I’m in my 20s and I’m just getting started in the working world. My employer has a 401(k) with the attached list of investment choices. I’m also looking at a Roth IRA. Is there a certain Roth you recommend? Which of the 401(k) investment choices do you recommend?

I have been reading some of your articles on your website and saw that you started your kids Roth contributions at age 14, so you might have a favorite you’ve been working with for a while now. I would love to start funding my Roth and 401(k), but I have no idea where to begin! Any advice would be appreciated.

Amy Lee

Greetings Amy Lee,

Great questions! I would be glad to help. I’m going to answer your questions in three separate blogs posts this week:

1. Which investments should I fund first?

2. Which of these 401(k) investment choices do you recommend?

3. Is there a certain Roth IRA you recommend?

WHICH OF THESE 401(K) INVESTMENT CHOICES DO YOU RECOMMEND?

I looked at the choices in your 401(k). I’m not a fan of Target date funds, so I did not include those choices in my analysis. Since you are in your 20s and adding to your portfolio every year you also do not need any stable bond investments at this time.

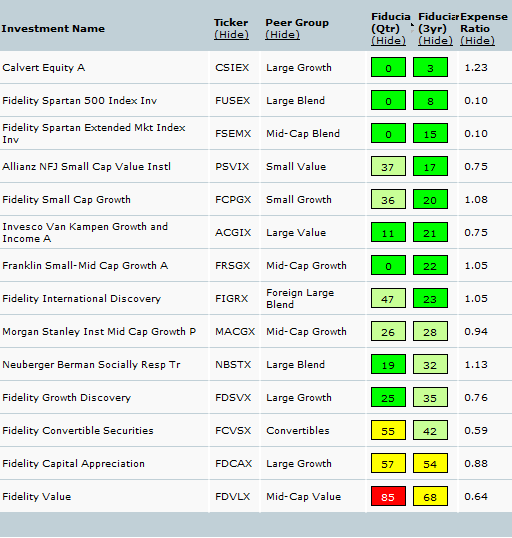

Here is a listing of the fund choices in your 401(k) (in so far as I was able to find the correct five letter ticker symbol from the fund names). This analysis comes from fi360.com which we subscribe to and recommend as a good first pass analysis of mutual funds and ETFs. The colorful boxes are their fiduciary score for the past quarter and the past 3 years worth of quarters (ending 2011-06-30). Scores of 0-25 are good. Scores of 50-100 are less than good.

I’ve hidden most of the columns because I want to focus on two columns which will probably be the greatest determinant of your investment returns: Peer Group (or the asset category that this fund is mostly invested in) and Expense Ratio (or how much the fund is going to take from your investments for managing it). Asset class matters, but cost also matters. So you want to build the best diversification for the lowest costs.

We use six asset classes to build a diversified asset allocation. The first allocation is 0% to stability (bonds) and 100% to appreciation (stocks). This eliminates three of our asset classes. I did not analyze any of your bond choices for that reason. The remaining three asset classes are U.S. stocks, foreign stocks, and hard asset stocks. Your 401(k) does not offer any funds which invest primarily in hard asset stocks. This is common among 401(k) stocks. Occasionally they might include a real estate investment trust (REIT) mutual fund, but your choices do not even include this. So we are down to just a mix of U.S. Stocks and foreign stocks.

Normally we recommend tilting foreign. We think this is a time when you ought to tilt foreign and toward specific countries with high economic freedom and low debt and deficit. But your 401(k) has only one foreign stock fund (Fidelity International Discovery [FIGRX]) and nothing to allow you to pick specific countries. This is another disadvantage of the limited investment choices in most 401(k) which you will not have in your own Roth where you can invest in whatever you want. As a result, we are going to tilt toward the U.S. with a 60% U.S. and 40% foreign tilt.

On the U.S. stock side we recommend tilting your investments toward small and value (away from large and growth) if such funds have low expense ratios. There are four such funds which would allow you low-cost methods of achieving this tilt. Here is the final asset allocation we would recommend, using the names from your 401(k) website, but the symbols listed in my analysis:

- 15% SPTN 500 INDEX INV (FUSEX) {large} Fidelity Spartan 500 Index Inv

- 15% IVK GRTH & INC A (ACGIX) {large value} Investco Van Kampen Growth and Income A

- 15% SPTN EXT MKT IDX INV (FSEMX) {mid-cap} Fidelity Spartan Extended Mkt Index Inv

- 15% ALLNZ NFJ SMCPVAL AD (PSVIX) {small value} Allianz NFS Small Cap Value Instl

- 40% FID INTL DISCOVERY (FIGRX) {Foreign} Fidelity International Discovery

This is 60% U.S. and 40% foreign. It is 30% large with a value tilt and 30% mid and small with a value tilt.

The weighted average expense ratio for this allocation is 0.57% even though the average fund in this 401(k) has an expense ratio of 0.79%. Saving 0.22% (or 22 basis points) may not seem like much, but it is. Investors measure everything in hundredths of a percent called a basis point which is abbreviated bps and pronounced (by those in-the-know) as “bips”. Investors kill for 10 bps so getting 22 bps means a lot. In fact, over your working career for every 100 bps extra return you can retire 7 years earlier or 50% richer. That means by getting an extra 22bps you might be able to retire a year and a half earlier.

Some companies provide the opportunity to have your 401(k) money put into a brokerage account where you can self direct your investments. If that option is available I recommend exercising that option.

Some companies provide the option to have your 5% contribution put into a Roth 401(k) while the companies 4% match is put into a traditional 401(k). If you can put your contributions into a Roth 401(k) I recommend making that election.

When you leave employment you will be allowed to take everything that you contributed and anything that the company has contributed which has also been vested and roll that into an IRA rollover which you can manage on your own. As soon as you leave employment we recommend you roll your 401(k) into an IRA and take control of your own investment choices.

Having said all of that, if your 401(k) does NOT have a match, you would probably do better to put the money in a Roth or a taxable account where you can have tax free growth or more investment choices right from the start.