Even though it is often the worst choice, most people take Social Security as early as possible, at age 62. This decision reduces lifetime benefits by hundreds of thousands of dollars. This often impoverishes retirees who can least afford it while the affluent consult with their financial advisor and make a better decision.

Even though it is often the worst choice, most people take Social Security as early as possible, at age 62. This decision reduces lifetime benefits by hundreds of thousands of dollars. This often impoverishes retirees who can least afford it while the affluent consult with their financial advisor and make a better decision.

For the married, Social Security Analysis is very important. The difference in a couple’s age along with their income history provide hundreds of different unique scenarios. Even the details of what month to file within a given year may be worth tens of thousands of dollars.

We originally developed our own analysis spreadsheet. You can see our heat map presentation of how much a typical couple might lose from early filing in our article “Gain $152,000 by Smart Filing for Social Security.” When several social security strategies were retired, we switched to a professional Social Security Analysis software that had emerged rather than upgrading our sheet.

If you’d like our help with the analysis, our Social Security Planning is a Bonus Service of ours which is included in our Comprehensive service level and available to our Do-It-Yourself service level for an extra charge.

If you’d like to perform the analysis yourself, there are a few free Social Security tools are available on the Internet.

After an analysis, a family may learn that it is valuable to delay the larger earner’s benefits. But they may not know how to do that. They may, for example, want to retire from their job at age 65 but the social security analysis suggests that they not start benefits until age 70.

For this reason, we developed a complex method of estimating the current value of future Social Security Benefits. We explain this in our article “How to Factor Social Security into Your Safe Withdrawal Rate.”

This methodology includes a calculation of how much should you consider your anticipated social security benefits at age 70 if you are retiring at age 50. (You should only consider 30.85% of their value.) As far as we know, this type of analysis doesn’t exist anywhere else on the internet. Here is a case study as an example of how to implement this analysis:

The Question:

James would like to retire at age 66. His age 66 benefits would be $3,000 a month. The Social Security analysis software suggests delaying his benefit until age 70, but he and his wife Linda need a flow of cash for their lifestyle in order to live. They have some savings, both in retirement accounts and in a joint taxable brokerage account. But they are hesitant to withdraw too great a percentage early in retirement. As a result, they are tempted to start James’ Social Security benefits now.

The Answer:

James’ age 66 benefit is $3,000 a month. His age 70 benefit would be 1.32 times greater or $3,960 a month. If James lives to be 100, he will collect $201,600 more in today’s dollars if he delays his benefits. The break even point is around age 82. Since the odds of one of either James or his wife living beyond age 82 are high, they would likely benefit from delaying until age 70 to file.

They look up the value of an age-70 benefit for an age-66 retirement in our tables, which is 70.21%. They take their age 70 benefit ($3,960) and multiple times 70.21% to get that they could spend $2,780 from their portfolio at age 66 in anticipation of future Social Security benefits.

Notice that these tables have tried to factor in the fact that Social Security is not keeping up with inflation. We have reduced the value of future benefits by 1% per year. Using these tables the calculation of what you could spend if you were retiring at age 66 and starting benefits at age 66 is only 87.26% of those benefits or $2,618 per month. Delaying your Social Security benefit in this case allows you to have a higher standard of living even if you still retire at age 66.

In those tables, we were trying to be cautious about Social Security not keeping up with inflation. If you take that adjustment out, you should still be able to spend more at age 66 if you are delaying Social Security benefits until age 70 than if you filed earlier. In our example, that would mean that you could choose to spend $3,000 a month from your assets at age 66 knowing that at age 70 you will continue to spend only $3,000 from your higher $3,960 benefit and use the excess $960 a month to save and invest, paying back what you have spent.

To do this strategy requires that you have the $144,000 required to live for four years from age 66 to 69 waiting for your increased benefits at age 70. Unfortunately for those who don’t have any savings, the alternative is retiring later or starting Social Security and receiving diminished payments for the rest of your life.

According to the U.S. Government Accountability Office , among households age 55 and older, around 29% have no defined benefit plan nor any retirement savings. The median financial assets of this group is just $1,000 and their total net worth is just $34,760. And an additional 23% have a defined benefit plan but no retirement savings. In total, about 52% of households approaching retirement have no retirement savings.

Another study found that while the average retirement savings for households headed by a 60-64 year old was $229,101, the median savings was only $16,000. Half of households had less than $16,000 in assets while the other half pulled the average up.

These statistics are probably the reason why many retirees start their Social Security benefits at age 62 and receive much lower lifetime benefits. For many retiring without starting Social Security is impossible.

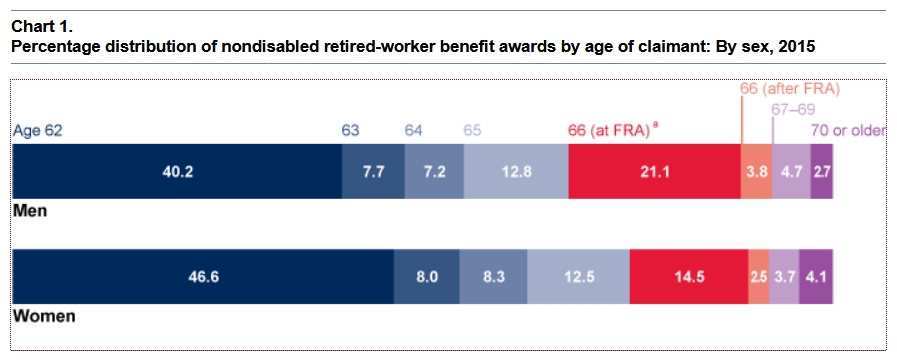

Here is a chart from Social Security’s Office of Retirement and Disability Policy showing the distribution of when people actually start Social Security:

In our example, had James decided to start Social Security benefits at age 62, he would only have received $2,250 per month. If James lives to age 100, he would receive $892,080 less in benefits than he would have received if he delayed starting Social Security until age 70. But this is exactly what a majority of retirees are doing for want either of sufficient assets to live until age 70 or wise advice when making the decision.

If you want to retire before age 70, you need to save adequately during your working career. And for those who haven’t saved, working until age 70 or beyond is not a bad option. For the higher wage earner, starting Social Security benefits before age 70 is often a bad option.

Photo by Olesya Grichina on Unsplash