When you go to a swimming pool in the summer, you see various strategies for entering the cool water. Some people prefer to plunge in immediately. Others start in the shallow end and gradually enter the water. Others sit beside the pool and do not enter the water at all.

When you go to a swimming pool in the summer, you see various strategies for entering the cool water. Some people prefer to plunge in immediately. Others start in the shallow end and gradually enter the water. Others sit beside the pool and do not enter the water at all.

Investors have similar approaches to investing. However, just as with investing, the depth of the pool you are getting into determines more of the outcome than your chosen entry strategy. This is why it is so important to take your time in designing your investment plan. However, once you have selected your desired risk, then it is time to get in the markets.

There is no way to know how the market will behave, but the market trends upward over long periods of time. This is why we like to say, “The best day to invest is today, and the next best day is tomorrow.”

By default, our advice is to carefully decide how much to put in stocks and how much in bonds and then take the plunge to implement your investing plan as soon as possible. Lingering by the edge will just make you more nervous.

However, we know that investing all at once can be too worrying for some people. For these clients, our recommendation is to invest the Stability (bonds) portion of your portfolio immediately and then gradually invest the Appreciation (stock) portion of your investments over a timeline that makes you feel comfortable.

How do you pick a timeline? We recommend picking a specific date in the future when you want to be fully invested. How would you feel being fully invested by the end of August? September? Once you have your selected month, then invest one share each month between now and then. For example if your selected date is a quarter away, invest one third now, half of what is left next month, and all that remains in the final month.

This provides a smoother entry while also preventing future nerves from sabotaging your investment plan.

In 2014, I drew attention to a Schwab study titled “Does Market Timing Work?” It was a deep dive into various investing strategies to see what investing methods were more or less successful.

Invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2001-2020.

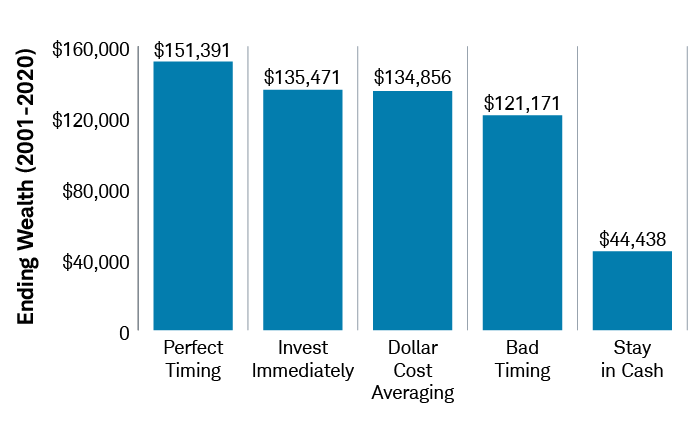

Recently Schwab refreshed their study, which you can read here . They looked at the twenty-year period between 2000 and 2020 and studied investing $2,000 annually for that period using five different investing strategies:

- Perfect Timing—someone who each year (luckily) chose the lowest day of the market to invest

- Invest Immediately—someone who invested their cash as soon as possible

- Dollar Cost Averaging—someone who divided their allotment into 12 portions and invested that amount every month

- Bad Timing—someone who each year (unluckily) chose the highest day of the market to invest

- Stay in Cash—someone who did not invest at all

The Schwab article includes a graph of how those approaches paid off for the five investors (see right). While the investor with the lucky streak did the best ($2,000/year for 20 years grew to $151,391), the second place winner (with $135,471) was the investor who decided to take the plunge and invest everything right away. The investor who used dollar-cost-averaging was a very close third place (with $134,856, only $615 behind second place). Even the investor who picked the worst day of every year for 20 years ended up with $121,171.

Meanwhile, the person who remained in cash and did not invest at all ended their 20 years with $44,438. Most investors are worried about picking the wrong day to get started, but the real danger is failing to get started at all.

Schwab also tested other time periods, explaining:

Regardless of the time period considered, the rankings turn out to be remarkably similar. We analyzed all 76 rolling 20-year periods dating back to 1926 (e.g., 1926-1945, 1927-1946, etc.). In 66 of the 76 periods, the rankings were exactly the same… . But what about the 10 periods when the results were not as expected? Even in these periods, investing immediately never came in last. It was in its normal second place four times, third place five times and fourth place only once, from 1962 to 1981, one of the few periods of persistently weak equity markets. What’s more, during that period, fourth, third and second places were virtually tied.

We also looked at all possible 30-, 40- and 50-year time periods, starting in 1926. If you don’t count the few instances when investing immediately swapped places with dollar cost averaging, all of these time periods followed the same pattern. In every 30-, 40- and 50-year period, perfect timing was first, followed by investing immediately or dollar cost averaging, bad timing and, finally, never buying stocks.

This is why investing immediately has normally been the right choice. Next time you are wondering if you should invest now or “wait for a better time,” remember Schwab’s study and invest now in whatever way makes you invest now. Can you take the plunge or would you rather wade in from the shallows? Whatever you do, don’t sit on the edge and dither. Take heart: Even picking an unlucky day now and then, the long-term trends are in your favor.

Photo by Oleksandr Pidvalny on Pexels. Image has been cropped.