Congress giveth and Congress taketh away. The Bipartisan Budget Act of 2015 ends two very profitable Social Security optimization techniques that allowed some savvy beneficiaries to take up to $50,000.00 in additional lifetime income. The good news is that some who are at least age 62 by the end of 2015 still preserve some of these planning opportunities.

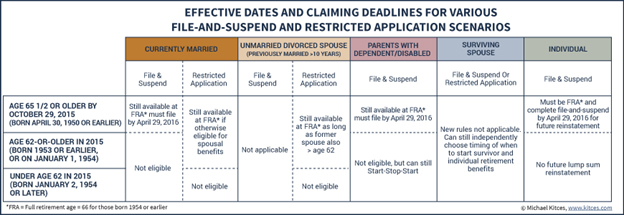

The new rules make Social Security planning for married couples much less interesting. The most lucrative option that is closing is the choice to file as a spouse first. This option, technically known as a “restricted application” allows eligible beneficiaries to claim spousal benefits while earning Delayed Retirement Credits on their own benefit. Filers must be at Full Retirement Age to access this option and now they must also be age 62 by the end of 2015 to be eligible. Those born after 1/1/1954 will no longer be able to file as a spouse first.

Those who are eligible for divorced spouse benefits – meaning they were previously married for at least 10 years – are also losing the option to take spousal benefits first while continuing to allow their own benefit to grow. If you were born after 1/1/1954 and you are ready to begin claiming benefits, you will only be able to claim the higher of your own benefits or your divorced spousal benefits.

Another option dubbed file and suspend is closing even sooner. Those who are at least age 66 by 4/29/2016 and who plan to delay their own benefits have the next several months to activate the file and suspend strategy. This have-your-cake-and-eat-it-too strategy is utilized when a high income filer wants to maximize his or her own benefits by delaying to age 70 but wishes to allow a spouse to access spousal benefits.

You pursue the file and suspend strategy by filing for your personal benefits and then immediately suspending them. This allows a spouse to claim a spousal benefit while your own benefit continues to earn delayed retirement credits which are maximized by age 70.

There has been a bit of confusion around the sunset of this provision because it isn’t the suspension that is going away. You can continue to voluntarily suspend your own benefits after Full Retirement Age (FRA)* in order to earn 8% per year delayed retirement credits until age 70. What is going away is the ability for your spouse to access spousal benefits during this suspension.

As well as married folks, individual seniors are also losing a valuable benefit on April 29, 2016. Previously, savvy individuals could file and suspend their benefit because this allowed them the possibility to retroactively claim all of the benefits going back to the original suspension. Going forward, no future lump sum payments will be awarded when benefits are reinstated.

Deciding when and how to claim Social Security is one of the more important financial questions that you will make in life. It pays to seek a qualified opinion before you settle on a final strategy. If your financial advisor isn’t an expert in this area, we recommend Social Security Solutions for an optimized plan.

*FRA = Full Retirement Age = 66 for those born in 1954 or earlier and scales up to age 67 afterwards

Photo used here under Flickr Creative Commons.