Shareholder meetings are a common occurrence, which means that, if you invest in individual stocks, you will frequently have at least one company asking you for your vote.

Shareholder meetings are a common occurrence, which means that, if you invest in individual stocks, you will frequently have at least one company asking you for your vote.

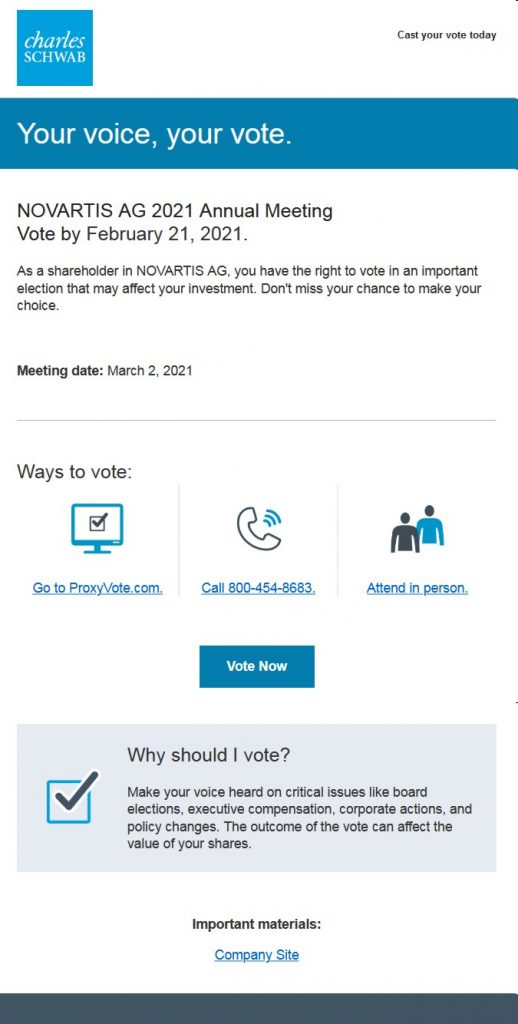

Shortly after we added individual foreign stocks to our Freedom Investing strategy, Novartis sent out proxy ballots for their upcoming annual meeting. As a result, shareholders who custody at Schwab have received an email that looks something like the one pictured here.

It tells you that Novartis is having an annual meeting and that you have a right to vote in the election. Here are some frequently asked questions about voting your shares.

Do I have to vote?

Do I have to vote?

No, you do not have to vote.

There are plenty of articles online about shareholder proxy or voting. Most of them will tell you — as Schwab does in this email — about the importance of your voice. “Don’t miss your chance to make your choice,” Schwab cautions. “The outcome of the vote can affect the value of your shares.”

While nothing in these encouragements is wrong, the overall pushiness of the message is not necessarily in your best interest.

Anyone who works with elections knows how challenging it can be to get a quorum. For this reason, the importance of the election, a sense of urgency, and the unique power of individual voters all need to be exaggerated in order to drum up the attendance necessary for a valid election. Poll workers do not care how you vote as much as they care that you are present. Even a vote of “abstain” helps give them a quorum.

You are not obligated to vote just because you own shares.

What effect will the outcome of these election items have on me?

Although there do exist proxies which could affect the value of the company, the board of directors is required by law to act in the best interest of the shareholders. This means that the votes they are putting before the shareholders are likely to help your investment if they pass.

What should I do if I have opinions on corporate governance?

If you have strong opinions, feel free to scan the ballot to determine if you feel strongly about any of the issues up to vote. If you do, by all means, vote your shares.

That being said, even if the vote doesn’t turn out the way you want, the company likely still has the same investment value as before the vote. We wouldn’t recommend selling your shares on the results of a basic corporate governance vote.

What if I don’t know how I should vote?

Then, feel free to skip voting.

What if I want to educate myself enough to vote?

You can click on “Company Site” at the bottom of the email. On the page that loads, you should be able to find a brochure containing details on the ballot.

In the case of Novartis, the brochure is titled “Invitation to the Annual General Meeting .”

The brochure is summarized, heavy reading which requires looking up many more reports and packets to be fully understood. Researching these issues is descending into a rabbit hole on the way to Wonderland. It can be confusing and bewildering. But this is the way to learn about corporate governance.

Photo by Element5 Digital on Unsplash