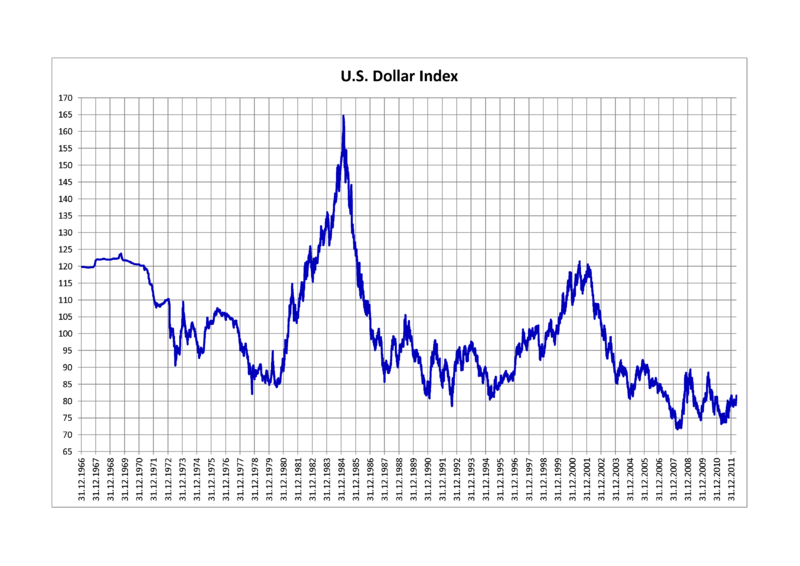

The US Dollar Index is a measure of the value of the United States Dollar relative to a basket of foreign currencies. It began at an arbitrary 100.000 in March of 1973. Since then it has been as high as 164.72 (February 1985) and as low as 70.698 (March 2008).

It is a weighted measure using the dollar’s movements relative to other select currencies in an attempt to represent our major trading partners. The current mix is approximately:

- 57.6% Euro (EUR)

- 13.6% Japanese Yen (JPY)

- 9.1% Canadian Dollar (CAD)

- 4.2% Swedish Krona (SEK)

- 3.6% Swiss Franc (CHF)

The basket was altered in 1999 when the Euro replaced several European currencies. It still includes the Swedish krona and the Swiss franc despite the fact that China, Mexico, and South Korea are more important trading partners.

In “The Success of Freedom Investing” we wrote:

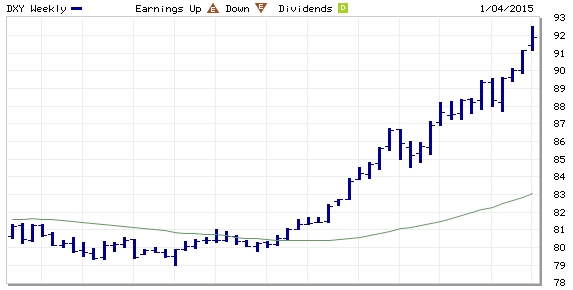

Over 2014, the dollar strengthened an average of 12.79% according to the U.S. Dollar Index.

Here is how the U.S. Dollar Index numbers can be computed:

The Dollar Index Spot (DXY) is computed each day and available at MarketWatch and other sites.

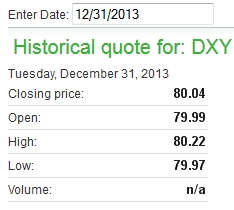

MarketWatch also allows you to enter a date and get a historical quote. Here is the historical quote for the end of 2013:

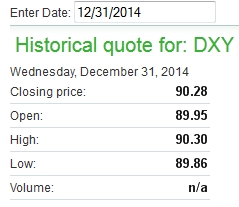

And here is the historical quote for the end of 2014:

For consistency, it is normal to use the closing values for comparison.

Computing how much the U.S. dollar appreciated is as simple as computing the appreciation (90.28 minus 80.04 equals 10.24) divided by the initial value (80.04).

The result is 12.79%.

Over 2014, the dollar strengthened an average of 12.79% according to the U.S. Dollar Index.

Note that the dollar appreciating 12.79% is not the same as foreign currencies losing 12.79%. To determine how much value foreign currencies lost requires some additional math.

In order to get an intuitive sense of why these two percentages are different, if the dollar appreciates 100% (doubling in value) that means that foreign currencies would only lose 50% of their value. Since one is the inverse of the other, the numbers are slightly different. Here is how to compute how much value foreign currencies lost:

If a dollar doubled, it would then be worth 2.000. The foreign currency is worth the inverse (1 divided by 2.000, which is 0.50). Since the foreign currency started out equal to 1.00 and now it is only worth 0.50 it lost 0.50. The loss (-0.50) divided by the original value (1.00) equals the percentage loss (50.00%). Here is that same computation using numbers for 2014:

If a dollar is now worth 1.1279 times as much, then the foreign currencies are worth the inverse (1 divided by 1.1279, which is 0.8866) This means that the foreign currency is only worth 88.66% of what is used to be worth. The loss, therefore is -0.1134 or 11.34%. Hence we could also say:

Over 2014 foreign currencies lost an average of 11.34% according to the U.S. Dollar Index.

Photo by TaxCredits used here under Flickr Creative Commons.