There is a large difference between owning your own home and owning investment real estate.

Your primary residence will on average keep up with inflation and also cost you about 1% of its value in maintenance and more in insurance and property taxes.

Real estate which you rent to others, on the other hand, pays you rent money every month. Like your house, your rental property will on average keep up with inflation, but the rent is, if you have priced well, sufficient to pay for the insurance, maintenance, and property taxes and still produce a profit. In other words, your real estate investment itself grows by inflation and you still have profit above and beyond inflation.

This is why rental property is an investment while your home is not.

Owning and operating rental real estate requires a great deal of work, but it can be profitable. The danger is that real estate is only one type of asset, it is often highly leveraged, and it is illiquid meaning that you are not immediately able to sell it for a reasonable price. If you own rental property, you should learn to evaluate your real estate investment as an investment and compute a return on your investment each year.

That being said, there is another way to get some of the benefit of investing in real estate without as much of the risk. One way is purchasing on the stock market is Real Estate Investment Trusts (REITs).

REITs were created in 1960 by Congress to give all Americans a vehicle to own long term real estate investments. Along with this invention, they have put in place specific guidelines which REITs, unlike other stock market securities, must follow. The two biggest rules are:

First, over 75% of their value must be comprised of owning or financing real estate. Equity REITs own property and get their income from renting the properties. Mortgage REITs get their income from interest payments from financing properties.

Second, REITs must distribute more than 90% of their profits as dividends. As a result, REITs have a dividend yield which is higher than average. Currently, the dividend yield for Vanguard’s REIT ETF (VNQ) is 4.21% while the dividend yield for Vanguard’s S&P 500 ETF (VOO) is only 2.10%.

In exchange for abiding by these and other rules, the IRS does not require REITs to pay income taxes.

Publicly-traded REITs are listed with the Securities and Exchange Commission and trade like stocks throughout the day. Because they are publicly priced and traded, you can always buy or sell them with a very small spread.

There are corporations that qualify as REITs but are either not listed on stock exchanges or not publicly owned. These non-publicly traded REITs have numerous potential problems and we recommend avoiding them. We recommend insisting on publicly priced and traded investments and don’t recommend investing in any illiquid assets.

You might think that not being taxed at the corporate level would mean that real estate appreciates more than stocks. This is not true. While bonds appreciate on average 3% over inflation and stocks appreciate about 6.5% over inflation, real estate falls between these two. Residential real estate investments appreciate about 4.1% over inflation and commercial real estate investments appreciates about 4.9% over inflation.

Simply because REITs have a lower mean return doesn’t mean that REITs should not be part of your investment portfolio. REIT investments have a low correlation to U.S. stock investments. They also have a lower volatility than U.S. stocks. The lower volatility and low correlation together means that REITs find a place in the efficient frontier of investing when you are crafting your investment plan.

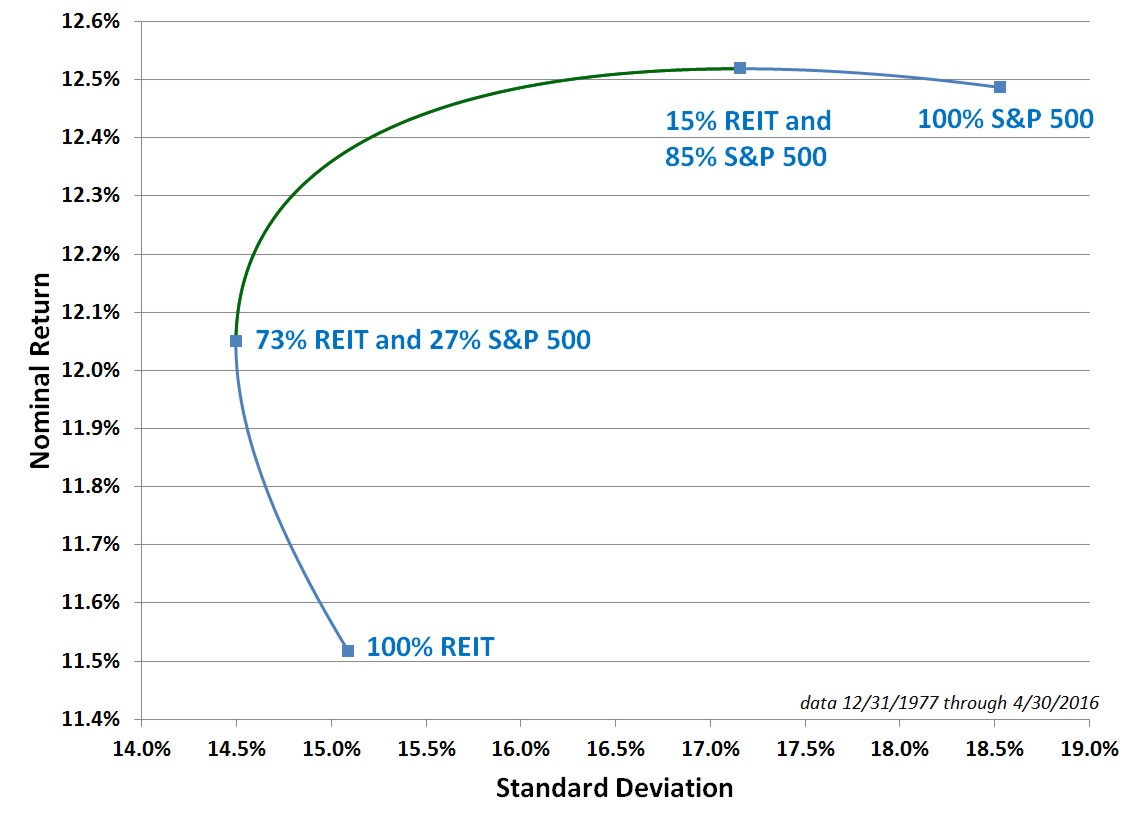

Here for example is the return and standard deviation of portfolios built solely from two investment indexes: The Wilshire REIT Index and the S&P 500 Composite Total Return. The data is from 12/31/1977 through 4/30/2016.

During this time period, the correlation between REIT and U.S. Stock indexes was only 0.58. Due to this low correlation and the normal volatility of the two indexes, the greatest return came from a portfolio consistently rebalanced back to 85% S&P 500 and 15% Wilshire REIT Index. Meanwhile the portfolio with the lowest volatility resulted from a portfolio consistently rebalanced back to 73% Wilshire REIT Index and 27% S&P 500.

For these two indexes over this time period, only portfolios between these two asset allocations would be on the efficient frontier. For any other mix, there would be a portfolio with a higher mean return and a lower volatility. As you add additional potential sectors to your analysis, these allocation percentages get smaller to make room for other investments, but the principle of including some REIT in your portfolio remains.

This is an example of diversification potentially both reducing volatility and increasing returns. Because of these benefits, we included an allocation to REITs in our Marotta Gone-Fishing Portfolios.

In addition to their slightly lower mean return, REIT dividends are also taxed at a less favorable rate. Most of the income that REITs are required to distribute is taxed at ordinary income tax rates. Ordinary income tax rates can be as low as 10% or as high as 39.6%. Meanwhile, most stock dividends qualify for a more favorable capital gains tax rate. The capital gains tax rate can be as low as zero and reaches its maximum at 23.8%. Many middle income taxpayers would experience a 25% tax on REIT income and a 15% tax on stock dividends.

This higher tax rate on income from a REIT can be mitigated by purchasing your REIT investments in qualified retirement accounts, especially traditional retirement accounts such as a traditional IRA or 401(k). Since any withdrawal from a traditional retirement account will ultimately be taxed at ordinary income tax rates, receiving REIT income in such an account has no disadvantage.

The same tax benefits can be gained by purchasing REITs in Roth accounts. But because Roth accounts will never be taxed again, we recommend purchasing those investments with the highest mean return regardless of the volatility in Roth IRAs or 401(k) accounts. Since REITs have a lower mean return, they are best purchased in traditional retirement accounts which will be subject to the income tax anyway.

Selecting the best investments to purchase in different investment vehicles can boost after-tax returns significantly. Purchasing REITs in traditional IRA accounts is just one example of this complex technique.

Photo used here under Flickr Creative Commons.