Q: My husband and I have been married for 36 years. He is 55 and I am 62 and I need 4 more quarters of work to qualify for my own social security – which would only amount to about $150 a month. I was told that I would not be able to apply for spousal social security until he qualifies for social security himself. Since he plans on working until 66 which is full retirement for him, that means I will be 73 before I can start collecting the maximum spousal payments (which would be about $1,000 a month). My question: should I keep working so I can eventually collect my small social security payment or should I just wait for spousal payments at age 73? Thanks for the help.

Sincerely, Seeking Security

$ ?s answered by Matthew Illian, CFP®

Dear Seeking Security,

The first thing you need to do is decouple the retirement and claiming decisions. Many retirees who start claiming their benefits as soon as they retire make the wrong decision. Some benefit from claiming before they retire. Others benefit by living off savings for a few years after retirement to maximize their social security checks.

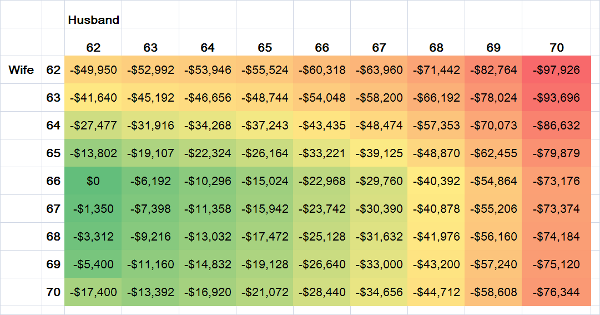

If you claim your own benefit at age 62, your own benefits will be reduced by 25% and more importantly, if you are the second to file, your spousal benefits will be forever reduced by 25%. If you are entitled to a $1000 spousal benefit at your full retirement age, this will be reduced to $750 a month. We estimate that filing before your optimal age will cost you up to $49,350 in reduced lifetime benefits (see chart: both husband and wife age 62). Our assumptions use social security’s actuarial tables which suggest that a 62 year old female has a life expectancy of 84 years and a 55 year old male has a life expectancy of 79.5 years.

If you are only four quarters away from being vested, even $150 a month would be a great return on your time. Earning $150 a month translates into $10,800 over the next six years before you are eligible for the larger spousal benefit. Any additional years that you work will only increase your social security benefit which is derived by taking a thirty five year average. Many stay-at-moms who have worked without pay for years find it valuable to replace some of those zeros with earnings when the children leave the house.

You all are in the unusual circumstance where your life expectancy is statistically shorter than your husband’s (according to the actuarial tables). In most cases, the higher paid husband should delay taking benefits as long as possible since his larger benefit will likely be inherited by his spouse as a survivor benefit. In your case, the earlier that your husband starts to claim, the more likely he will maximize his lifetime social security benefits (See chart: benefits reduce each year that your husband delays claiming). If you beat the odds and outlive your husband, you will not receive a penalty for the fact that he claimed early benefits. A survivor receives 100% of their spouses full retirement age benefit (assuming this is larger than their own benefit).

The reason for this counter intuitive result is because your spousal benefit can go no higher than 50% of his age sixty six “basic benefit”. If your husband files for benefits at age 62 and you file for spousal benefits at age 69 you are receiving same percentage of benefits (50%) as you would if you waited until he was 66 and you were 73. Essentially, every month that you delay claiming spousal benefits after he turns 62, you miss out on an approximately $1,000 payment.

On the other hand, delaying will give both of you a marginally higher benefits because he will presumably be adding higher compensated income years to his 35 year calculation. Additionally, if you husband begins receiving social security benefits at 62 and continues to work, his benefits will be reduced and these deferred dollars will not begin to be repaid until he stops working. These earning penalty benefits will be repaid in the future and I am under the impression that they get repaid over a seven year period.

In summary, I would encourage you to get vested and build your social security benefit as much as possible until age 66. Before your husband turns 62, I suggest you work with an accountant or other financial counselor who understands the social security system to closely evaluate the differences between having him claim at 62 and delaying until 66. Our calculations suggest that delaying his benefit and your larger spousal benefit can gain you $22,968 in total benefits.

If you have a money question that is nagging at you, please submit it using our contact page. We attempt to respond to every question. If yours is chosen for MONEY QUESTIONS, we will give you a pseudonym and let you know the date the Q&A is published.