1958. He went on to found the Foundation for Economic Education. His essay chronicles all of the invisible hand economics required to build a single pencil. Find some simple object like a pencil and invest in the four or five companies that make such a product possible.

Chile: Foreign Investments that trade on the New York Stock Exchange are done so through an American Depository Receipt (ADR). The value of foreign companies go up or down like other stocks, but they also go up or down as the foreign currency appreciates or depreciates against the US dollar. All the companies from the same country will go up or down in sync with the exchange rate to the US Dollar. Pick a country like Chile and four or five companies from a list of the most common Chilean ADRs trading on US stock exchanges. This gives you both the volatility of individual stocks and the volatility of currency exchanges, a recipe for glory regardless of if the outcome is positive or negative.

Single Stat: Learn about various financial ratios and pick one of them. Find a stock screener and invest in companies that have the most extreme scores for your financial statistic.

Going Bankrupt: Distressed securities are the stock of companies that are near to or currently going through bankruptcy. If they manage not to go bankrupt the appreciation can be tremendous. The Motley Fool keeps a list of distressed companies with a total debt-to-equity ratio of greater than 80%, and a current ratio less than 1.0 or a short interest greater than 10%. Pick four companies you think won’t go bankrupt and hope for the best. You could also short sell some of these.

Haters Gonna Hate: Many news organizations keep lists of the most hated companies in America. Find such a list and pick four companies on the list that you think don’t deserve the hate they receive. Or pick four companies you do think deserve the hate they receive. You could also short sell some of these.

I Like To Buy: Form a team of four people and let each person pick the company they like to buy from the most. Write an essay on why the world is a better place because of these four companies.

The Letter Q: Pick a letter of the alphabet. Select all stocks that contain this letter in their ticker symbol.

Blind Monkeys Throwing Darts: It has been said that blind monkeys throwing darts can beat the return of the S&P 500. Buy a Wall Street Journal and throw four darts at the stock pages to pick your portfolio’s investment strategy.

Dead Cat Bounce: Find companies whose stock prices have lost the greatest percent of their value in the past six months. Invest in those on the idea that they have already had all the bad news they can.

Hope For A Market Crash: You could short sell as many similar stocks as possible. Since most participants will have a strategy that does well if the markets go up, you may be the only one who wins big if the market goes down. The more spectacular the drop, the better you may do. Or you may lose your shirt!

Margin To The Hilt: Bet on the market appreciating significantly and go on margin as much as possible without risking a margin call. If the market goes up at a rate of more than 7% annually your extra investment should earn more than the cost of going on margin.

Any of these strategies would easily make the news if your strategy won the competition. Write an accompanying essay about the wisdom or folly of your chosen strategy and submit it to InvestWrite National Writing Competition.

Schools, teachers, or students interested in participating in the Virginia Stock Market Game can learn more on the Virginia Council on Economic Education website. If you do compete and want to share your results with us, fill out our Contact form and let us know about your strategy. We may even write an article about you.