In my article entitled “The Optimum Asset Allocation to Gold Is Always Zero” I wrote:

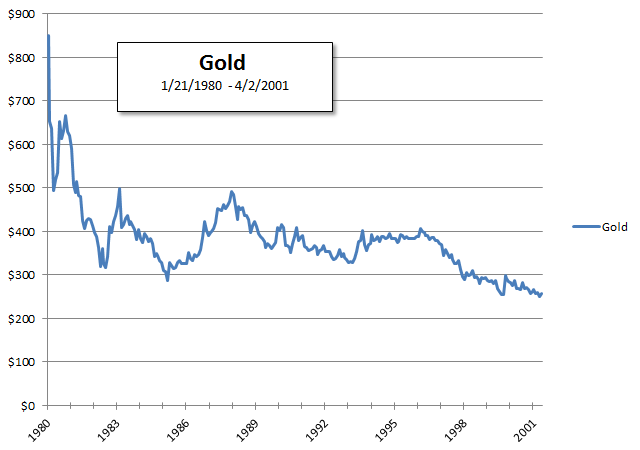

In January 1980, gold reached a high of $850 an ounce ($2,399 in today’s dollars). For the next 21 years the price of gold dropped to a low of $256, losing over 70% of its value.

The price of gold peaked at $850 an ounce on 1/21/1980. It bottomed 21 years later on 4/2/2001 at $255.95. The decline looked something like this:

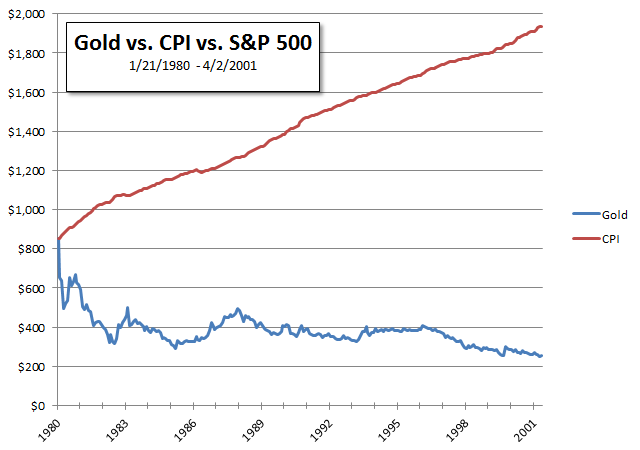

And if we compare that decline with the Consumer Price Index you can see that gold lost even more of its purchasing power during its decline:

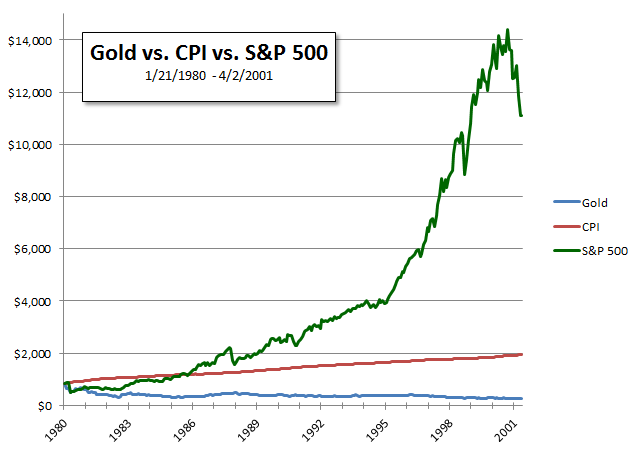

And if we add in the Total Return of the S&P 500 you can see the lost opportunity costs of not having been invested in the markets.

Gold is very volatile. Read “Over 11 Years Gold Rose Over Six-Fold” to see that gold can go up as well as down!

Subscribe and receive the free presentation: If Not Gold, Then What?!