This latest article by Jed Graham of Investor’s Business Daily shows how Social Security, already not keeping up with inflation, may get worse.

This latest article by Jed Graham of Investor’s Business Daily shows how Social Security, already not keeping up with inflation, may get worse.

Debt Talks Target Cost Of Living

To solve the deficit reduction riddle, Obama reportedly is embracing an idea that purports to raise tax revenue without a tax hike and claims to cut Social Security outlays without cutting benefits.

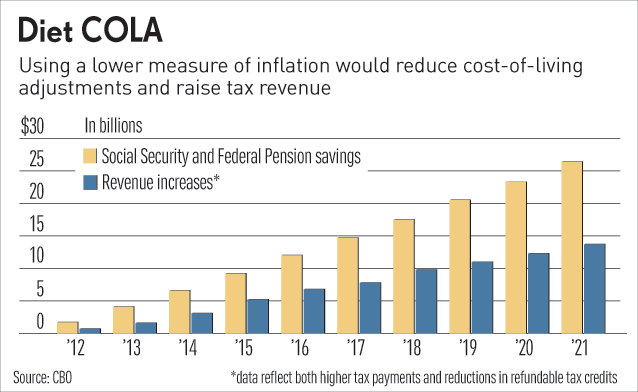

The idea is to adopt a new, lower inflation gauge as the basis for annual tax code adjustments and cost-of-living adjustments, or COLAs, for Social Security and federal pensions. The switch to the so-called chained CPI would cut deficits by $208 billion over a decade, the Congressional Budget Office says.

We’ve written earlier about how the government already under-reports inflation, what the results of under-reporting inflation are, and how you can protect yourself and your portfolio against inflation.

What is equally important is that since Social Security won’t keep pace with inflation, if you don’t discount the stream of Social Security payments in retirement planning you could easily find yourself living an Amish life in a digital age.

Knowing how and when to take Social Security can make a quarter of a million dollar difference between the best and worst options. And of course having a financial planner who will help you not need it at all is priceless.

Subscribe and receive free presentation: Social Security: How to Get $250,000 More!