Among the most complicated and frustrating IRA rules are required minimum distributions (RMDs). RMDs are required on all traditional IRAs in and after the year the owner turns 70 1/2 years old. For inherited IRAs, RMDs are also obligatory starting in the year after the previous owner’s death.

Among the most complicated and frustrating IRA rules are required minimum distributions (RMDs). RMDs are required on all traditional IRAs in and after the year the owner turns 70 1/2 years old. For inherited IRAs, RMDs are also obligatory starting in the year after the previous owner’s death.

A new RMD value must be calculated every year.

Although many companies will determine traditional IRA RMDs for you, the RMD of inherited IRAs is significantly more complex. The inherited IRA calculation is so onerous that account owners or their advisors must compute it manually.

Although the client is ultimately responsible, we provide assistance in calculating and implementing our clients’ RMDs, both traditional and inherited, each year as a part of our “Comprehensive” service. We also provide the administrative support necessary to oversee the entire distribution process.

That being said, there is a way to see your year-to-date IRA distributions from your Schwab IRA online as well as any RMD calculation Schwab has made for you. Here’s how.

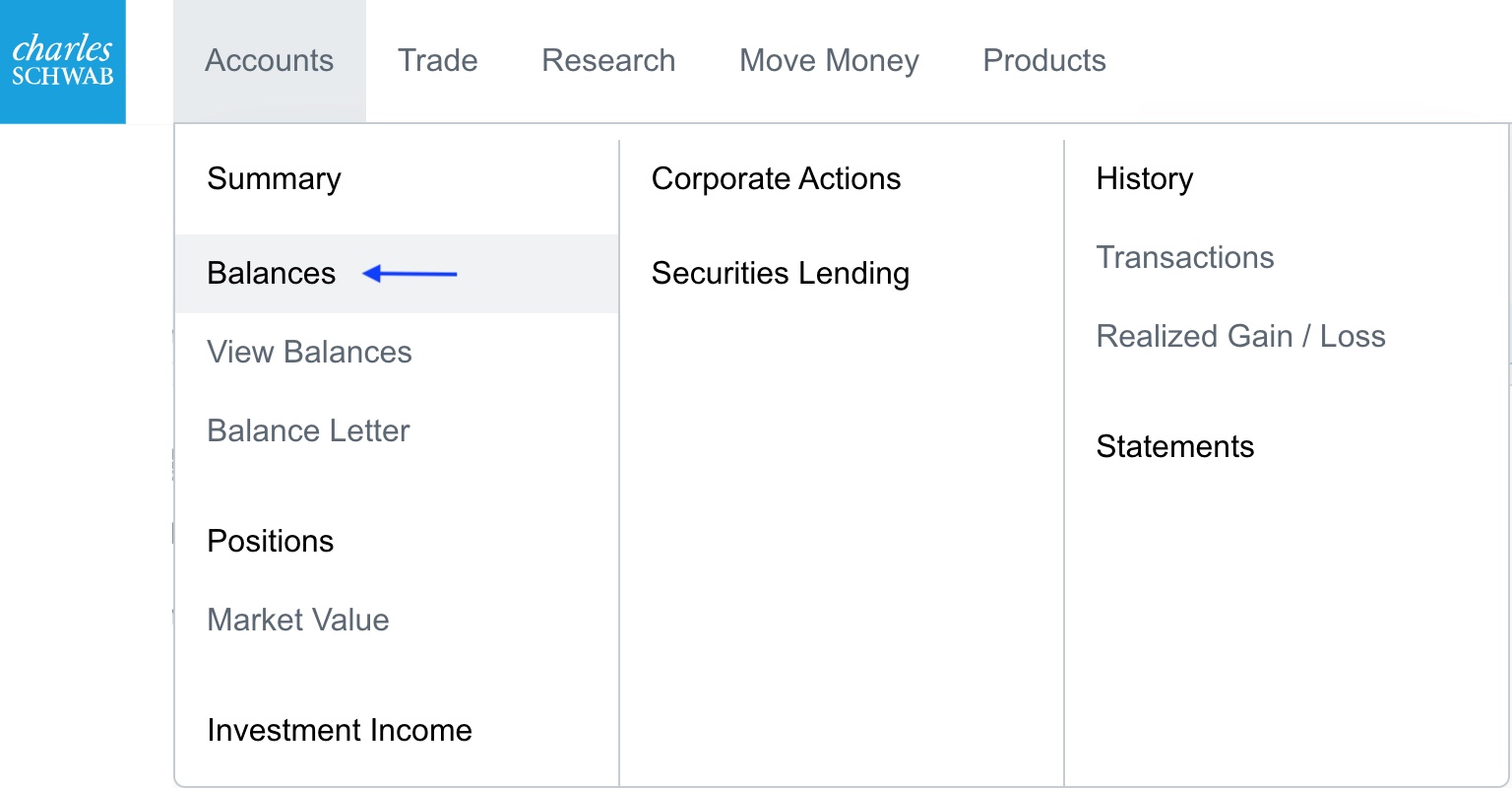

After logging in to Schwab Alliance at https://www.schwab.com, select the “Accounts” tab at the top and then click on “Balances” in the menu that comes up.

In the drop down menu at the top of that page, select the relevant IRA or inherited IRA.

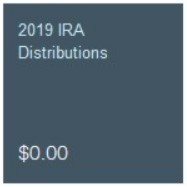

On the page that loads, a graph should appear of your account’s historical balances. To the right of this graph, there is a box that displays the distributions remaining and the amount of the IRA Distributions that have been taken for the year. For Inherited IRAs, it will only display the amount of the IRA Distributions that have been taken for the year as Schwab will not calculate an inherited RMD for you.

In this way, you can login close to the end of the year to confirm that you have satisfied your required minimum distributions for the year.

It is important to note that if you are doing Qualified Charitable Distributions (QCDs) for the year, this number may include checks written to charities that have not technically been cashed yet. For this reason, it may be important to call Schwab to ask about each QCD check and verify that it has been cashed by the charity already. You wouldn’t want to be hit with a 50% penalty from not meeting your RMD in the proper year.

That being said, for those who are doing it themselves or are just curious about if your RMD is done for the year, this page can help you satisfy this important IRS requirement.

For those who have access to our Required Minimum Distribution service, we provide assistance in calculating and implementing our clients’ RMDs, both traditional and inherited, each year.

Photo by Alejandro Escamilla on Unsplash