In “Marketplace Fairness Act Burdens Businesses with State Compliance Audits” I wrote, “Compliance isn’t just a technical burden. It is a threat of legal liability. … Compliance costs should not be discounted. Americans spend an estimated 6.6 billion hours per year filling out tax forms. Depending on the size of the business, the costs of compliance can exceed the revenue collected.”

I wish voters understood the costs of government compliance. You can’t under estimate government compliance. And more government regulations and compliance do not make us safer.

I just got the following notice from our payroll service:

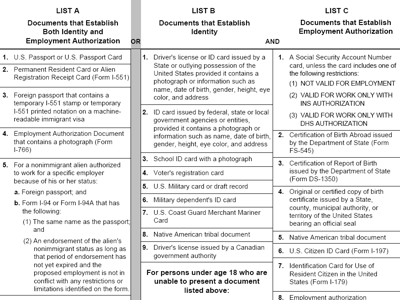

U.S. Citizenship and Immigration Services (USCIS) recently revised the Form I-9 that employers must use to verify the identity and employment authorization for individuals, both citizens and noncitizens, hired for employment in the United States. The form, which is completed by both the employer and employee, must be completed for each person on the payroll, with a few exceptions, and must be retained by the employer either for:

- Three years after the date of hire, or;

- One year after employment is terminated, whichever is later.

Employers do not need to complete the revised Form I-9 for current employees if a properly completed Form I-9 is already on file, unless re-verification applies.

Failure to complete, retain and/or make available for inspection Form I-9, as required by law, may result in civil monetary penalties ranging from $110 to $1,100 per violation. In determining the amount of the penalty, consideration is given to:

- Good faith on behalf of the employer

- Size of the business

- The history of previous violations by the employer

- The seriousness of the violation

- Whether or not the individual was an unauthorized alien

It is recommended that employers maintain the completed I-9 forms separate from the employees’ personnel files, so that the forms are readily accessible in case of an audit.

The federal government has the most up-to-date information about I-9 forms at “I-9 Central,” located at www.uscis.gov/I-9Central.

When you think of businesses that are “not in compliance” think of the father who hires his daughter in a family business and fails to complete an I-9. Think of the failure to have the forms readily accessible in the case of an audit. Think of the difficulty of knowing all the requirement as required by law let alone having any of these be your primary concerns when you are trying to run a business.

For most small businesses, the hourly wage of employees filling out I-9 forms and the time and effort to ensure they are collected, retained, stored, moved and accessible is much greater than the penalties when they are discounted by the likelihood of an audit. And yet we wonder why small businesses disregard so many government regulations.