Choosing the optimal point to apply for Social Security can mean the difference in as much as $250,000 in expected lifetime benefits. The options available to spouses are extremely complex, which can often lead to costly mistakes. Before making a six-digit error, make sure you understand the “file and suspend” strategy.

Choosing the optimal point to apply for Social Security can mean the difference in as much as $250,000 in expected lifetime benefits. The options available to spouses are extremely complex, which can often lead to costly mistakes. Before making a six-digit error, make sure you understand the “file and suspend” strategy.

You probably know the Social Security Administration offers three types of benefits for retirees and their spouses:

- Retirement worker benefit

- Spousal benefit: provides up to 50% of the retired worker’s benefit

- Survivor benefit: provides up to 100% of retired worker’s benefit.

Although it takes 10 years to earn a retirement worker benefit, a spousal benefit can be applied for without any (or limited) reported earnings history. This is good news for stay-at-home parents like my mother. However, a spouse cannot apply for a benefit until the primary earner applies for his or her own benefit.

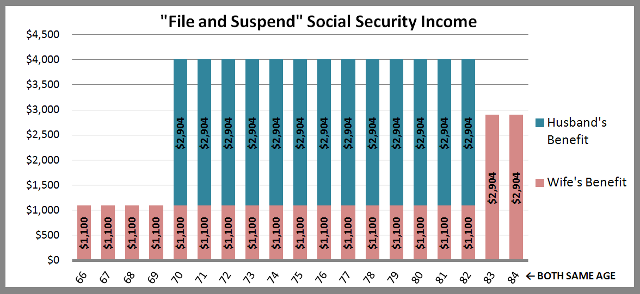

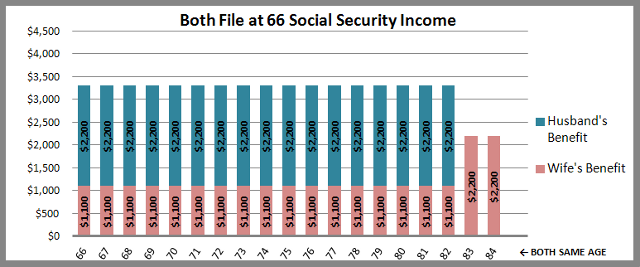

I plan to encourage my father to delay applying for his benefit as long as possible. Each month he waits, his benefit grows by an annual rate of 8%. I haven’t asked him for his specific benefit amounts, but a typical example would be a monthly age 62 benefit of $1,650 or an age 70 benefit of $2,904.

The main benefit to delaying is that my mother, whose own mother is almost 100 years old, will inherit my father’s larger payment, assuming she survives him. Many higher earning husbands base their filing date decision based on their own life expectancy, which is a mistake. They should rather be asking the question, “What benefit do I want to leave my wife?” Delaying my father’s Social Security paychecks will ensure that my mother has the largest possible Social Security paycheck for the rest of her life. This is the most cost-effective form of longevity insurance available on the market.

The good news is that my mother does not need to wait until my father applies at age 70 to receive spousal benefits. My father can choose to “file and suspend” his benefit, which would entitle my mother to begin receiving a spousal benefit of her own. If my father does not “file and suspend,” I estimate he will likely be leaving $52,800 on the table in unused benefits.

The charts below compare the monthly cash flows. You will see that in this example, the “file and suspend” method leaves an additional $704 a month to the surviving spouse when compared to both filing at age 66. This example assumes that both spouses are the same age and excludes cost of living adjustments.

One catch is that my father must be “full retirement age”(FRA) to be eligible for this suspension. For anyone born between 1943 and 1954, FRA is age 66. No earlier suspensions are possible. And my mother must be at least age 62 to begin receiving spousal benefits.

This strategy works particularly well in the rare cases when minor children are involved. Suspending also allows a minor to claim a child benefit even when the applicant (Social Security calls this person the “number holder”) is delaying his or her worker benefits. I have seen a scenario in which a spouse and two children were all claiming benefits on the husband’s suspended benefit.

Anytime I bring up the concept of delaying a Social Security application, many respond that they prefer to claim early while there is still money available in the system. I believe these early filers are making a costly mistake. All of the proposed “fixes” preserve the existing Social Security benefits for those people age 55 and older.

“File and suspend” allows many to have their cake and eat it too. These couples are able to claim a smaller check early while maximizing the larger income. I highly recommend you meet with an advisor who is experienced in evaluating these options before locking in your claiming decision.

Photo by Megan Marotta

3 Responses

Bill

I think calling this a “loophole” in the title is misleading. The Senior Citizens’ Freedom to Work Act of 2000 made a very clear policy choice – allowing “claim & suspend” to encourage those above FRA continuing to work. Studies of this policy change (e.g. http://crr.bc.edu/working-papers/unusual-social-security-claiming-strategies-costs-and-distributional-effects/) have shown its small cost. Have you seen studies of the additional payroll taxes paid by those over FRA? BLS says 31.5% of those age 65-69 are “labor force participants.” I suspect their payroll tax contribution far exceeds the cost of the benefit.

David John Marotta

You seem to be under the misconception that loophole as used here is a negative term.

Originally a loophole was the term used for the slit in a castle wall. Applied here a loophole is a small provision in complex legislation through which you can avoid the normal provisions of the law which are applied to the majority of participants. My definition of a loophole is when government regulation doesn’t entirely bind you so as to completely take away free will. Loopholes leave you with some free choices still to be made.

Matthew Illian

I would add that you do not need to be working to take advantage of the “File and Suspend” strategy. Retirees earn 8% a year in delayed retirement credits which should be considered whether you continue working or not. In this way, the benefit can be utilized in a manner that was not intended by the provision. I also think the term “Loophole” is useful because this information is not easily accessed on the Social Security website and most retirees do not know it is available.

Your point about this provision costing our government very little is well taken. From a financial standpoint, the best answer for everyone is almost always, “work longer.”