We did a Morningstar analysis of the following portfolio over the past decade:

- 20% iShares MSCI Hong Kong (EWH)

- 20% iShares MSCI Singapore (EWS)

- 20% iShares MSCI Australia (EWA)

- 20% iShares MSCI Switzerland (EWL)

- 20% iShares MSCI Canada (EWC)

These are the five countries considered “free” by the 2014 Heritage Foundation Index of Economic Freedom. Although New Zealand showed some of the best performance for the past three years, the iShares MSCI New Zealand ETF (ENZL) has only been available for the past three years and therefore was not included.

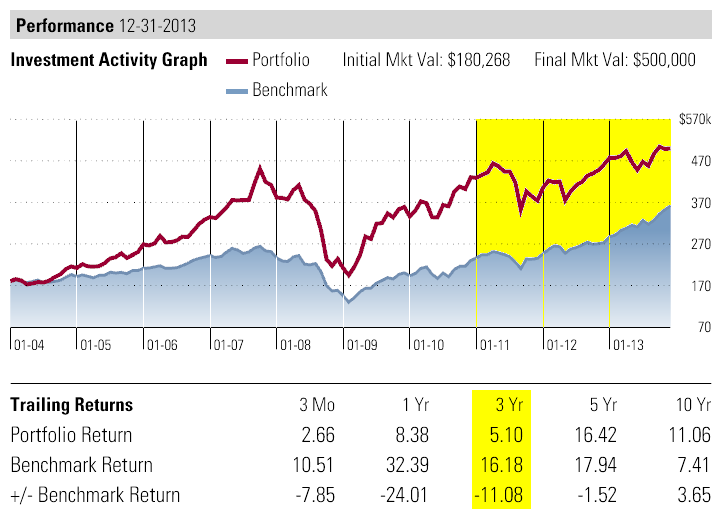

The portfolio of the five freedom countries has an annualized return of 11.06% over the past decade verses the S&P 500’s 7.41%. But you can also see that the S&P 500 has performed very well over the past three years and is catching up from its prior underperformance. The United States ranks 12th near the top of the “mostly free” category.

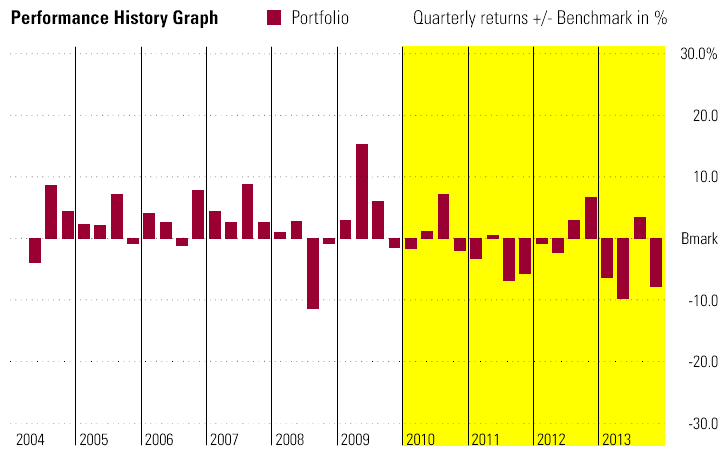

Here you can see the quarters where the freedom portfolio either outperformed or underperformed the S&P 500.

The goal of Freedom Investing is not to outperform the S&P 500. After all the United States is one of the countries which is relatively high in economic freedom. The goal is to outperform the EAFE Index of foreign developed countries over long periods of time.

The expense ratio for this portfolio is a relatively low 0.51%. This expense ratio is low enough and the gain against the EAFE Index seems likely enough to warrant using these funds.

Disclaimer: Both myself personally and the clients we manage invest in the investments mentioned in this article.