A Backdoor Roth is a method by which high income taxpayers can get money into a Roth IRA even though they are over the income limits which allow direct Roth contributions.

The process involves contributing after-tax funds to a traditional IRA and then converting that money from the traditional IRA to a Roth IRA. Since the money has already been taxed, if this is the only money you have in traditional IRAs the conversion won’t be subject to tax. This method of funding your Roth IRA is only possible when you have no other IRA assets. If you have other IRA assets, then only a prorated portion of your conversion is tax-free and the remainder is taxed.

However, having money in a 401(k) does not disallow you from doing the Backdoor Roth, even though it is pre-tax money. This means that it is still possible for you to do a Backdoor Roth even if you have Traditional IRA assets – you just have to roll your pre-tax IRA money into a company 401(k) before taking the first step of the Backdoor Roth process of making after-tax IRA contributions.

Doing Roth conversions up to the tax-advantaged amount each year and gradually depleting your traditional IRA accounts will also allow you to make Backdoor Roth contributions after you fully convert your Traditional IRA. Please consult someone with both a good knowledge of your tax situation and your overall financial picture to make sure you don’t pay too much tax on conversion or that you miss converting when you should.

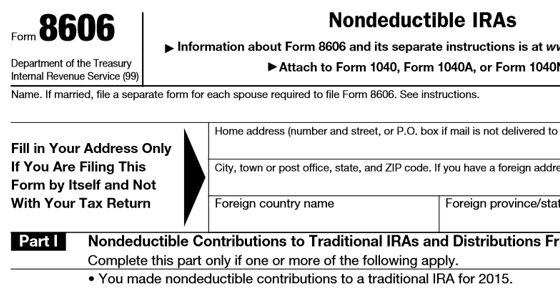

Regardless of the timing, whenever you contribute after-tax dollars to an IRA, you must report that they were after-tax dollars to the IRS on Form 8606.

This reporting allows the IRS to know that certain funds are not subject to tax when you subsequently do a Roth conversion. Filing this smooths the process by letting the IRS know what you are doing. Failing to annually report your after tax-contributions jeopardizes the tax-advantaged strategy because the IRS may claim, without the waiver, that your after-tax contributions were pre-tax.

Thought it sounds complicated, the Backdoor Roth process is an essential financial planning tool and any good financial planner should know how to see you through it.