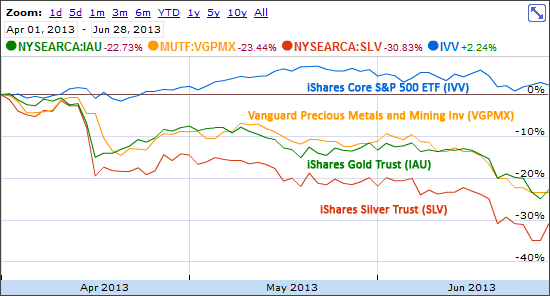

I’ve written elsewhere that it is better to invest in precious metal mining companies than the metals themselves. Precious Metal Mining companies are leveraged against the movements of the underlying price of the metals themselves. Second quarter 2013 saw the price of the metals tumble sharply sending the mining companies down as well:

- Vanguard Precious Metals and Mining Fund (VGPMX) was down 23.00% during the second quarter, but still averaging 7.41% for the last 10 years.

As bad as the drop in mining companies was, it was still not as bad as the drop in the price of the metals themselves:

- iShares Gold Trust (IAU) was down 25.48% during the second quarter.

- iShares Silver Trust (SLV) was down 34.22% during the second quarter.

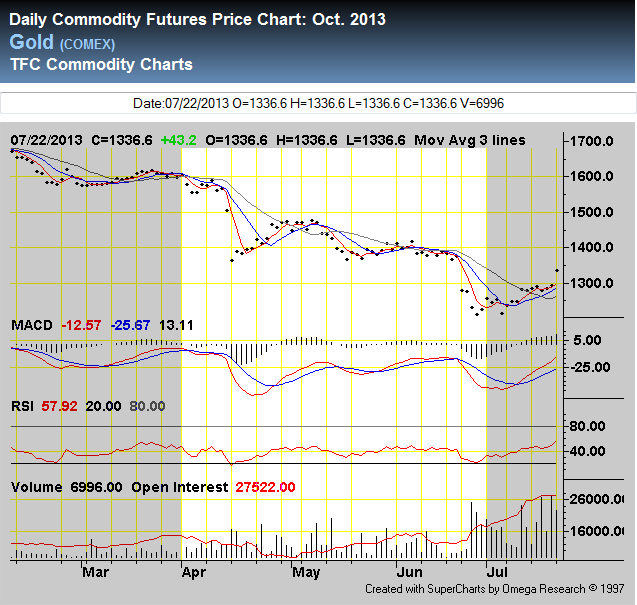

Here is a chart showing the movement of the price of gold during the second quarter of 2013:

We suggest that you limit your investment In gold and silver to less than 3% of your portfolio. In truth, the optimum asset allocation to gold and silver as metals is always zero.