In my article entitled “The Optimum Asset Allocation to Gold Is Always Zero” I wrote:

Gold’s volatility means it has both positive and negative runs. Gold advocates try to make their case based on the positive returns from the bottom of the gold market in 2001 until recently. They ignore the 21 years of decline in favor of the recent 12 years of growth.

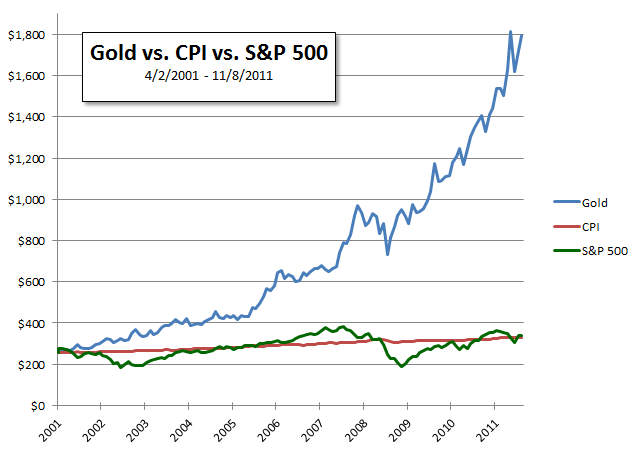

The price of gold on 4/2/2001 at $255.95. While the S&P 500 went nowhere in what has been called “The Lost Decade”, the value of gold went up to $1,795 peaking on 11/8/2011. The ascent from trough to peak looked something like this:

I mentioned in the article that gold is up for the past 12 years, although that is not strictly true. Gold peaked at $1,795 and is now (May, 2013) trading at about $1,400.

Gold is very volatile. Read “Over 21 Years Gold Lost 70% Of Its Value” to see that gold can go down as well as up!