We are pleasantly surprised by how widely popular our Schwab Tutorials are here on the Marotta On Money website. We are an independently owned and operated wealth management firm. We are not affiliated with Schwab or any other custodian. We use Charles Schwab as the primary custodian for most of our service levels.

We are pleasantly surprised by how widely popular our Schwab Tutorials are here on the Marotta On Money website. We are an independently owned and operated wealth management firm. We are not affiliated with Schwab or any other custodian. We use Charles Schwab as the primary custodian for most of our service levels.

If you’d like to read more tutorials like these, you may enjoy subscribing to our weekly newsletter.

Through a relationship with Charles Schwab, you can have access to the Schwab mobile app. If you have a smartphone, there are many ways the Schwab mobile app can simplify your life.

As we have written previously, the Schwab mobile app provides the ability to easily deposit checks and set-up or use a MoneyLink to transfer money between accounts directly from your smartphone.

This article provides an overview of some of the additional features offered within the Schwab mobile app. If you have any questions or run into any problems while using these or any other features of the Schwab mobile app, we recommend calling Schwab Alliance directly at 800-515-2157.

The homepage of the app lists the following options:

Order Status

To check the order status of recent investment account transactions, tap “Order Status” at the bottom of the “Summary” page (the first page you see after you’ve logged in).

Then, select the investment account you would like to view the order status of and the status of all recent orders for that account will appear.

You can select “Filter” under the account to specify which orders the “Order Status” page will show. For example, if you’re trying to see the orders that were placed today for stocks and exchange-traded funds (ETFs), under the “Show:” filter select “Today’s Activity” and under the “For:” filter select “Stocks & ETFs.”

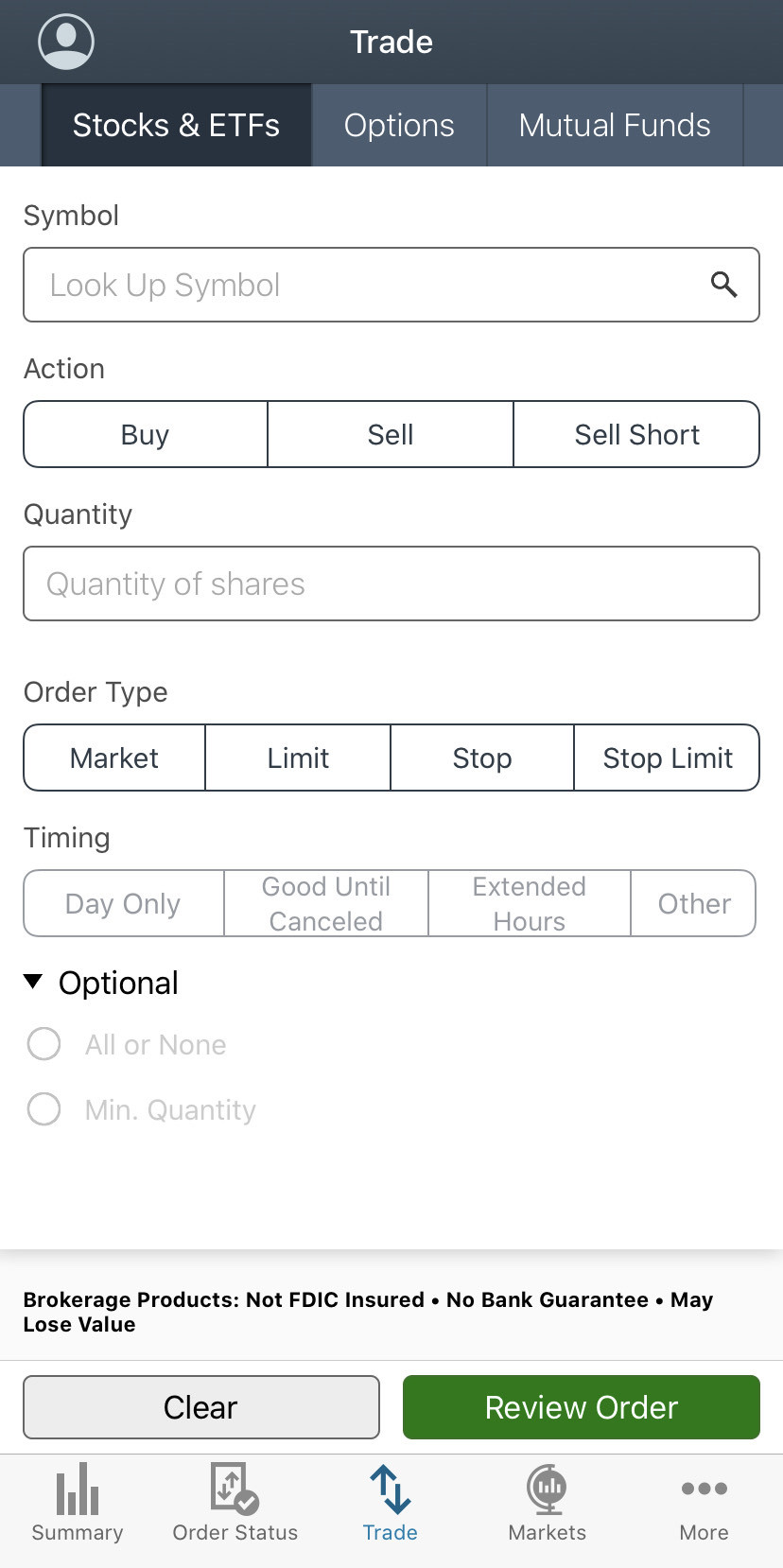

Trade

The “Trade” page of the mobile app allows you to buy, sell, or sell short stocks and ETFs, buy or sell mutual funds, or trade in options if your account is approved for options trading.

Once you are on the “Trade” page, tap the “Stocks & ETFs” tab, “Options” tab, or “Mutual Funds” tab at the top of the screen for the type of trade you’d like to place.

When trading stocks or ETFs, first select the Schwab account you would like to trade in to view the cash available to invest, as well as the cash available to invest plus the amount you can borrow to invest.

Then, look up the ticker symbol of the stock or ETF you want to trade and select your desired action: Buy, Sell, or Sell Sort.

You can then enter the quantity of shares you would like to trade and select the type of order you would like to place: Market, Limit, Stop, or Stop Limit.

Next select the timing of your trade. The timing options include Day Only, Good Until Cancelled, Extended Hours, or Other.

When trading mutual funds, first select the Schwab account you would like to trade in to view the cash available to invest, as well as the cash available to invest plus the amount you can borrow to invest.

Then, look up the ticker symbol of the mutual fund you want to trade and select your desired action: Buy, Sell, or Sell One/Buy Another.

If you select “Buy” a new box will appear for you to enter the dollar amount you want to purchase starting at a minimum of $1.00. Below that you will be prompted to choose an option for the Reinvestment Instructions. The choices include: (1) Reinvest both dividends and capital gains, (2) Pay dividends in cash and reinvest capital gains, or (3) Pay both dividends and capital gains in cash.

If you select “Sell” a new box will appear for you to enter the dollar amount you want to sell. There will also be a “Sell All” button you can tap if you want to sell your entire holding of the mutual fund.

Once you have filled out all the information for your trade, tap the green “Review Order” button at the bottom of the page.

Markets

The “Markets” page of the mobile app provides a variety of information about the performance of the markets including:

- Indices shows a graph of the 1-Day, 5-Day, 1-Month, and 1-Year performance as well as the price and percentage change of various indices including the Dow Jones Industrial Average Index (DJIA), the S&P 500 Index, the NASDAQ Index, the Russell 2000 Index, and many more.

- Breaking News provides news articles and interactive charts on investment subjects such as earnings reports for companies.

- Schwab Market Updates includes information to read about the market and a podcast to listen to Schwab’s daily market updates.

- Top Mentions provides links to stories related to ten specific stocks.

- Sectors shows the 1-Day, 30-Day, and 1-Year performance of market sectors including Energy, Real Estate, Consumer Discretionary, etc.

- Company Movers illustrates the movement of stocks and can be filtered by Most Actives, % Price Increase, % Price Decrease, $ Price Increase, $ Price Decrease, 52 Week Highs, or 52 Week Lows, as well as by Sector.

- Market Volatility provides a graph of the S&P 500 1-Month Rate of Change, The CBOE Volatility Index (VIX), and the CBOE S&P 500 Options Put/Call Ratio over the last 30 days.

- Futures shows the 1-Day, 5-Day, 30-Day, 6-Month, and 1-Year price and percentage change of various futures including the E-Mini S&P 500, the E-Mini NASDAQ, Crude Oil, Gold, and the 10-Year Treasury Note.

- Reports provides market focused articles published by companies such as Argus, Ned Davis Research, and Morningstar.

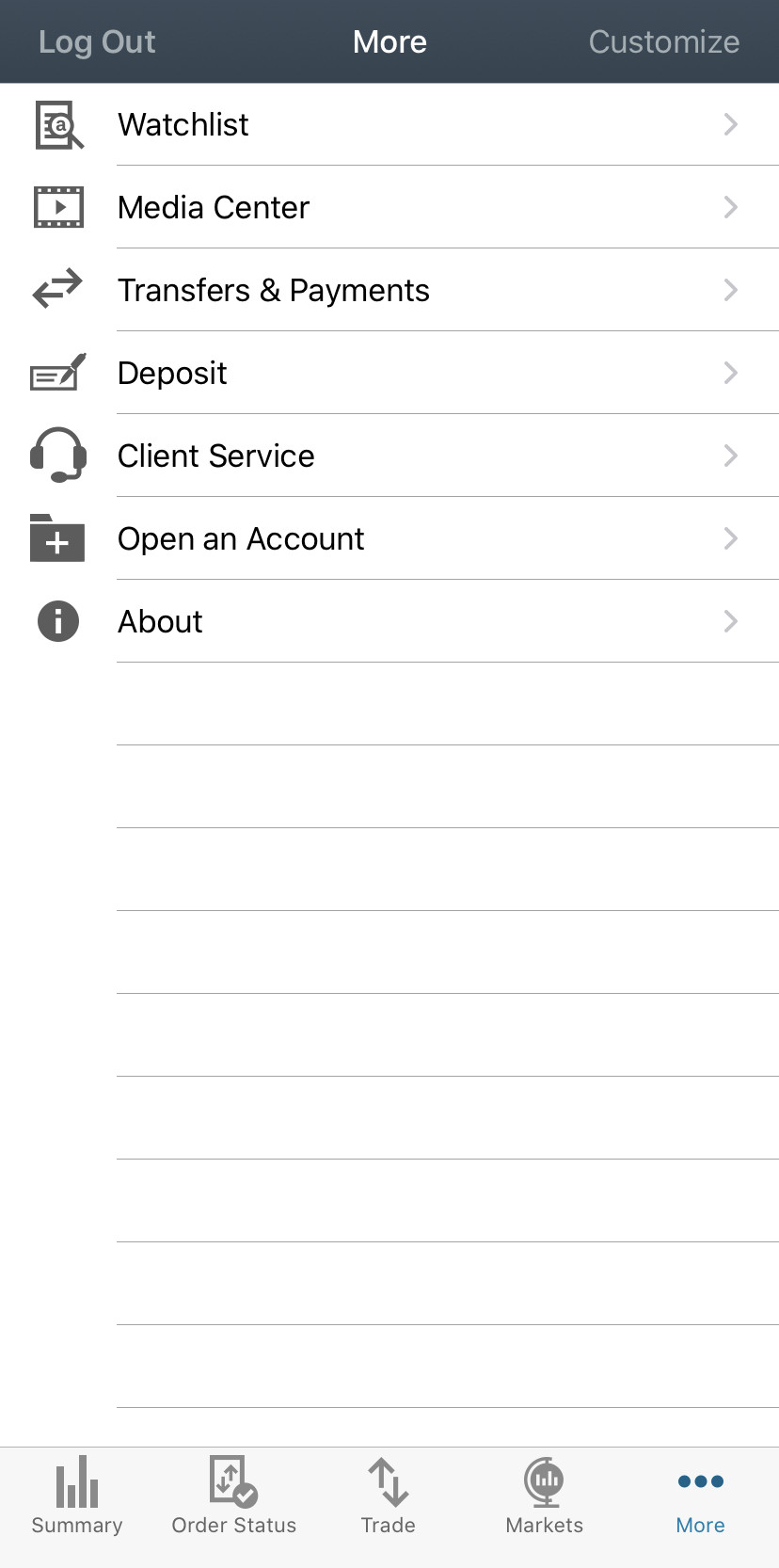

More

The “More” page offers many additional features including:

Watchlist allows you to add ticker symbols of securities you would like to “watch” and includes a toggle button for you turn an Auto-Update Quotes feature on or off.

Media Center provides Featured Content, Podcasts, and YouTube Playlists suggested by Schwab.

Transfers & Payments takes you to the “Bill Pay” tab, the “Transfers” tab described in our article “Schwab Mobile App: How to Set-Up or Use a MoneyLink” to transfer money between your accounts, or the “Routing Numbers” tab where you can find specific information regarding direct deposit, outgoing payments, and wire instructions for each of your Schwab accounts.

Deposit takes you to the “Deposit” tab discussed in our article “Schwab Mobile App: How to Deposit a Check.”

Client Service offers many additional features including:

- “Statements & Reports” where you can view and download account statements, tax forms, letters, reports and plans, and trade confirmations;

- “1099 Tax Forms” where you can view and download the 1099 Composite for each of your eligible accounts as they become available;

- “Balance Letters” where you can generate a letter showing the Average Balance or Balance in Excess during a time period ranging from the previous 2 months to the previous 12 months for your accounts that are at least 2 months old;

- “Call Schwab” where you can view a list of customer service phone numbers including Charles Schwab Brokerage, Retirement Plan Services, Stock Plan Services, Charles Schwab Bank, and Schwab Charitable;

- “Branch Locator” where you can locate a Schwab branch by entering a zip code or city and state;

- “Travel Notice” where you can add the dates and destination(s) of your upcoming travel plans to notify Schwab of transactions that may take place outside of your normal region;

- “Manage Cards” where you can manage your Schwab debit card(s) by locking your card to block new ATM transactions, purchases, and cash advances, as well as set up debit card alerts or travel notices and replace your debit card or report a stolen debit card; and

- “Send Secure Documents” where you can securely send up to 5 documents per message with a maximum total of 15MB to Schwab.

Open an Account allows you to open a Brokerage, Retirement, Schwab Intelligent Portfolios, Schwab Bank Checking, Custodial, Small Business Retirement, or Estate Planning account.

About provides information regarding Frequently Asked Questions, What’s New, Rate My App, Terms of Use, and the App Version.

Legal Documents & Disclosures provides information regarding Disclosures, Privacy, USA Patriot Act, SIPC, FDIC Insurance, and Other Important Information.

As always, if you run into any problems with these features or have more questions, you can call Schwab Alliance directly at 800-515-2157.

Whether you have held Schwab accounts for many years or are in the process of opening an account with Schwab for the first time, you may enjoy the smartphone app and the many convenient features it offers.

Photo by Clique Images on Unsplash