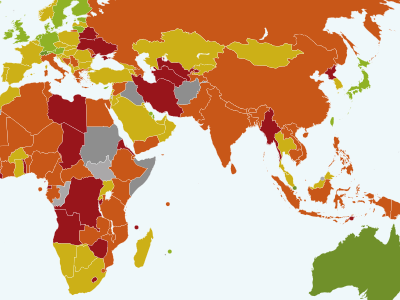

I’ve been writing about Freedom Investing since my first article. Countries are constantly in flux, and with all the noise of the markets, it is easy for the noise drown out the signal. I’ve often summarized the concept of Freedom investing with this simple statement:

Investing in countries high in economic freedom and low in debt and deficit boosts returns about four to five percent over the EAFE Index.

Because of the randomness of the markets, I am certain that at some point the set of countries with the most economic freedom will under-perform the EAFE index over some short period of time. Japan will do well or perhaps the PIGIGS (Portugal, Italy, Ireland, Greece and Spain) having been so under valued will rebound for some period of time. But not this past year.

It may be difficult to find cheer when the average country with economic freedom is down nearly 10% over the past 12 months, but they are still down 4.3% less than the EAFE index.

3 mos. 6mos. 12 mos. Index (returns through 6/30/2012) -4.89% +7.88% -8.16% MSCI Hong Kong Index -3.78% +14.77% -7.09% MSCI Singapore Index -5.07% +3.42% -11.29% MSCI Australia Index -6.25% +6.81% -2.94% MSCI New Zealand Index -6.08% +3.36% -11.20% MSCI Switzerland Index -7.75% -1.87% -16.49% MSCI Canada Index -5.64% +5.73% -9.53% Average Freedom -7.13% +2.96% -13.83% MSCI EAFE Index +1.49% +2.77% +4.30% Freedom Bonus over the EAFE Index

Even in the midst of a global market drop, countries with the most economic freedom have dropped less.

Subscribe to Marotta On Money and receive free access to the 1.5 hour video: Where in the World Should I Invest?

2 Responses

Doug

What do you think of this article? http://seekingalpha.com/article/818251-do-economic-freedom-rankings-predict-etf-investing-success?source=yahoo

David John Marotta

Greetings Doug,

The article you referenced anecdotal compares Hong Kong, the #1 in Heritage’s Freedom Index with #53 Malaysia (EWM), #54 Mexico (EWW) and #70 South Africa (EZA) during 2012. There are three problems with this criticism:

(1) It is anecdotal and cherry picks a couple of countries

(2) It compares emerging market countries to developed countries that rank highest in economic freedom. I’ve written that the measurement of economic freedom (which includes low debt and deficit) seems to work as a indicator to boost returns over longer periods of time in the developed countries. The primary force in the emerging markets is inexpensive capital and this produces superior returns over the long term as well. That developed countries with freedom can, at time, compete well with the emerging markets is another indication that freedom-investing is a good long-term strategy.

(3) It compares these three cherry-picked emerging market countries for one year, 2012. Invest for long term trends such as economic freedom is like in bridge when you are finessing for the King. An expert can guess that there is a 60% chance of the king being on the right. If they finesse for the King to be on the right and it turns out to be on the left this hand, that is not a mistake. Playing the long-term odds is a superior strategy for the long-term investor.

As you can see from this post’s analysis, the countries higher in economic freedom have returns superior to the MSCI EAFE Index. The problem with the countries that comprise the MSCI EAFE Index is that 61% of them are in what Bill Gross calls the “Ring of Fire.”

Given the malaise of Europe and to a lesser extent the troubles in the United States as a result of well intentioned government policies it is an odd suggestion to challenge. Any Econ 101 class would prove mathematically that greater economic freedom would result in a more productive society.

I think the point of the article you site is to suggest that countries are complex systems which can’t be reduced to a single predictive measure which guarantees a better return. If for no other reason that a country’s equities can get over bought and need to correct. Hence P/E ratios and diversification are other important principles.