“One of an advisor’s greatest challenges? Directing client expectations – and meeting them with portfolio performance.” write Craig L. Israelsen and Megan Howell in a Financial Planning magazine article entitled “Being Reasonable“. In that article they describe the problem this way:

Managing the expectations clients have for their investment portfolios can be more challenging than actually managing the portfolios themselves. There are at least two important elements in this tango: clients having reasonable expectations, and portfolio performance that hovers around those reasonable expectations.

…

Unrealistic upside expectations are hard to manage, which means clients face a high probability of being disappointed even if their portfolios deliver what would otherwise be deemed acceptable performance. Basically, their portfolios are doing fine, it’s their expectations that are messed up. Conversely, after a ugly bear market, it can be difficult for investors to remember that investments actually can produce gains.

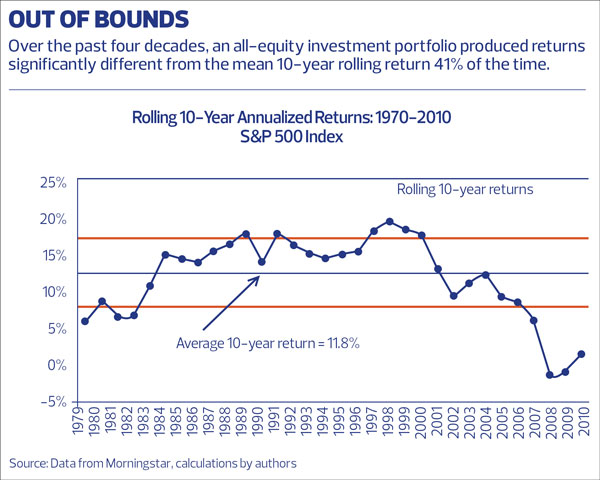

There are several lessons that can be learned from their article. First, the markets are inherently volatile. Here is there chart for the rolling 10-year annualized returns, out of bounds 41% of the time:

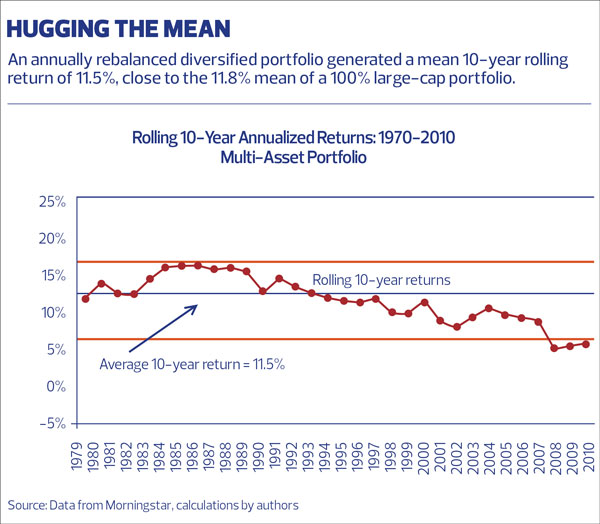

Remember my favorite Paul Volker quote: “You can’t hedge the world.” But what you can do is have a diversified portfolio. Here is their chart of that same 10-year rolling average time period only using a multi-asset portfolio that includes seven equally weighted portions of large-cap U.S. equity, small-cap U.S. equity, non-U.S. equity, real estate, commodities, bonds and cash:

There are probably better asset allocations that one-seventh in each of their categories, but what is interesting is to see the effect of any diversification on risk and return. As you can see, the average portfolio return drops from 11.8% to 11.5%, but the volatility is much smaller. Please also note that the only under-performance that is out of bounds is the past three years, 2008-2010.

We have another saying within the firm: “It is always a good time to have a balanced portfolio.”

Make sure that your portfolio is well balanced to meet your goals.

Photo by Megan Marotta