Credit card companies have teams of people running over ten thousand experiments every year trying to find the best way to discourage transactors, people who pay off their credit card every month, and encourage revolvers, people who don’t pay off their credit card every month. Their goal is trying to determine how to maximize and entice the credit payments from revolvers, while minimizing the giveaways, especially for the superusers who take advantage of every reward and perk offered.

Credit card companies have teams of people running over ten thousand experiments every year trying to find the best way to discourage transactors, people who pay off their credit card every month, and encourage revolvers, people who don’t pay off their credit card every month. Their goal is trying to determine how to maximize and entice the credit payments from revolvers, while minimizing the giveaways, especially for the superusers who take advantage of every reward and perk offered.

I am on the border of being a superuser. There are people who are much more sophisticated than I am at taking advantage of the credit card companies. I know that if I slip, some free burrito may end up costing me $50. I like to set my life up so that I have a routine. Decisions which cost me time and effort are expensive. Things that happen automatically are genius.

Recently, I signed up for Capital One’s SavorOne Rewards credit card offering a $200 online cash rewards bonus and 3% cash back on dining, entertainment, popular streaming services and at grocery stores. My intention was to receive 3% back on dining and grocery store purchases. It also allows 3% back if you use it for qualified entertainment purchases such as going to the movies.

One thing I’ve learned about credit cards is that the categories are entirely dependent on the correct categorization with a specific card of a company’s primary business. I’ve seen the same business categorized three entirely different ways with VISA, Mastercard, and American Express. That categorization, not what you purchased, will ultimately determine your rewards. I checked the categorization of my charges to ensure that those businesses I thought were grocery or dinning budgets were actually coded that way by VISA.

I made sure that all of the various marketing was turned off on this card. You have to do this periodically (every three years) in order to make sure that you avoid as much marketing as possible.

I set an alert to automatically notify me if I make a purchase over $1. This is the best fraud alert that I have found. Any time after using my credit card I will receive an email telling me that I made a purchase. This is quick enough that I have not forgotten about my purchase but delayed enough to remind me what my purchase costs.

I then also set my entire credit card bill to automatically pay from my checking account each month.

And I set the bill to come to me via postal mail in order to have a written record of my purchases and also in order to remind me that money will be flowing out of my checking account.

The $200 cash back was only good if you charged over $500 during the first 3 months after opening your account. I made sure to charge at least $500 in my first 60 days since it took some time to receive my card. I did subsequently receive this $200 bonus.

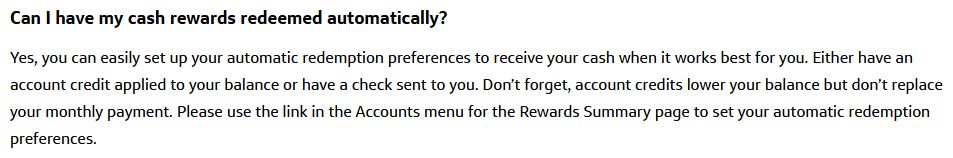

I received a statement for the prior month and read it carefully. I had a reward summary showing that my rewards had built up. I called the company because I couldn’t find a way for my rewards to be automatically applied to my account. I was encouraged that there would be a way to automatically apply my cash reward to my account balance each month. I was encouraged by the frequently asked questions (FAQ) on the SavorOne card website which read:

After calling Capital One, I was transferred from their Customer Service Department to the Rewards Department and then to the Technical Services Department. Then, Technical Services tried to transfer me back to the Rewards Department. After nearly an hour everyone at Capital One said it should be on the website, but it is not. They also said that they thought they should be able to set such a setting for me, but that also was not possible. Finally, I was transferred to the Escalation Department. They put me on hold, and after over an hour the call dropped. It pays to have work to do while you are on hold, and it pays to have an even temperament and not get frustrated, upset, or angry.

I was finally able to find out how to Auto-Redeem my rewards for Cash. While their Service Department couldn’t find it they gave me sufficient clues for me to find it on my own. One of the account representatives said, “Oh, did they hide it again somewhere?” Knowing that they had hidden the method of automatically redeeming your cash rewards was sufficient for me to find where it was.

While the Overview suggests six ways to redeem your cash rewards, none of them are what you want. You can Redeem for Cash which is a one time way to lower your account balance or get a check. You can Redeem With PayPal, but this only let’s you pay for something with rewards; this doesn’t transfer your balance to a PayPal balance. You can also pay using rewards by Shop With Amazon. Or you can tie up your rewards in “Get Gift Cards.” You can get reimbursed for a recent purchase with “Cover Purchases.” Or you can “Move Rewards” between your Capital One accounts. But as I said, none of these are what you want.

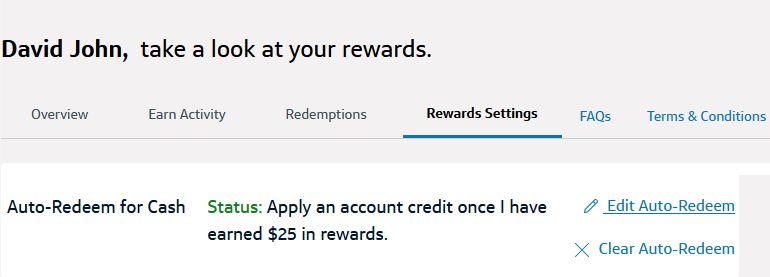

Instead, when you click on Rewards Settings, a hidden setting of Auto-Redeem for Cash appears along with the ability to edit this feature. Once this feature is selected the lines should open on the website.

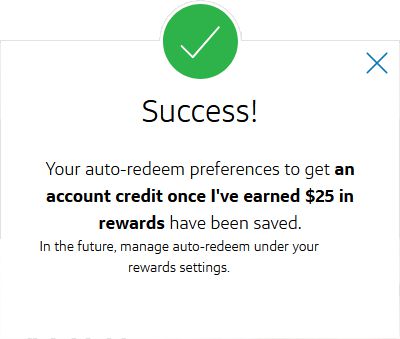

Select Edit Auto-Redeem and choose to get an account credit once you have earned at least $25 in rewards. This is the minimum and should keep your reward balance as low as possible. After selection you should get a message which looks something like this:

Remember that Capital One is trying to make receiving your credit card cash rewards as difficult as possible. They want to use the opportunity to entice you to make an additional purchase. Your job is to find and configure a credit card where saving money is as easy as possible. This setting, while hidden, is better than others where it may be impossible.

If all of this seems to be a great deal of effort in order to receive a 1% better reward for dining purchases and the grocery store, you may be right. It may be sufficient to have a card which automatically deposits 2% into your investment account or a card that offers 2% back everywhere. That being said, being persistent is one of my strengths. And once set up, the extra rewards may be worth the extra effort.

Background photo by Gus Moretta on Unsplash. Screenshot of SavorOne credit card from CapitalOne.com.